Financial education

What is and how to make an emergency reserve?

Do you know what it is and how important it is to create an emergency reserve? Find out now and don't stay in the red

Advertisement

Create your emergency reserve

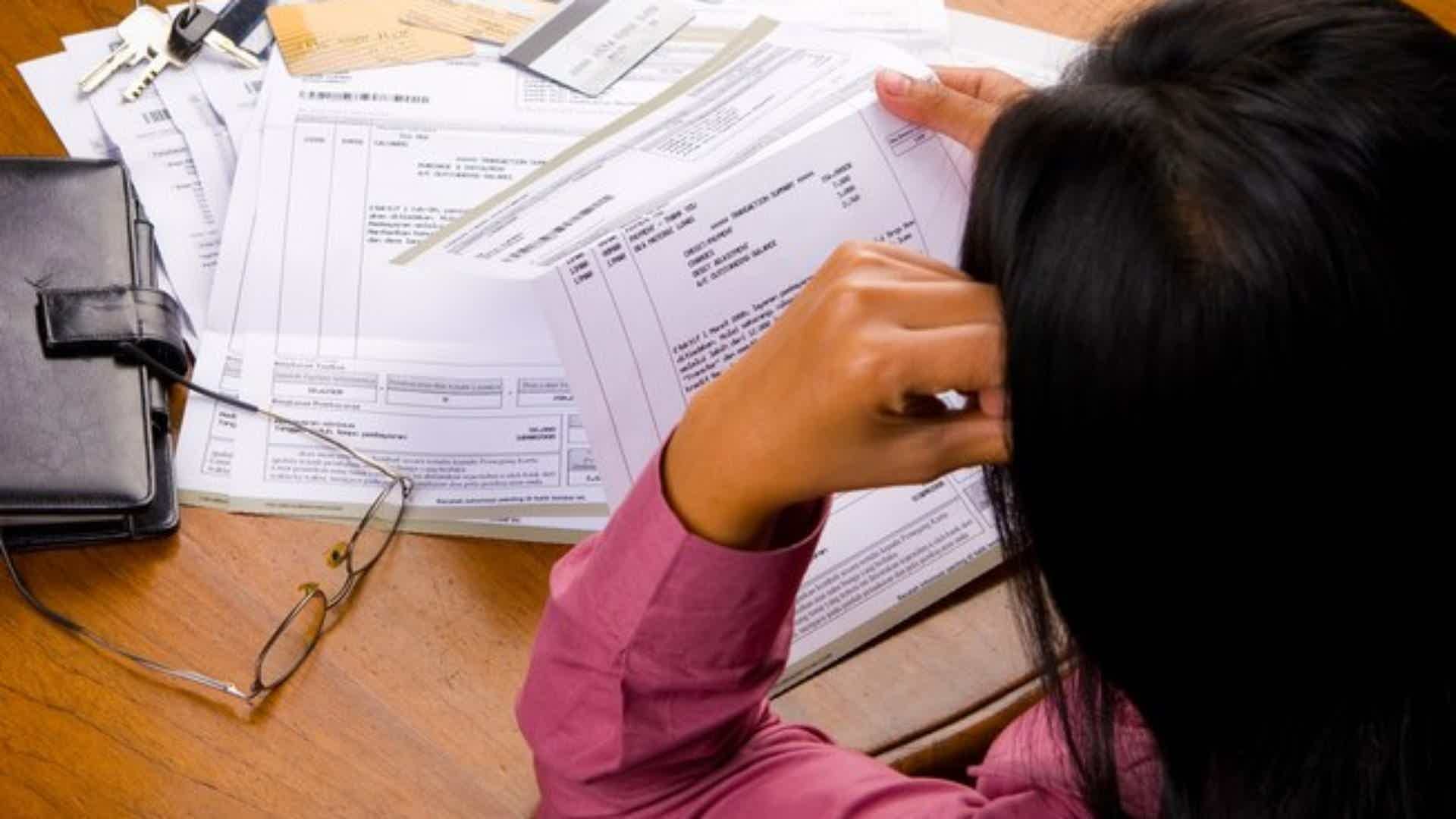

If there was something that everyone noticed during 2020, it was the need to have an emergency reserve, right? Even if not well known, this economy was missed in the lives of many people due to the crisis.

Unemployment, health problems, unforeseen circumstances and other situations take us by surprise and with that the difficulty of maintaining finances as we did before.

Therefore, it is extremely important to understand what it is, how important it is and how to make an emergency reservation. Learn the best tips and don't let yourself be taken by surprise anymore.

What is an emergency reserve?

But, do you know what this emergency reserve is? In short, it is a cash value that is saved to ensure a more peaceful future. After all, if unforeseen events happen, you will have a place to turn.

