finance

Clean name: 8 best practices

Did you know that a clean name is important, but do you need good practices for that? See which ones guarantee the success of your finances.

Advertisement

how to keep oneat clean

Many consumers dream of reaching the status of clean name. This has been an increasingly difficult task in view of the current economic crisis. However, there are some practices that can make this process a little simpler.

Thus, it is essential that people are aware of what they are. Only then will it be possible to reach this desired level. Now, understand that this is a task that requires a lot of effort and research.

Therefore, we have prepared this article to help you. Here, you will stay on top of everything on the subject. Learn how to have clean name and what to do to keep it that way. You will be surprised, believe me.

The advantages of having a clean name

The benefits of maintaining this financial status are many. They give you more freedom. That's because institutions trust your word more and let you be entitled to more credit alternatives.

Therefore, it is something worth fighting for. Discover now some examples of advantages you have with your name without any default.

Get to know Serasa Limpa Nome

Are you negative and want to get out of this situation? Get to know Serasa Limpa Nome and stay positive right now, get rid of debt once and for all

healthier life

People who have their financial life in order are more relaxed. That way, they are healthier. That's because there are no worries like "I'm behind on a bill".

It may even seem like something insignificant, but these issues greatly affect an individual's well-being. However, this is just one benefit of this list.

quality relationship

Many couples break up because of financial dismantling. The lack of transparency is destroying trust between the two. That's why those who are well resolved in this regard have better and more lasting relationships.

Greater productivity at work

Returning to the subject of peace of mind, the lack of debt also gives you more confidence. Thus, doing well at work is also a consequence.

You focus more and increase your productivity. After all, your financial life will not be a cause for concern.

Building a good story

A good status in the financial market opens many doors for you. Soon, you can get a fairer credit analysis. Also, some institutions offer you lower interest rates.

Finally, realize how important these advantages are. They directly interfere with your quality of life. So don't hesitate to look for ways to keep your clean name. In the end, you are the main beneficiary of all this.

Tips on how to clear your name and keep it that way

By now, you already know well the importance of being well resolved financially. Now, it's time to understand how to do this. First of all, it is important to emphasize that each person lives within a reality.

So things don't work the same way. That's why we advise you to look for different ways to stay stable. All that fit within the scenario in which you find yourself.

However, to help you, we separate some more general tips. So, you already know where to take your first step. So, come on, check it out.

1- Organization and planning is everything to keep your name clean

These are two extremely important elements for anyone who wants to escape default. Organization and planning will help you go beyond that goal.

Soon, with these tools, you can even grow financially speaking. In case of keeping the clean name, they will guide your steps to resolve debts in a smarter way.

Now, don't think that getting organized is an easy task. So, at first it will be work, but believe me, the result is always worth it. Therefore, we have prepared some points for you to catch up on your planning.

Opt for financial spreadsheets

There are numerous online worksheets available on the internet. So you don't have to create anything from scratch. Our tip is that you choose one of them and start recording your expenses, as well as your income.

It is a task that can take some time. However, only until you get used to it. In this way, a document of this type will give you a clearer view of everything you are consuming. Also, it allows you to see if this is within your monthly earnings reality.

