loans

Superdigital loan or Jeitto loan: which one to choose?

Superdigital loan or Jeitto loan: Do you know which one is the best option when taking out a personal loan? Check out!

Advertisement

Superdigital loan or Jeitto loan

To begin with, the Superdigital Loan or Jeitto Loan are two loan options that are among the best on the market! In this, they have very interesting proposals with all the transparency and security you need!

So, to learn a little more about the pros and cons of these loans, we have brought a comparison for you to do an analysis! Check out!

How to apply for the Superdigital loan

Learn all about how to apply for this loan with amounts of up to R$25 thousand, low interest rates and up to 18 months to pay off the credit. Check out!

How to apply for the Jeitto loan

Do you want to learn how to apply for the Jeitto personal loan with quick and immediate release? Then continue reading to learn the step by step!

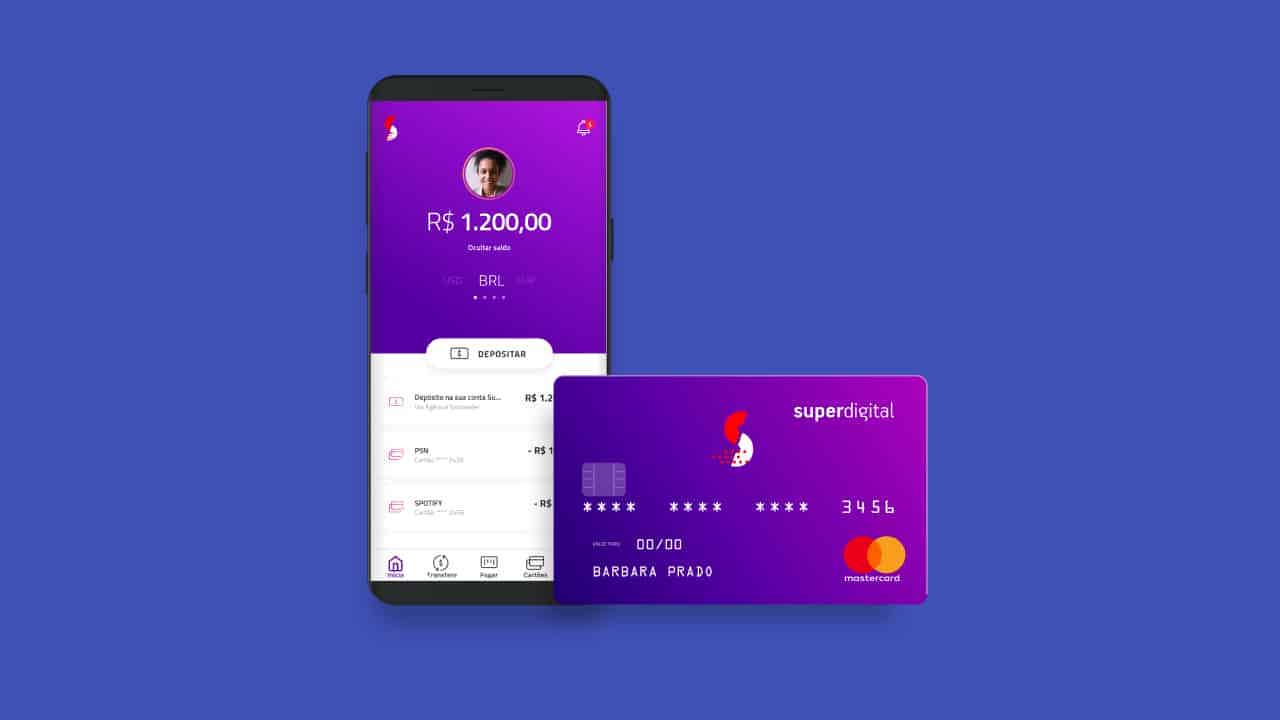

Superdigital loan

Well, the Superdigital loan is a completely online loan, which has several facilities to help you have a more uncomplicated financial life!

And besides, it has all the security and transparency you need when taking out a personal loan!

That's because, you can also do the simulation in up to 02 minutes, being able to pay in up to 18 installments with low rates and amounts from R$500 to R$25,000.00.

