loans

Geru Loan or Creditas Loan: which is better?

Are you in doubt about the Geru loan or Creditas loan? Both options have a good interest rate and can be applied for online. Check here for more information about them and find out which one to choose.

Advertisement

Geru x Credits: find out which one to choose

Geru loan or Creditas loan, which would be the best option for you? When choosing a good personal credit, it is common to have doubts about which alternative to choose.

After all, nowadays we can find several loan options with different interest rates and different deadlines to pay off the loan amount.

| Geru Loan | Credit Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1,90% per month | From 0.99% per month |

| Deadline to pay | Up to 36 months | Up to 240 months |

| release period | Within 1 business day | Uninformed |

| loan amount | Up to R$ 50 thousand | Up to R$ 3 million |

| Do you accept negatives? | Uninformed | Uninformed |

| Benefits | Quick approval Does not ask for guarantees Process 100% online | good payment term Higher credit amount Online and secure process |

How to apply for a Geru loan?

Check out the complete step-by-step here and learn how to apply for your credit!

How to apply for a Creditas loan?

Learn all about the process of applying for this credit and enjoy its advantages.

In this sense, those who want to take out a loan of greater value, but with low interest rates, may be in doubt between the Geru loan or the Creditas loan.

Both offer great installment conditions and interest rates. Therefore, in this post, you will check a comparison between them to decide which one will be the best. Check out!

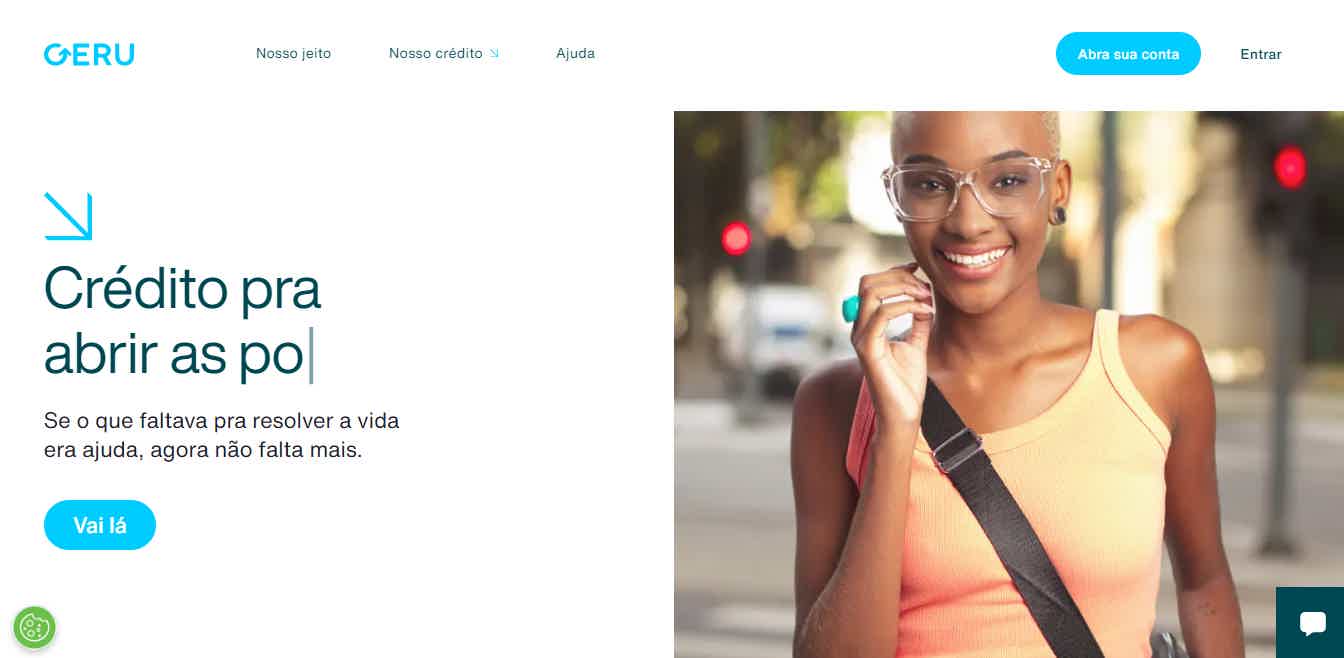

Geru Loan

Geru is a personal loan fintech that has been around since 2015. In short, it works by offering more affordable credit at lower rates for many Brazilians.