This amount is reserved to supply finances in a difficult time. Which could be: unemployment, illness, need for expensive medication, emergency trips, accidents and others.

Some people, especially the older ones, call the reserve a “mattress”. It is a relief at a time when the budget calls for more money than usual.

How important is the emergency reserve?

The name itself says how important it is to guarantee this reservation, that is, to guarantee safety in times of EMERGENCY!

In addition, some points become important for investing in an emergency reserve. Below, we will show you some of them. But before that, know that below we will show you how to make your reservation, so stay with us!

Control your financial life

In Brazil, people are not in the habit of saving money. In fact, things happen quite the opposite. After all, most of them not only don't book, they also spend more than they earn, don't they?

Therefore, guaranteeing the start of a reservation helps you to maintain control of your financial life. A reservation teaches you to have discipline so you don't live with "the rope around your neck" and have where to turn when you need it.

The emergency reserve will help you to get help in difficult times, but also to learn to use your money consciously, so you don't live from payment to payment and get out of the choke for good.

Keep calm regardless of the moment

With the world's economy stable, you never know when we'll need to resort to an urgent measure, right? Who knew we'd go through all the tough times we've had in the last few years?

Therefore, another advantage of the reserve is to have economic tranquility regardless of the external scenario. Thus, you will be able to deal with problems more consciously and calmly.

After all, just imagine going through a difficult time and in addition to worrying about him, having to worry about finances? Better not, OK? So let's teach you how to start your reservation and secure your future!

5 tips to start your financial control

Know that it is possible to carry out a financial control so as not to be tight at the end of the month and be able to make your reservation. Check out the 5 killer tips for organizing now

Who can make the emergency reservation and when to start?

Maybe you thought, “That reserve is only for the rich. They can save money. I don't have a good amount to keep”. And if that crossed your mind, we need to tell you that this is not the way you will be able to plan.

The emergency reserve is for anyone, from any social class and it must be started right now!

Do you know why people remain in debt and desperate in a time of need? For not understanding that all construction takes time and is brick by brick.

Most people want to “build a house” overnight and in that format, of course it won't work. After all, let's face it, who has extra money to save today?

So, regardless of the amount of your income, your profession and how your financial life is, the reservation is for you too. Just learn to develop planning and take it one step at a time, starting now.

How to make an emergency reservation?

Before starting the process of creating your emergency reserve for good, you need to plan and organize your financial life. There is no point in starting the process, if in the second month you will have to interrupt it due to lack of organization.

So, pay attention to the steps below, from the simplest to the most complex so that it works and you can prevent future situations.

Take note of your financial situation

The first and one of the most important steps is to take note of your financial situation and understand where you are at that moment. The tip is to make a spreadsheet, where you list:

- Fixed expenses: First, list all your fixed expenses such as: water, electricity, rent, condominium, children's school, internet, food, medicine for continuous use, if any, and others that you pay every month;

- Accounts in installments: Also list the installments you have to pay. Whether it's a car, loan, financing, furniture, negotiations. Everything that is paid in installments and will end at some point, list it in this step;

- Essential care: Here enter nutritionist, gym, treatments, therapies and other expenses that you have with your health and well-being, also of your family;

- Overdue debts: It is also important to be aware of the debts that are in arrears and their current values for negotiation;

- Extra or superfluous expenses: Here it is important to remember everything that is spent in a month. From a coxinha on the corner of work, to new clothes for a certain occasion.

Now that you know how much money comes out of your account every month, it's time to open a new column in your spreadsheet and list how much money comes in monthly.

Here, list your fixed salary, rents, extra income, pension and any other amount that you have access to on a monthly basis. Thus, you will be aware of whether your final balance is positive or negative, and only then can you take the next step.

Avoid the installments

Now that you already have a drawing of all your accounts, notice how much you spend with “little installments” that come together and form a barrier between you and financial success.

So, at this point, you need to review what can be cut and which ones you can avoid. After all, if we have credit, the tendency is to open a new account when the old one is about to close, right?

But if you want to be able to establish good financial health and reserve money for emergencies, you need to avoid installments. First, because they take up space in the budget and second, because they make you pay twice as much for something, due to interest rates.

negotiate debts

It's no use trying to make an emergency reservation, if your cell phone rings with a debt collection at all times, isn't it? So, before starting this process, it is necessary to negotiate the delays and pendencies.

Contact all the companies you owe and request a settlement proposal. Thus, you will regularize your finances and have space to save money without having a guilty conscience about it.

Which debt to negotiate first?

It's time to negotiate debts, but what now? Which one to trade first? Where to start? Find out now the easiest way to resolve all your pending issues

Cut expenses unnecessarily

You know that list you made with tips above spending on coxinha around the corner from work, new clothes and among others that we always have throughout the month? At that point it's time to stop them.

