Cards

What is the best credit card in Brazil?

Are you looking for a complete credit card with the best features to take care of your finances? So, discover the best credit card in Brazil! To find out more, just continue reading with us!

Advertisement

Check out 8 card options and be surprised by their advantages

Knowing which is the best credit card in Brazil is extremely important, this way you guarantee choosing a complete resource for your finances.

This is because a credit card is an indispensable resource in our lives. With it, we can make purchases in installments and go through emergencies or unexpected situations with more peace of mind.

Credit cards for minimum wage earners

Check out the 7 cards that can be acquired by those who earn a minimum wage. This way, you can choose the ideal one for you.

Do you want to know more about the subject and get to know some of today's best credit cards in full, their advantages and characteristics? So, come with us and check it out!

What is the best credit card in Brazil?

To take care of your financial life as it deserves, it is extremely important to choose the best credit card for your conditions.

This way, you can make sure you have the main resources to take care of your money and pay for your purchases in installments.

To find out about the best credit cards in Brazil, just continue with us throughout the text!

10 best credit cards online

See the best online cards on the market here and choose the ideal one for you.

Unicred Mastercard Black

The Unicred Black card, with the Mastercard brand, is complete for those who want more benefits in their everyday purchases and payments.

It has exclusive and differentiated services, and is multiple, bringing together the advantages of debit and credit on the same card.

With the Mastercard brand, it is accepted in several commercial establishments, abroad and throughout Brazil.

With the app, you can track all transactions and purchases made on the card. And, you can also withdraw your balance at Banco24Horas, the Cirrus network and the Interligada network.

In addition, the card offers two credit limits, one for purchases in installments and one for purchases in cash.

| Annuity | not informed |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Withdrawals on the Banco24Horas network, international coverage, multiple card, separate limit for installment and cash purchases |

Itaú Private Visa Infinite

If you are looking for an ideal credit card for any moment in your life, the Itaú Private Visa Infinite card, as with it you have the best resources for paying in installments for your purchases, travel facilities and various benefits at your disposal.

When applying for the card and being approved, you have 3 months of free annual membership to take advantage and learn about its features. Furthermore, the limit is flexible, that is, it is targeted according to your spending profile.

In fact, with the points program, your expenses are converted into points that do not expire, to be exchanged later for products and services of your choice.

| Annuity | not informed |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Flexible limit, international coverage, Visa brand, differentiated annual fee according to your expenses |

Santander Unlimited Mastercard Black

For those looking for a world of possibilities and ease in their purchases, the Santander Unlimited Mastercard Black card is a great option.

With it, you have the Esfera program, where you receive 3 points on international purchases and 2.6 on national purchases, for every dollar spent.

In addition, you have access to the Premiado Card Insurance for free and up to 7 additional cards for your dependents or family.

In fact, you also have free and unlimited access to airport VIP lounges, with the right to up to 8 guests. And, when you accumulate purchases above R$ 20,000.00 on the card, you are free of annual fees.

| Annuity | No annual fee on invoices above R$ 20,000.00 |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Free annual fee with spending above R$ 20 thousand, Esfera points program |

Uniprime Mastercard Black

The Uniprime card is a complete credit card option, for whenever you need it. With it, you can experience incredible and different experiences throughout Brazil and the world, and because it is a multiple card, you can also use it as a debit card.

Additionally, you accumulate points on all purchases and can exchange them for airline tickets and rewards, directly through the websites and apps of our partners, Livelo and TudoAzul. Everything to help you save!

| Annuity | not informed |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Exchange of points for airline tickets, international coverage, Mastercard brand |

Bradesco Aeternum Visa Infinite

The Bradesco Aeternum Visa is exclusive to Black Bradesco customers, and has points that never expire, in the Fidelidade Bradesco Cartões points program.

With it, you can redeem hundreds of products or exchange them for airline miles. Additionally, for every US$1 spent in Brazil and abroad, you earn 4.0 Livelo points.

In addition, customers can count on Bradesco Concierge, an exclusivity offered by bank consultants who have extensive experience. This service is available 24 hours a day, 7 days a week.

| Annuity | not informed |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Points that never expire, exclusive concierge, points program |

Sicoob Mastercard Black Merit

The Sicoob Mastercard Black Merit card is the option you are looking for to have access to more credit and facilities in your daily life.

With it, you accumulate points that can be exchanged for products, from a selection of today's best brands or invoice credit, airline miles and much more.

Furthermore, you can share the benefits of the card with other people by requesting additional cards, you can also choose the limit you want for each card and receive all notifications about purchases made on them.

| Annuity | not informed |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Up to 40 days to pay, withdrawal in installments, additional cards, choice of additional card limit |

Santander Unlimited Visa Infinite

The Unlimited Visa Infinite card has all the options you are looking for to take care of your finances, with more resources and facilities for your daily life.

With the Esfera points program, you earn points on international and national purchases for every dollar spent. Additionally, you can request up to 7 additional cards at no cost and with no annual fee.

| Annuity | not informed |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Points program, Visa brand, international coverage, up to 7 additional cards |

So, what do you think of the card options we have selected for you? They are certainly a great alternative for taking care of your finances and having more resources for your daily life, right?