Thus, Geru operates by offering personal loans. From them, you can access fees from 1,90% per month and a credit of R$ 1 thousand up to R$ 50 thousand that can be contracted completely online.

Thus, after a quick registration on Geru's official website, the customer can access the amount available for loan and the interest rate that will be applied according to his financial profile.

In addition, you can pay off your entire loan within 36 months, in addition to having the credit amount in your account within 1 business day.

In this way, Geru is a very fast personal loan solution that can be used in times of emergency.

And to apply for the loan, Geru asks the person to have an account in their name, have proof of residence also in their name and not be a politically exposed person.

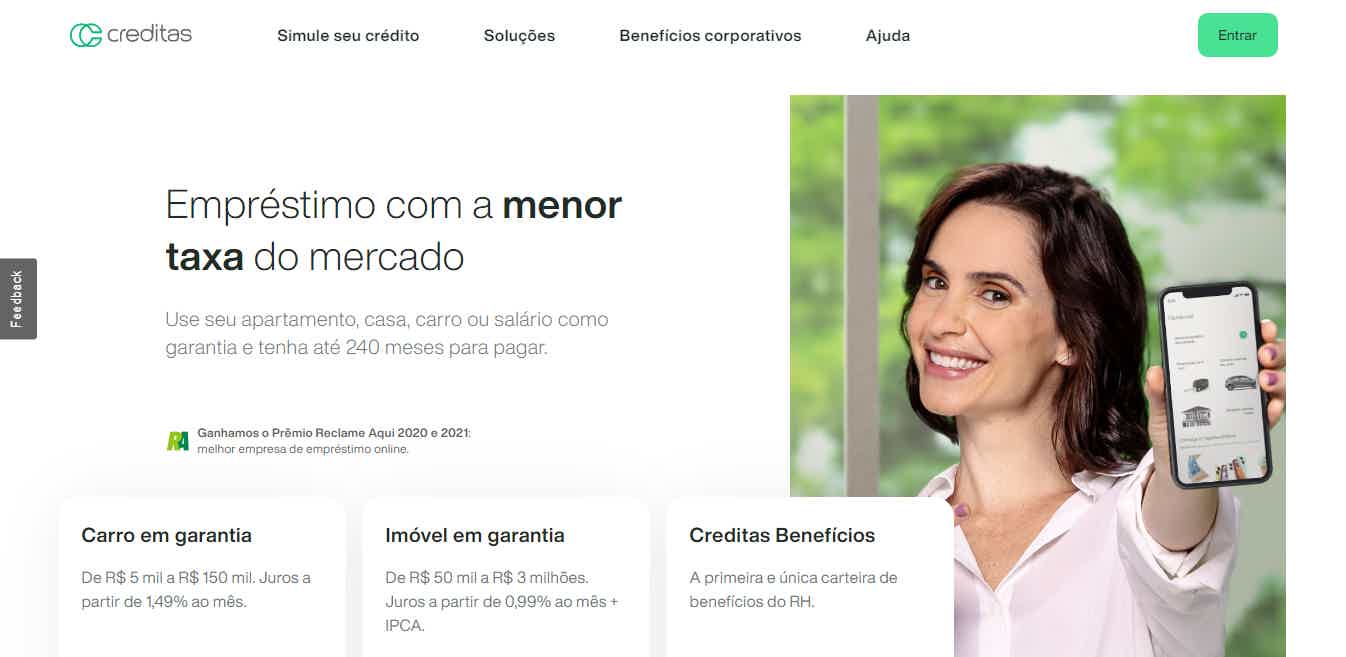

Credit Loan

Creditas is a company that offers secured loans to several Brazilians.

It started as a simple loan comparison platform and thus can use its experience to offer good credit solutions.

In this way, today it is able to offer loans in the vehicle and property guarantee modality. Because of this, your loans usually have lower interest rates and longer to pay off.

Thus, when taking out a loan with Creditas' property guarantee, you can transform up to 60% of the value of the property into credit and, in this way, be able to access values starting at R$ 50 thousand and going up to R$ 3 million.

In addition, in the vehicle modality, you can convert up to 90% of the value of the car into credit and, thus, get credit from R$ 6 thousand to R$ 150 thousand.

And regarding the payment period that Creditas offers to customers, it is possible to pay for the loan in up to 60 months, in the vehicle guarantee loan, or in up to 240 months in the modality with the guarantee property.