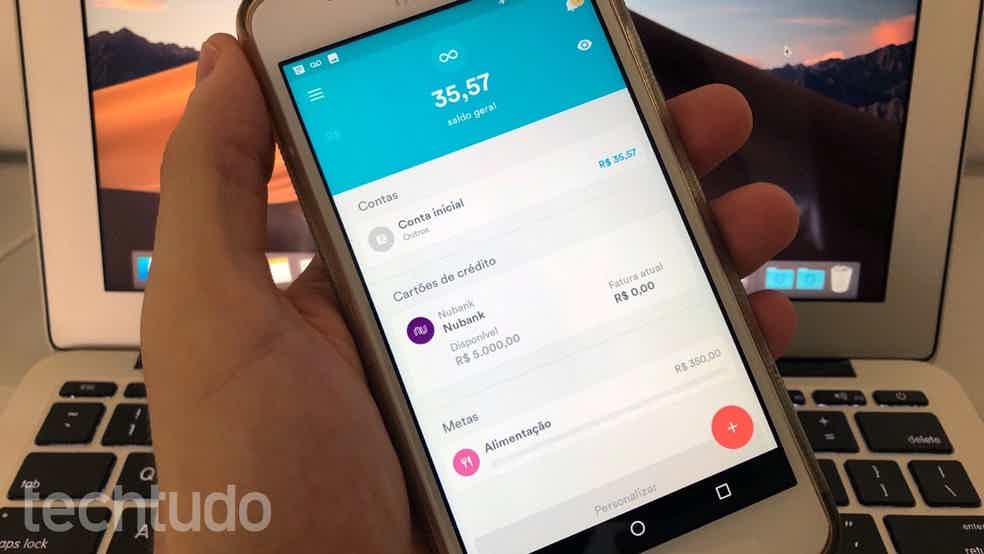

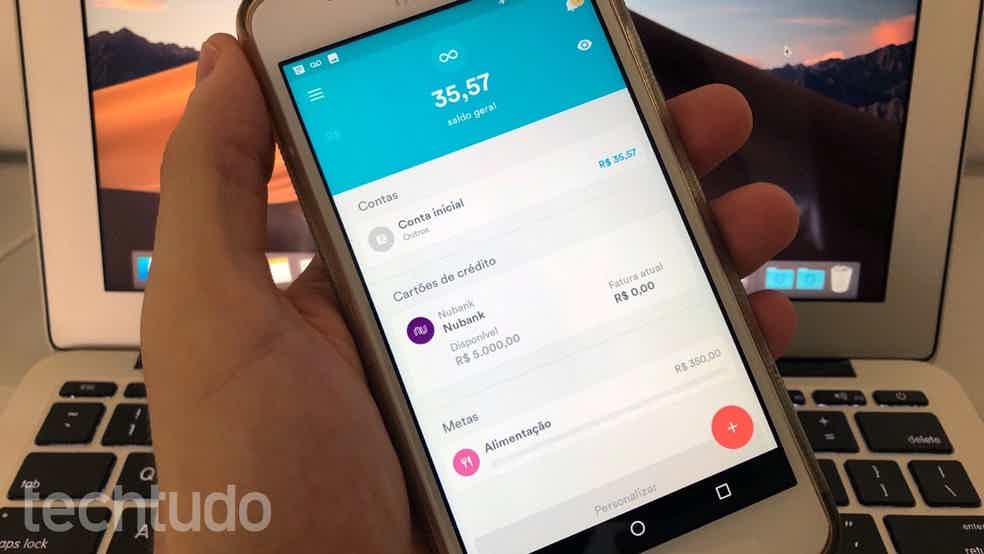

Use an app to track your spending

Let's say you can't always access your financial spreadsheet. Thus, for situations where you are not at home, an app can help. There are also several available for both iOS and Android.

So just pick one and start using it. So your control is not limited. These are some of the options you have to keep your organization and planning up to date.

2- Be aware of your expenses to keep your name clean

The tip above serves exactly to help you in this process of understanding. You need to be fully conscious of everything you spend. It may sound silly, but at the end of the month it makes all the difference.

The spreadsheet will help you to write down all your expenses. This goes for both those that are essential and those that are superfluous. Next, it's time to understand how they organize themselves.

Therefore, an alternative is to do a simple subtraction calculation. So, take all of your monthly income and subtract it from your expenses. This will give you a good idea of how your financial life is going.

To keep the name out of trouble, this is essential. Soon, you start to get an idea of how much you are spending. Thus, it is easier to create strategies to save in the coming months.

3- Keep prudence

Not all consumption is essential, is it? So, use the two tips above to get the big picture of everything you spend. That done, it's time to list what is very important and what can be avoided.

However, look carefully, don't think that depriving yourself of some things is the way out. For example, don't cut your health insurance to save some money. There are things that need to get into your budget.

Therefore, be very careful when classifying these expenses. Also, let's say you want to buy a new cell phone. However, your current one is in perfect condition.

This is an example of a purchase that can wait a little longer. Sometimes, it's those little things that get you out of financial complications.

Finally, the ideal is not to go out cutting everything and not buying anything. Balance is always the best way out. It is behind him that you must guide your journey to keep your clean name.

4- Be careful with your CPF to keep your name clean

Many people have the habit of lending their CPF. So friends and family make purchases on your behalf. This is one of the biggest mistakes that exist when talking about financial stability.

Never entrust this document to individuals. It doesn't matter if they are your acquaintances. That way, you avoid embarrassing situations. Imagine the following scenario.

Your friend asked to pass a fridge in your name. So, out of friendship, you accepted. However, he had a problem and was unable to pay off the debt. Therefore, the person responsible for it is in fact the owner of the CPF.

However, you are also unable to afford the debt. As a consequence, your name goes to the SPC or Serasa list. It seems like something far away, but believe me, it happens all the time.

So, be careful with this kind of situation. In addition, the credit card follows the same logic. Don't lend to anyone. Anyone who wants to have good financial control needs to pay attention to these points.

5- Pay attention to your credit card

Card lending isn't the only thing you should worry about if you want to keep your clean name. The credit card is an extremely useful tool these days.

