loans

How to find the best loan in 2022?

Looking for the best condition to take out a loan? Knowing how to choose the best offer is important to avoid high interest rates and losses. Check out in our article how to choose the best loan option.

Advertisement

The best loan is the one that fits in your pocket

Many people still wonder how to find the best loan or what is the best condition to hire and many other things about the famous personal credit operations.

The truth is that there is no best opportunity or company to take out a loan. Quite the contrary, the best loan is the one that fits your financial profile.

But where to find the conditions of these contracts and the companies that operate the credit? Well, if you still have doubts about this, you're in luck.

We have prepared a special article for anyone interested in finding the loan with the ideal conditions, so be sure to follow along.

What is the best online loan?

Check out our recommended content for the best online loan and hire without bureaucracy.

How to find the best loan for you?

With the diversification of the financial market, finding a loan is no longer a laborious and tiring process.

The vast majority of credit operating companies are migrating with great force to social networks, targeting the digital market as a whole.

Nowadays, instead of having to go to the bank, you can find advertisements about loans on your cell phone screen while lying in bed.

A few years ago this would have been unimaginable, would you agree?

Yeah, but today if you want to find loan conditions just do a search on your search engine and several opportunities will appear.

Concluding this first part, we can say that the online loan is currently the simplest and fastest way to apply for a new personal loan.

Therefore, there are several compilations on the internet that present analyzes of credit operating companies, in which you can find the best opportunity.

Check below some options of companies that offer the loan agreement online:

- Geru individual credit

- Loan with vehicle guarantee Creditas

- Good for Credit

- Easy Credit

- I want to finance

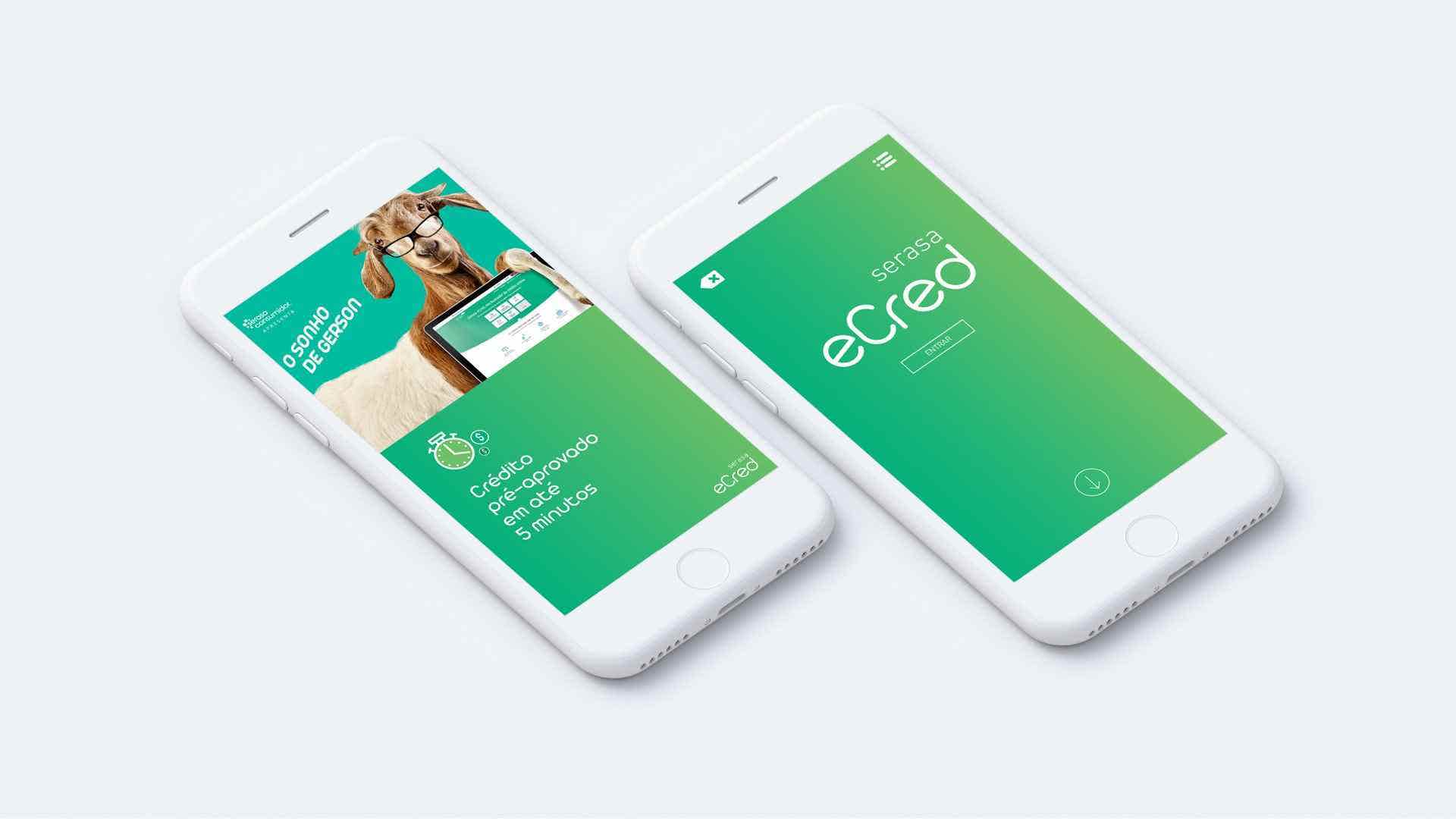

- Serasa eCred

- legendary

- MoneyMan

- FinanceZero

- Just

- rebel

- credisphere

- DigioGrana

- guys yes

- Crefisa

- NoGreen

- Simplify

For those who are not yet so familiar with digital mechanisms, the solution is to resort to the good old face-to-face service, going directly to the branches

In that case, you can turn, first of all, to banks and finance companies. To date, these two categories of companies offer the best credit terms.

Choosing to search online or in person, you cannot give up analyzing your financial context at the moment, as it will direct you to the best loan.

In other words, before researching the terms, make sure you understand how much you can afford to pay, for how long, how much you really need, and a few other essentials.

How to choose the best type of loan?

To choose the best loan you need to stop and analyze the following points:

- What is the main purpose of this money?

- Under current conditions, can you meet the payments?

- What amount will be required?

Do not want to take more money than necessary, because today this can be good, but in the future debts can harm your financial situation. What's more, loans usually charge one of the highest interest rates on the market.

After analyzing the points above, let's go to the tips.

The first step is to accurately observe the final cost of the values that are on the market, as there is no limit interest rate and they vary greatly according to the contract.

In this context, it is very important to compare interest rates to understand whether this is really an opportunity or whether it will generate long-term losses.

Also be aware of the payment deadlines for each loan opportunity, as the amount can often differ.

For example, even if you have in mind to contract a credit of R$10 thousand, the amount paid will be different if the contract is divided into 24x or 48x.

This happens because the time variable benefits credit operators most of the time.

Note that a 24x loan with interest at 30% per year will still be cheaper than the other option, with 48 months to pay, but at the rate of 17% per year.

When we take into account the total cost, the first option costs R$16 thousand, while the second costs R$16800.

This does not take into account the Total Effective Cost (CET) which brings other tariffs and tax charges within credit operations, such as the IOF.

How to compare loans in a simple way

Comparing loan terms can often be tricky, but the truth is that you don't have to be afraid of this part.

Remember the cost example we gave above? Companies often try to disguise the total amount in installment payments and you end up paying higher amounts without even realizing it.

So the first step is to calculate the total loan amount, taking into account the initial amount, interest rates, transaction and taxes involved. Thus, this process of comparing the total amount boils down to observing which loan has the highest Total Effective Cost (CET).

That done, the second step is to compare the payment term. In this case, it's interesting to see which parameter fits your priorities, whether the main one will be the total cost or the payment term.

Still, never forget that a relatively low interest rate, for long periods, can snowball debt and that's what we don't want.

Finally, one of the best ways to compare your loan is to use online simulation platforms. Therefore, most of the time these systems have partners who operate credit and offer many plans similar to the simulation that fits your conditions.

Many specialists recommend using the Serasa eCred system. There you can still consult your Score and work to increase that score and be approved in any credit analysis.

Did you like it? Check out our recommended content and find out how Serasa eCred works.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Sicoob Black Card or C6 Carbon Card: which is better?

Before choosing your Black card, see our comparative content between Sicoob Black card or C6 Carbon card and find out which one is better!

Keep Reading

How to send resume to Seara? Check it out here

Find out how to send your resume to Seara and thus apply for several open opportunities with salaries of up to more than R$ 8 thousand per month!

Keep Reading

Loan Meu Tudo online: fast credit and no bureaucracy

Get to know the main characteristics of the Meu Tudo loan online and find out what conditions the 3 types of credit have!

Keep ReadingYou may also like

How to register for SISU 2022

If entering a college is a great desire for your professional and academic life, we have no doubt that SISU 2022 can be a good option for you. Read on to see how to register for the program for free.

Keep Reading

How to apply for Montepio car credit

Montepio car credit is the ideal option to help you with the purchase of your new car. To learn how to apply for credit and enjoy its benefits, just continue reading.

Keep Reading

Cryptocurrency: Learn how to protect yourself!

Cryptocurrencies arrived to change the financial market and bring a new concept in money and technology. However, as it is a relatively new area for some people, crypto scams spread over the internet and make small investors lose their money. Do you want to know what crypto scams are, the most common ones and how to protect your investments? Come with us!

Keep Reading