This cut in unnecessary expenses is essential at this first moment, so that the bills are balanced and you can make your reservation without having to compromise the fixed bills.

Before buying something, ask yourself: “Do I really need it right now?”, “Will I miss this amount?” “If I buy now, will I have money towards my monthly reserve goal?” and, if the answer is no to any of them, avoid the purchase.

Remember that these tips may cause some discomfort at first. After all, it will change your comfort and take you out of your comfort zone. However, in the medium and long term, you will be proud of the result you will achieve in your finances.

seek extra income

Another tip that can help you improve this path and have a little more “slack” in your monthly budget is to look for a way to earn extra income. That is, having a receipt, in addition to your salary, to help pay bills and fulfill the reservation.

Look for something you like to do and excel at it, then research if there's a market to make money within the niche. Start by researching your friends and then find out how to sell a product or service in your area to earn more.

I calculate your ideal emergency reserve

Well, finally we reached an extremely important point, which is to understand how much you need to have in an emergency reserve.

Economists, after studies, claim that the ideal emergency reserve should be an amount of 6x your monthly costs. I.e:

Someone who spends R$ 2 thousand a month on their expenses and manages to live comfortably will need R$ 12 thousand as a reserve.

Someone who spends R$ 5 thousand a month will need a reserve of R$ 30 thousand, in order to maintain 6 months of life in emergency cases.

Remember your expenses that you noted above? They will serve here. Look:

- Residential bills: R$ 1100.00

- Food: R$ 400.00

- Transport: R$ 200.00

- Health: R$ 150.00

- Total essential expenses: R$ 1,850.00/month

- Ideal emergency reserve: R$ 11,100.00

Set a monthly goal

Calm down, do not despair and give up seeing the high value of the amount. We know that it is almost impossible to have that amount immediately available to reserve. So here's another tip: Set a monthly goal!

You don't need to save all the money just one month. This reserve is built monthly. Then, with the analysis of your finances, define how much you can separate per month, to know how long you will have your complete reservation.

For example, if you can save R$ 500 per month and your ideal reserve is R$ 10 thousand, then you will have it in 20 months. Of course, the ideal is to try to reduce this period as much as possible, but if this is not possible, the important thing is to walk.

Decide to save or invest your reservation

Now that you know how much you need in total and how much you should save each month, it's time to ask yourself: "Where do I leave this money?"

More ideal than just saving, is investing so that this value still gives you profitability, that is, that it multiplies. But, as it needs to be rescued easily in emergency cases, look for investments with this profile and the possibility of withdrawal in the medium term.

Some interesting options are:

- Selic Direct Treasury

- Investment Funds with short redemption terms

- CDB with daily liquidity and yield of more than 100% of CDI

Know exactly when to withdraw

Alright, everything is getting in order!

Now, you need to define what is in fact an emergency to withdraw the reserve, otherwise, every time the bills tighten a little, you will decide to use the amount.

Think about your whole life and the situations that can occur that get out of control and you can't afford your income, these are the right situations.

Remember, by correctly planning your finances, emergencies will not be shared. Thus, you can have an even better quality of life!

Conclusion

Well, the emergency reserve is nothing more than an economy intended for unexpected situations that happen in our life throughout it. Be it an accident, health issues, unemployment, among other unforeseen events that are beyond our financial control.

These moments already bring us too many difficulties, so we must assuage concerns as much as possible. For this, having planning to secure finances during these difficulties is essential.

Here you understood what the reserve is, saw that you can do it regardless of your financial condition and even received the step by step on how to put it into practice.

I don't know about you, but we're already excited to hear that you're going to start changing your financial life. Let's go? Remember, every project has its path. Know how to face the path to guarantee the final result!

How to organize your finances: Step by step

Are you tired of living "hanged" financially? See right now the best step by step to organize your finances and get out of the grip.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Corinthias BMG credit card: what is Corinthias BMG?

Do you already know the Corinthians BMG card? No? So read on, because we're going to tell you all about this card! Check out!

Keep Reading

Sicoob Gold Card or Nubank Ultraviolet Card: which is better?

Decide between the Sicoob Gold card or the Nubank Ultraviolet card. They are two different cards, but they have incredible benefits. Learn more here!

Keep Reading

How to apply for a loan from Banco Olé

Learn how to apply for the Olé bank payroll loan online and other information about service channels, to receive your credit!

Keep ReadingYou may also like

How to calculate the loan interest rate?

Taking out a loan is the easiest way to get quick cash. However, it is very important to observe and calculate your interest rates. Interested? Check out today's post.

Keep Reading

American credit card: how it works

Do you like to shop at Americanas and want to enjoy exclusive benefits? So, see how the network card works, which has the Mastercard brand and you can use it both in stores and anywhere else. Learn more later.

Keep Reading