Cards

How to know the establishment by the card statement?

Have you had a suspicious purchase and want to find out the name of the establishment on your card statement? In today's article, we'll show you how you can do that. Even without suspicious purchases, it is very important to check the invoice monthly. Check it out now!

Advertisement

Find out the name of the establishment from the invoice

Unfortunately, credit card scams are becoming more and more common. Therefore, it is important to know the establishment by the card statement. This can help when identifying suspicious purchases and clarifying the situation.

Basically, for that you need the detailed credit card statement. It contains all the information about the establishments where your card was used. That is, address, time of purchase and name of the establishment.

Therefore, if you need to know the name of the establishments on the card statement, continue reading. Let's help you!

How to apply for the Nubank card

The Nubank card is free of annual fees, has international coverage under the Mastercard brand and can be requested online by 100%. Find out how to order yours!

How to find the store by the name that appears on the invoice?

First, we'll show you how to find out the name of establishments. In summary, with the detailed invoice you have access to the name, place where the purchase was made and also the time.

In this sense, the names of companies can be confused due to the difference between Corporate Name and Trade Name. In summary, one as a Fantasy Name is that you can find out where the CNPJ is registered.

With this number, it is possible to identify whether you have been a victim of credit card fraud. Especially if you don't recognize the establishment listed on the invoice.

How to know where the credit card was used?

Now, if you just want to find out where the card was used, it might be a little simpler. In the detailed invoice, you have access to information more focused on the moment of purchase. For example, the address and time of purchase.

But if you just want to know the name of the location, just look in the bank application to find out. In addition, it is also possible to consult through Internet Banking. In both cases you can see your purchases.

You can also contact the Service Center to find out this information. This way, a customer service queries where your purchases went and also has access to a detailed invoice, if you need it.

What is the invoice breakdown?

In short, the itemized invoice is where all the information about your credit card expenses is. It is very important to check it every month to understand your expenses and also to ensure that you have not had any suspicious purchases.

Therefore, with the detailed invoice you have access to the total amount of payment, amount of each purchase, amount of installments, due date, among others. In addition to being able to see where the purchases were made.

To access the detailed card bill, access your bank's application, or Internet Banking. Another option is to go to an agency in person to request this invoice detailing.

What is the difference between corporate name and trade name?

As we mentioned at the beginning, it is common for people to get confused when searching for an establishment they found on the invoice. This happens because companies can have a trade name or corporate name on the invoice.

So, to summarize, the trade name is the trade name of a brand. That is, it is what will appear on the front of the store, or the name by which the general public knows that particular brand.

The Corporate Name is the name that appears in the registration of that company. By the way, this is probably the name that will appear on the itemized invoice and may confuse you.

Finally, be very careful when using your credit card. Only use on sites that are reliable and you have references. In face-to-face life, avoid using the card in establishments you don't trust.

Also, never hand your card over to anyone. When using, keep the card in view throughout the purchase process. If even taking these precautions you have any irregularity, you must block the card immediately.

After that, you should contact the bank to take further action. Whether refunding suspicious purchases, or asking for a new card.

By the way, in this other article we show you how you can request a duplicate Nubank card. Continue reading and see how easy it is!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Havan Card Review 2021

Do you want to know a financial product with exclusive discounts and installments, in addition to ZERO annuity? Then check out our Havan card review!

Keep Reading

What is the best credit card score?

Do you need to have the best score to apply for a credit card? There is no exact score value, but an ideal value for each card. Understand!

Keep Reading

How to apply for the Unifisa car consortium

With the Unifisa automobile consortium, it is possible to get a letter of credit of up to R$ 240 thousand to be paid in up to 100 months. Find out how to apply here.

Keep ReadingYou may also like

Meet the world's first credit card with a limit on cryptocurrencies

For those who invest in assets, a credit card with a limit in cryptocurrencies seems like a dream, but it exists! Created by Nexo in partnership with Mastercard, the product promises to revolutionize the digital currency market and provide consumers with even more purchasing power. Check out more below!

Keep Reading

How to apply for Lanistar card

The Lanistar card is a great financial product, as it is possible to integrate up to 8 cards in a single plastic. In addition, you can use the sum of their limit to make your everyday purchases. Find out how to apply here!