For more articles like this, read our recommended content below.

Until later!

7 Best Black Cards 2022

Want to know more cards? So, see here our list of the best Black cards on the financial market.

About the author / Maria Luisa Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Meet the 15 strangest traditions in the world that you've never heard of!

Do you know the strangest traditions in the world? If not yet, then read our text and be surprised by the weirdest rituals that exist.

Keep Reading

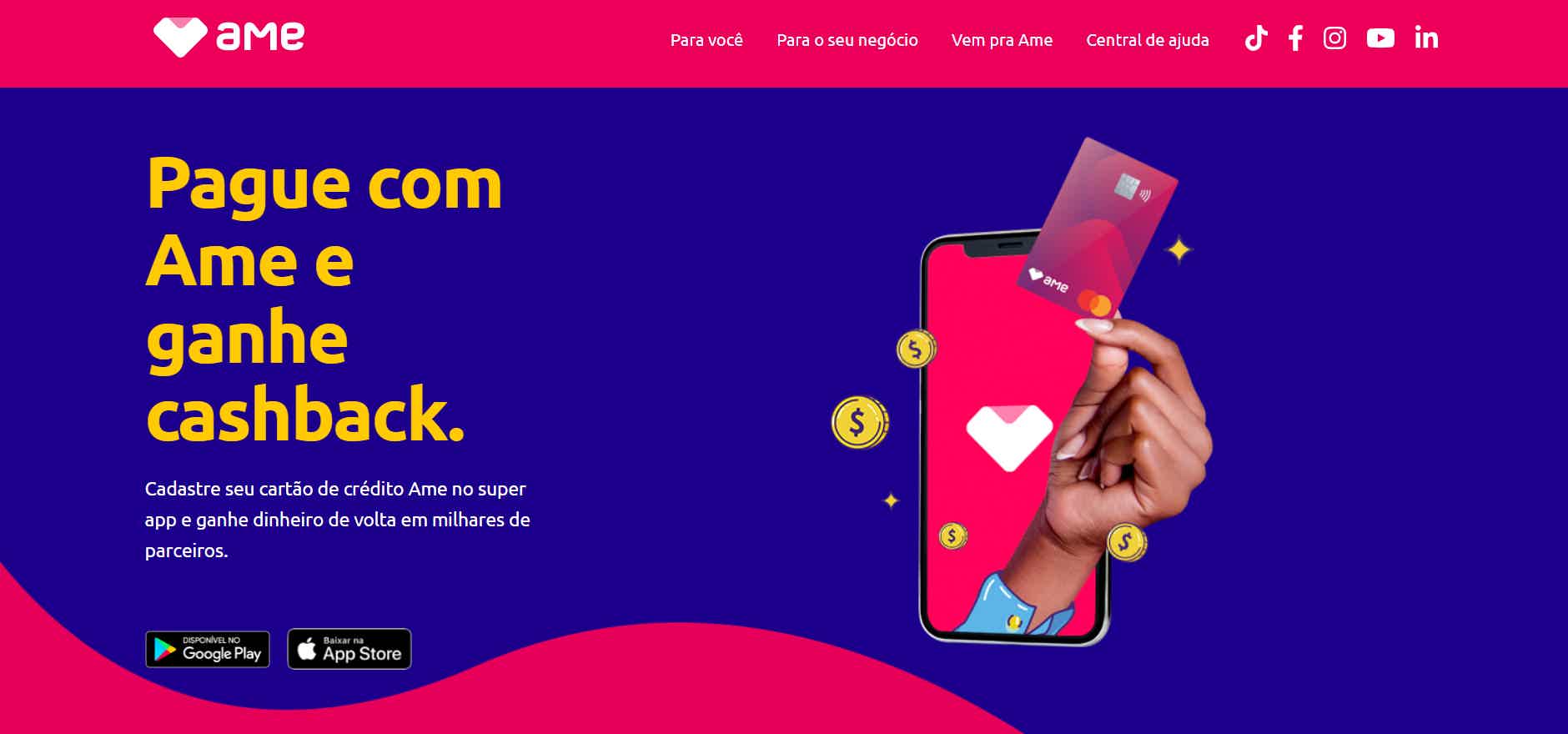

Discover the AME credit card

The AME credit card offers up to 10% of cashback and has the international Mastercard brand. Check out more about him here!

Keep Reading

How to advance FGTS through Digio? Know the step by step

Check out in this article how you can anticipate the FGTS through Digio and find out how to make this request from your cell phone!

Keep ReadingYou may also like

Learn how to make money selling beauty products

Being a reseller is quite an opportunity for those who want to guarantee an extra income or even find a professional opportunity. Learn here about the prerequisites, investment amount and step-by-step registration.

Keep Reading

5 supermarket card options 2022

If you were looking for a supermarket card with several benefits for you and your financial life, your search ends now! We separate the best options for you to use in your monthly purchases and in other establishments, in addition to the main information about the card, your annual fee, etc. Want to know more about these complete options? Stay with us throughout this review!

Keep Reading

Discover the Bradesco Marvel card

Do you want to live a unique experience inspired by Marvel movies and also enjoy unique benefits? Discover the Bradesco Marvel card here.

Keep Reading