Finally, it is also important to know the interest rate applied to Creditas loans. Namely, the company applies interest rates that start at 0.99% per month.

What are the advantages of the Geru loan?

To choose between the Geru loan or the Creditas loan, it is essential to know the advantages that each one can offer you.

Thus, starting with the Geru loan, we were able to find the biggest advantage of not having to offer payment guarantees.

That way, you can access a good credit value without compromising your assets.

In addition, the Geru loan takes place completely online and securely. From it, it is possible to find a lot of transparency in relation to the credit analysis that they carry out.

And let's not forget that the loan has a quick approval and very low rates. Thus, when taking out the credit, interest can start at 1.90% per month and the money can be deposited in your account within 1 business day.

What are the advantages of the Creditas loan?

The Creditas loan offers the greatest advantage access to a very high amount of credit for individuals.

With it, you can access up to R$ 3 million credit, which is a very high amount and difficult to find in other financial options.

In addition, the Creditas loan has a very low interest rate, starting at 0.99%, which is another value that is difficult to find in the market.

Finally, despite the fact that the loan is secured, you can continue to use your assets linked to it normally for the duration of the loan.

Here the company will only use the good to settle the debt when you are unable to pay the installments.

But, by paying the installments on time and not having any delays, you don't have to worry that your property will stay with you.

What are the disadvantages of the Geru loan?

Despite having great benefits, such as a completely online application, low interest rates and a good repayment term, the Geru loan may still have some negative points.

Firstly, there is the fact that you need to provide your personal data when applying for a loan. Therefore, for those who do not trust the online means for this, this step can be a little negative.

In addition, to carry out the loan, you must also have an original proof of residence in your name. This can be difficult for people who live with their parents or others where your name doesn't appear on bills.

Finally, if you are a very active person and exposed to political issues in the country, you will not be able to access the credit that Geru offers.

What are the disadvantages of the Creditas loan?

On the other hand, Creditas also has some disadvantages in its loan. Starting with the fact that all the modalities that the company offers are secured loans.

In this way, those who do not own an asset, such as a car or property, will not be able to take out the loan and access a lower rate and better installment conditions.

In addition, because your loan is secured, access to it also becomes more bureaucratic, making it take longer for you to have the money in your account.

Thus, the loan of credits does not become such an attractive option for those who need to quickly receive the loan amount and cannot wait a long time for it.

Geru loan or Creditas loan: which one to choose?

In summary, the Geru loan and the Creditas loan can offer you great advantages. Both have a low interest rate and offer a good amount of credit to borrow.

However, the Creditas loan can be a little more bureaucratic, despite being completely online, in addition to being a more limited option, since only people who own an asset can apply for it.

On the other hand, the Geru loan is easier and more practical, and allows you to access the amount in just 1 business day. However, the Geru loan has more requirements on the profile of those who will apply for the credit.

But, in general, both options offer good loan conditions and allow access to good credit for you to use.

However, if you are still having doubts between the two options, it may be that knowing other loan options will help you make a better comparison and, therefore, know which option best fits your financial life.

To do this, just check out the comparison post shown below, which will show you how the Bom Pra Crédito loan and the BMG bank loan work.

Good Loan for Credit or BMG loan?

After all, which one to choose? Learn all about these options and find out which one is best for you!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How do I know if I have old debts?

Did you know that old debts may be barring your financial life? Find out now how to know if there are these debts in your name

Keep Reading

Itaucard Click Visa card without annuity and Iupp points

In today's article, we'll introduce you to the Itaucard Click card with no annual fee. Read this post and find out all the details about it.

Keep Reading

How to apply for card More

The Plus! has free membership and an exclusive points program! Want to know how to apply? Check it out here!

Keep ReadingYou may also like

Discover the Microcenter credit card

The Microcenter credit card is issued by Wells Fargo Bank, an institution located in the United States. It is made for customers of the Microcenter network, so the card offers cashback and other advantages. But is he worth it? Find out the answer in our text below.

Keep Reading

Get to know the Mercado Pago card machine

Mercado Pago is a digital account and also a card machine. Thus, you pay nothing to register and you can buy the machine that facilitates sales. Learn more about the service right now!

Keep Reading

How to apply for Bcredi Real Estate Financing

Learn how to apply for Bcredi real estate financing with 5 simple steps and conquer your dreamed home.

Keep Reading