However, she can be a big reason for you to get out of control financially speaking. Thus, the ideal is that it is used intelligently. Always respect the credit limit you have.

Therefore, it is possible to avoid interest and extra fees, which, by the way, are not usually cheap. Therefore, pay close attention to this. One tip is to only use your credit card in times of emergency.

Some financial market professionals believe that this tool can be very dangerous. Therefore, this is because when you swipe a card, you are not having the feeling that you are spending money.

Thus, it is different from taking R$ 50.00 in hand. In this way, they indicate that you avoid using this accessory in excess. This is especially true for those who want to get rid of complications with their name.

6- Have a financial reserve

You can't always predict all your expenses. After all, life is full of surprises. So, it may be that at some point, an emergency appears and you need to spend more than you should.

That's where the importance of having a financial reserve comes in. This tip is more aimed at people who do not have any defaults. Thus, it is a way to maintain this status.

Building a reserve is not something that happens overnight. It takes a lot of effort and planning. In this way, we separate some alternatives to help you in this process. See what they are below.

Save money before you need it

Most of the time, saving can be tricky. This is especially so if you leave it to do it in times of crisis. Therefore, the ideal is to save more money even when you are more relaxed.

Now, don't think you need to set aside half of your paycheck. So always be in line with your financial reality. That way, if you can collect more money great. If not, save what you can and that's fine.

One tip is to use your planning to see where you can save. Note that tip number 1 cuts across all the others. Therefore, do not hesitate to apply it.

save money every month

This does not depend on the amount you can collect. Let's say that in a month it is only possible to save R$ 50.00. However, on the next one, you saved R$ 70.00. This is how your financial reserve is being built, little by little.

Study the possibility of entering the world of investments

Make your money work. Therefore, it is worth studying more about investments. See where you can keep what you've gathered and how much it can give you back.

7- Use the thirteenth or your FGTS

Have you ever noticed that keeping the clean name it's not easy. Now, getting to that status can be even more complicated. So if you have an outstanding debt, beware.

The thirteenth or FGTS are good options to get rid of a debt. Soon, depending on your situation, they can solve your problem and bring financial stability back.

8- Don't be afraid to negotiate to have your name cleared

A special tip for those with late debts. Negotiation is an essential tool to get out of this problem. So you can't be afraid or ashamed to start this process.

So, the first step is to identify the debt. Also, if there are several, that's fine, give preference to the bigger ones. Then go in search of lenders. Talk to them about the possibility of negotiating your debt.

Remember that both are interested in resolving the issue. In this way, the creditor must present you with a proposal. However, don't think you have to accept it at first.

Many people ask for time to assess the situation and study ways to launch what is called a counterproposal. So you can do the same. Now, if they do not reach an agreement, there is still another way out.

It is known as credit portability. That way, it happens when you transfer a debt from one institution to another. In this process, you should look for lower interest rates.

So, is keeping the name clean worth it?

Certainly, have no doubt about it. During this reading, you already knew the advantages of being well financially speaking. So, don't hesitate to put these tips into practice.

They are as valid for those who seek to maintain a status as for people who want to get there.

Finally, you already know all about the best practices for having a clean name in the market. Now it is your turn. don't miss mais time and go in search of your financial autonomy.

7 personal finance tools

Want to organize your financial life but don't know how to start? Then see 7 personal finance tools that will help you

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Meu Tudo Consignado loan

Learn all about how to apply for the Meu Tudo Consignado loan and apply for this loan today with interest from 1.70% per month.

Keep Reading

How to make money with digital certificate reselling

Want to know more about digital certificate reselling and how you can make money from it? Check out some tips here!

Keep Reading

How do you consult Vale Gas by CPF?

Find out how to consult Vale Gás through the CPF, see the benefit amounts, payment dates and if you are entitled to assistance, check it out!

Keep ReadingYou may also like

Pantanal 2022 remake should premiere later this year

One of the most famous soap operas on TV Globo, Pantanal will get a remake with new actors and a plot bringing conflicts and current issues. Big names like Caco Ciocler and Juliana Paes will be part of the cast. The remake is expected to debut later this year in prime time on the network.

Keep Reading

Neon credit card: how does it work and what are its advantages?

The Neon card, a financial product from the digital bank, is one of the best digital cards in Brazil. This is because it is free of annuity and has several Visa flag benefits. Find out here how it works.

Keep Reading

Right Agreement: negotiate Santander debts

Do you have outstanding debts with Banco Santander? Don't despair, this can be resolved! Find out here how the Agreement Right platform can help you stay up to date with your finances.

Keep Reading