Cards

How to choose the best PagBank card?

PagBank offers the public 4 card options with no annual fee and with various benefits. Find out in this post all the features and advantages of each one and learn how to choose the best one for you.

Advertisement

Find out which of the 4 cards fits your financial life

PagBank manages to innovate in its offer of financial products and today has a large catalog that includes card machines, digital accounts and cards. In this scenario, it can be difficult to know how to choose the best PagBank card to use.

Nowadays, the company has a solution of four different cards, which work in credit, debit and prepaid modes.

Each of them has its own characteristics, advantages and disadvantages. However, they all have free annual membership fees and are able to offer exclusive discounts and benefits from the brand.

Therefore, if you currently have a PagBank account and want to know which of the four cards would be ideal for you to use, continue reading this post and at the end you will know how to choose the best PagBank card!

What are the PagBank cards available?

In summary, PagBank works by offering four different cards. He has the account card, a debit card, a credit card and a prepaid card.

To know how to choose between them, first of all, you need to know each of the cards and see what they can offer. Let's go!

PagBank account card

On our list of the best PagBank card, the first is the account card, which is the ideal option for those who only have one PagBank account and want to use the balance added to it.

With this card, you can make national and international purchases and place orders in physical stores or online. Additionally, it allows you to make purchases using the credit function.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Discounts and benefits No need to have a machine Can be used to subscribe to streams |

As advantages, it allows you to have all the resources without paying an annual fee and to make quick purchases physically when using the contactless payment feature.

However, it also counts as a big negative. With this card, you cannot pay in installments for your purchases, but only buy them in cash with the balance you have.

To request this card, simply go to your app, access your account and ask to have access to it. In the following post you can see in more detail how this process is done.

How to request a PagBank account card

See here how simple it is to access this card by opening an account at PagBank.

PagBank debit card

If you are looking to have more control over your routine purchases, the PagBank debit card could be an interesting option.

From there, you can access streaming services and make purchases in physical and online stores with peace of mind. Furthermore, it is an international card that can accompany you on your travels.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | points program approximation payment Withdrawals abroad |

Therefore, its main positive points are the fact that with it you can better organize your daily expenses and access the Mastercard Surpreenda points program.

However, this card ends up charging a fee of R$7.50 when making withdrawals in Brazil or abroad.

However, it is still a very interesting option that, like the previous one, can be requested 100% online, as you can see in the following post!

How to request a PagBank debit card

The request is made via the app and the card can arrive in a few days! To do this, learn in this post and open your account and then request the card.

PagBank credit card

For those who need a limit to make larger purchases, this PagBank card is an interesting option. With it, you can pay your purchases in installments and use your balance to pay the invoice.

As positive points, this card allows you to increase your limit when investing in CDBs. However, you can also use your account balance as a limit value on the card to make larger purchases.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Your money yields more than savings Exclusive promotions from the flag Limit up to R$ 100 thousand if you make investments |

However, this card has very high fees that you need to be aware of. To give you an idea, when making withdrawals you may have to pay a fee of R$ 29.99, in addition to having interest of 14.99% when the invoice is late.

Even so, this card can be a good option for those who pay their bills correctly and don't need to make withdrawals. The request can be made through your app and you will receive the card within 15 business days.

PagBank prepaid card

Finally, there is the PagBank prepaid card where you need to add a balance amount to be able to use it for purchases. This way, it becomes easier to control the card's inputs and outputs.

This card is a great choice to give your child an allowance or to give to a relative. And since you control the amount that comes in, it's easier not to be surprised at the end of the month.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise Program Can be used in online games |

By having this card, you can access discounts on the Mastercard Surpreenda program, in addition to making purchases and withdrawing money in Brazil and abroad.

However, the fact that you cannot pay in installments can be a hindrance when making larger purchases.

However, for those who want a simple option to make purchases without compromising their budget, the prepaid card is interesting. To request it, simply access the PagBank website and register to have this card.

How to choose the best PagBank card?

If, after knowing all the company's cards, you still have doubts about which PagBank card is best, you can start analyzing some points.

First, think about why you want a card. What will it be used for in your daily life and how will it help you.

For example, anyone who needs to make basic day-to-day purchases to balance their balance can opt for the account card that everyone has access to.

If you want to make everyday purchases, but access a points program, the debit program may be more interesting.

For those who need the card to make a large purchase in installments, the credit option is more viable, as there are options to increase your limit.

Finally, if you want the card to make one-off expenses, or to give it to your child, the prepaid card is the best Pagbank card so you don't face surprises at the end of the month.