Keep Reading

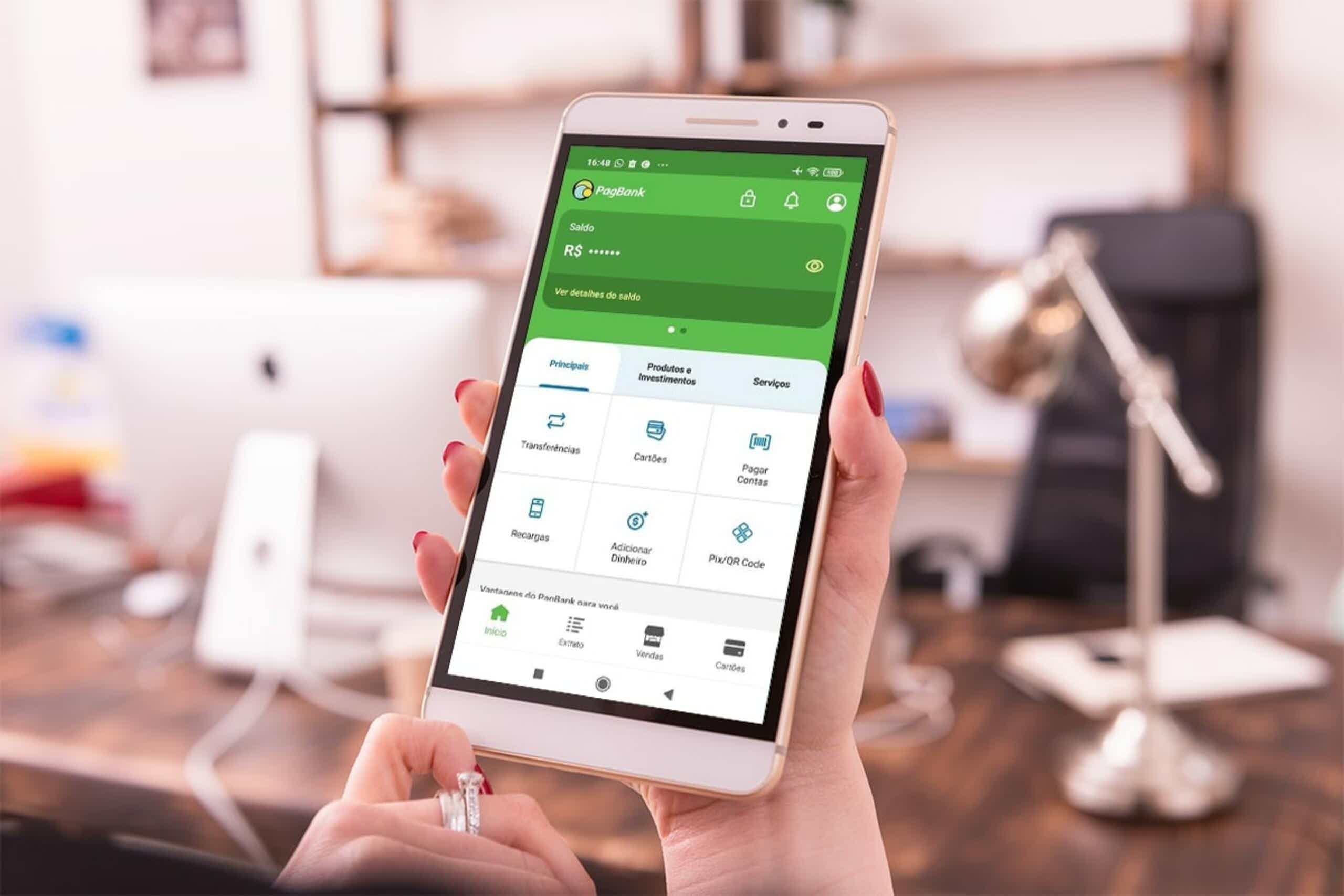

Discover the Rendeira PagBank account

For our financial health to always be up to date, all we need are digital account options that take care of our money and, above all, do not charge abusive fees or unnecessary fees. This is the case with the Rendeira PagBank account, a 100% digital account with great income that helps you with day-to-day payments, save your money and also enjoy greater profitability. Learn more about it here.

Keep Reading