Also, to apply for a Superdigital loan, you must be a Superdigital customer! So, just install the application, open a Superdigital account, register and make a deposit, and wait to have access to all the advantages of the Superdigital loan!

Jeitto Loan

So, the Jeitto personal loan works as a secure and very quick release loan!

That's because it works with values up to R$150, ideal for paying bills and making cell phone recharges or other operations in up to R$150.

And in addition, you can request it through the application itself that works like a credit card!

This is because the due date of the invoice is previously established and occurs on the tenth of every month, with the bill generated by the application itself!

Furthermore, Jeitto does not charge monthly or annual fees, and a single fee is charged for payment of bank slips!

Therefore, Jeitto is a great option if you are looking for a loan with low amounts just for paying simple bills and top-ups!

What are the advantages of the Superdigital Loan?

Well then, the Superdigital loan has several advantages, including the term of up to 18 months to be able to pay off the credit!

And in addition, you manage to reduce interest rates over the term for payment of installments!

And best of all, it's also offered to self-employed and self-employed professionals! Therefore, the Superdigital loan is a great option if you are self-employed or a liberal professional and are looking for a secure loan with exclusive conditions!

What are the benefits of the Jeitto Loan?

So, the Jeitto loan has several advantages, including the fact that you do not need to have a bank account or offer anything as collateral to apply for this loan!

And in addition, the amounts of this loan are released in a few minutes and can be used to pay bills, recharge mobile phones, as well as internet purchase slips!

Finally, you can also insert a balance into Jeitto's digital wallet, to use it through the app! Therefore, it is a loan that is a little simpler than the others on the market!

What are the disadvantages of the Superdigital Loan?

Well, one of the biggest disadvantages of the Superdigital loan is the fact that you need to open a Superdigital account in order to apply for the loan!

This is because only account holders will be able to apply for this credit, bringing a little more bureaucracy to the process compared to others on the market!

And in addition, some more restrictive conditions of the loan regarding interest rates, for example, can only be accessed after the loan simulation!

Therefore, before choosing to take out the Superdigital loan, evaluate others in the market to find out if it really is the best option according to your financial situation!

What are the disadvantages of the Jeitto Loan?

So, the biggest disadvantage of this loan is the credit analysis performed. This is because, it is a loan that is not advantageous for negatives since it is necessary to prove income and financial stability such as a high credit score!

And in addition, the loan amounts are reduced, not reaching R$200, as well as the payment term is also short, in just 1 installment!

Therefore, if you need a loan with higher amounts, this is certainly not the best option, and you should look for other alternatives such as the Jeitto loan!

Superdigital loan or Jeitto loan: which one to choose?

Well then, the Superdigital Loan or Jeitto Loan are two loan options that have all the credibility, security, ease and accessibility that these financial institutions offer to their customers!

Therefore, make an analysis of the loans that are available to you in the market and see which one is the best option for you! And if you still have doubts, see a recommended content below about personal loans that we brought!

Discover the Digio Personal Loan

Get to know the Digio personal loan and understand how it works and can help you get out of debt quickly and safely!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open original shared account

Check out in this post how you can have an original shared account and thus enjoy its benefits with one more person.

Keep Reading

5 loan options to settle contract with abusive interest

Do you have debts with abusive interest to be paid and don't know what to do? See then the 5 best loans to pay off

Keep Reading

Get to know the Bradesco Elo Internacional Consigned Card

Get to know everything about the Bradesco Elo Internacional Consignado Card, how it works, how it is and also what is needed to have it.

Keep ReadingYou may also like

Meet cryptocurrency broker NovaDAX

NovaDAX is a São Paulo-based cryptocurrency brokerage with more than 40 digital asset options to invest in. See how this exchange works in the article below.

Keep Reading

How to apply for Credistar Personal Credit

If you want a loan with simple approval and that releases money in a short time, you need to know how to apply for Credistar Personal Credit online. See how to do this next.

Keep Reading

Is it possible to save money as a minor?

Want to save money? We separate in this content some tips on how it is possible to save money being a minor. Continue reading and check it out!

Keep Reading