On the other hand, if you want to know more details about how a prepaid card works, read our recommended content below.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

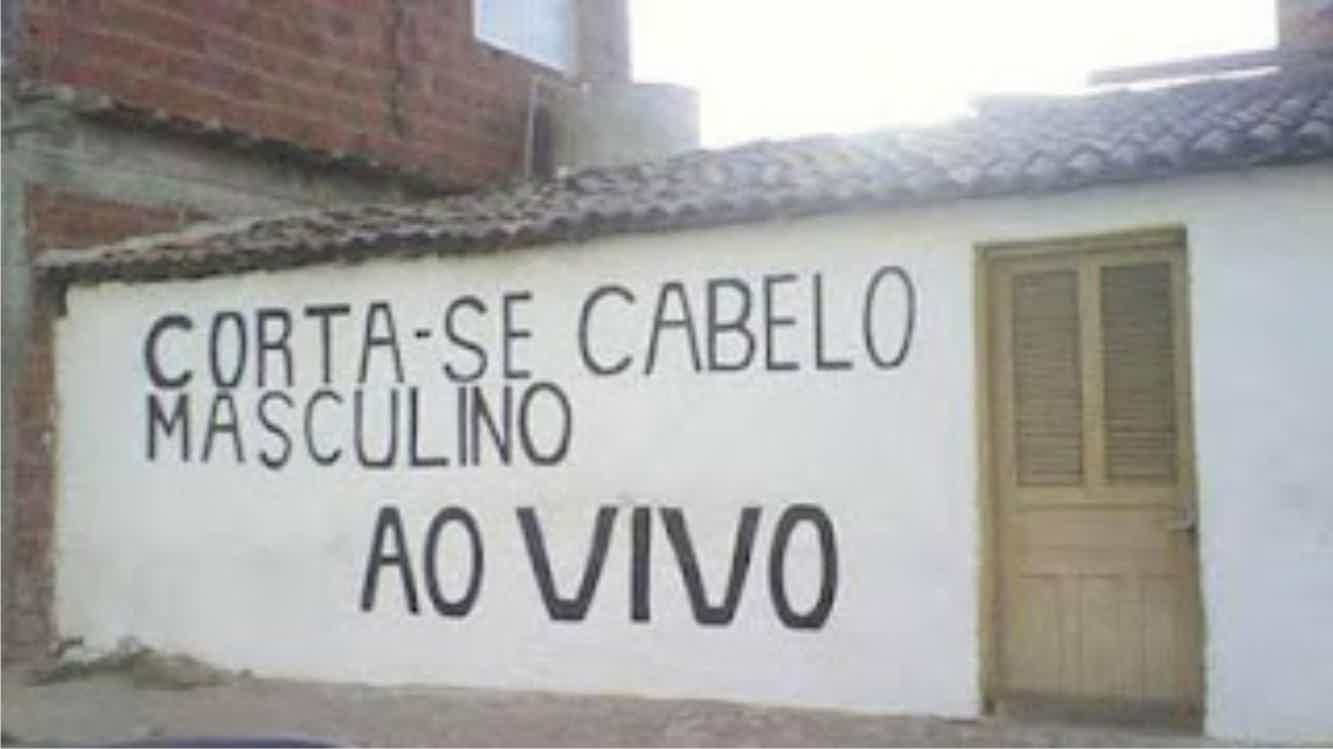

It's “serto”: the 30 funniest Portuguese mistakes you'll ever see!

Who doesn't like to see some confusion with the Portuguese language?! With that, we list the 30 funniest Portuguese mistakes for you to relax.

Keep Reading

Hidden Devices Detector: discover the app to detect hidden microphones

Can't find out if you have a bug at home? Don't worry, keep reading and find out with Hidden Devices Detector.

Keep Reading

Atacadão Card or Avista Card: which is better?

Decide between the Atacadão card or the Avista card. They have low annual fees, immediate approval and international coverage. Check out the comparison here!

Keep ReadingYou may also like

Get to know the Uber account

To prevent partner drivers from waiting a long time to receive the money from the rides, Uber created a free account that still pays for the balance. Meet her below!

Keep Reading

6 advantages of the Lojas Americanas card

The Lojas Americanas credit card offers many advantages to its customers. Among them we can highlight the AME cashback program in which you earn up to 25% of the cash back buying in the store. Want to know more advantages? So read this post and check it out!

Keep Reading

Companies that hire to work online

Nowadays, the number of companies hiring to work through the internet is increasing. Thus, remote work offers several advantages, such as flexibility, cost savings and much more. So, check out how to earn money without leaving home!

Keep Reading