loans

Loan for negative with Banco do Brasil

Do you want to take out a loan even though you are negative? Get to know the options that Banco do Brasil offers to make your life easier

Advertisement

BB facilitates loan for those with a dirty name

Since the beginning of the Covid-19 virus pandemic, Brazil has been facing many difficulties, so a negative loan would be a good solution.

The problems then happened not only in public health, but also with problems in the economy. This resulted in many unemployed workers and consequently no fixed income to pay their debts.

However, if the situation was already discouraging with Brazil breaking records of negatives with more than 60 million in 2019, after the crisis that came with the pandemic, the trend is that this number will only grow.

As a result, consumer interest in lines of credit and loans for bad credit also increased. And thinking of meeting the demand of the population, Banco do Brasil started to offer loans to those who have a dirty name in the market.

Here, you will clear all possible doubts about this new BB loan, so stay with us!

Banco do Brasil: loan for bad credit

Being negative, therefore, can bring you big headaches. You simply run out of credit with almost all companies and banks. It becomes very difficult to get loans, financing, installment plans and credit cards. So, the bills at the end of the month don't match and it seems increasingly difficult to settle everything.

Banco do Brasil's proposal consists of offering a loan for negatives with low interest and up to 180 days to pay the first installment. All this without consultation with the SPC and Serasa.

This credit is then intended for INSS retirees and pensioners or employees of companies that have a link with the bank. The loan amount is deducted directly from the negative customer's payroll or INSS benefit.

With automatic debit, the bank has greater security to grant you this type of credit, as it then has the guarantee of your payment. Therefore, there are more possibilities for negotiating interest rates that are relatively lower compared to other lines of credit.

How do I know if my name is dirty?

Before applying for a loan, you need to know if your name is really dirty. Learn how to find out if your name is dirty right now!

Understand about lines of credit for negative

Line of credit is a resource, which you acquire through a bank or financial institution. They are therefore offered to individuals (PF) or legal entities (PJ), in which it is basically possible to borrow money from these institutions.

At Banco do Brasil, you have several ways to borrow money. Therefore, here, we are dealing with the payroll loan that has some restrictions. But if you, who are not part of the target audience, still want to take out a loan, apply for BB credit lines and see which one fits.

Depending on your income, you can then get good amounts to cover emergencies or invest in your projects.

What are the advantages of the BB negative loan?

Banco do Brasil is one of the largest retail banks in Brazil. They offer products and services of the most varied styles for the most varied consumer profiles.

For those who need loans, payroll or financing, BB credit lines offer these services to everyone. The bank serves active public servants, retirees, pensioners, military personnel, employees of private companies or even non-account holders.

Now with the negative loan, you have one more opportunity to pay off your debts. Among the advantages of hiring the service are these:

- fixed installments

- No SPC/Serasa consultation

- Up to 6 months to pay

- Interest rates ranging from 2.51% to 5.89% per month

- Term of up to 6 years to pay

- Debt installments up to 96 installments

Even if you do not have an account at Banco do Brasil, it is possible to take out this loan. This is due to the fact that the credit is included in the payroll with the bank. In this way, the loan installments are automatically deducted from the benefit or retirement.

It is also possible to take out the loan without leaving home. Due to social isolation, leaving the house then becomes a problem, but with BB it is not necessary to go to an agency. Take out the loan through the website or application in the comfort of your home.

Payroll loan to clear name

Are you tired of having the bills in the red and continuing with the dirty name? So, find out how to apply for a payroll loan to clear your name

Who can apply for the loan?

The target audience for the negative loan are retirees, INSS pensioners, civil servants and employees of private companies that have an agreement with BB. To find out if the company you work for has an agreement with the bank, contact the HR department.

However, even offering loans to retirees, Banco do Brasil restricts this public to people aged up to 80 years.

Some of the requirements to take out the loan for negative are these:

- The employer must have an agreement with BB

- You must have available assignable margin

- Credit limit available at Banco do Brasil

Here is a tip for those who already have some credit contracted with BB. It is possible to renew by getting the same grace period to pay the first installment. Just enter the application and access “Loans” then go to the “Hire” option and then “Renew credit”.

Understand about assignable margin

When taking out a loan for negative credit, the amount that the bank releases depends on your assignable margin.

Basically, the assignable margin is the maximum amount that can be withdrawn from your salary or retirement every month to pay off the loan. This calculation is made by Banco do Brasil and will reflect in the final amount of your loan.

However, by law, no person can pay a portion exceeding 35% of monthly income. Knowing this, it is easier to have an idea of how much you can get with the BB loan.

The assignable margin is defined by the employer and if it is not available on the payslip, you can consult with the HR sector.

How to take out the loan for negative?

If you fit into the loan audience, it's time to find out how you can hire one. Hiring can be done online or in person. At a branch or via the Banco do Brasil website or App.

It is also possible to request the loan through BB's Internet Banking (in the case of account holders). This space works as an internet banking environment where account holders can carry out various bank transactions and queries without depending on the branch.

If you are negative and need credit, this is a great option. You will still be preserving your health by doing the whole procedure without leaving home, respecting social isolation.

After approval of the request, the requested amount is quickly deposited in your checking or savings account without the need to justify the request.

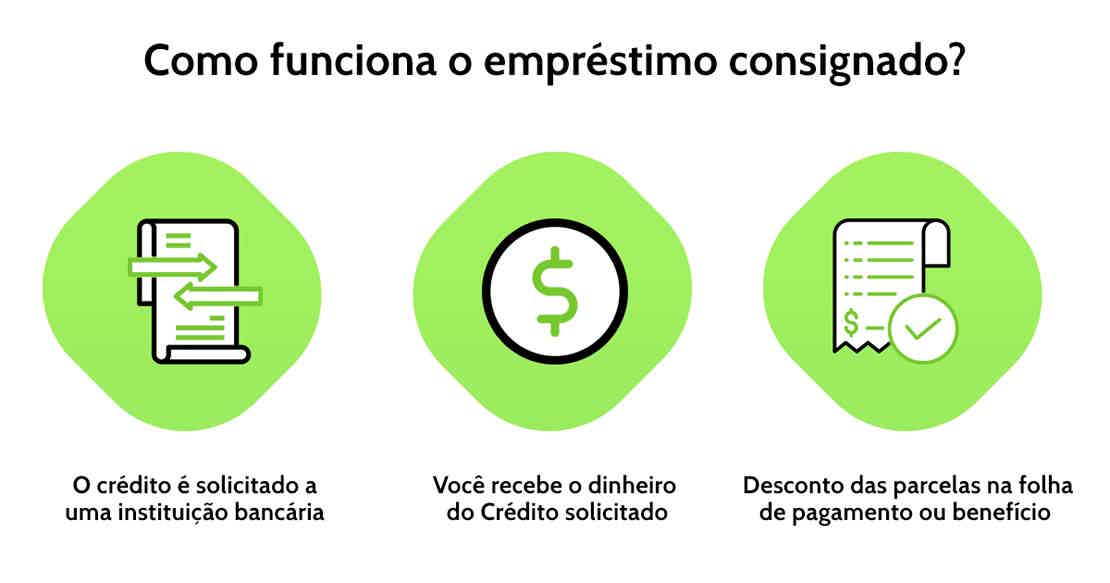

How does the payroll loan modality work for negatives?

The payroll loan is offered to meet any financial need you may have. And if contracted, the discount is automatic.

Payroll credit is offered by Banco do Brasil, one of the most conventional types of loans in the country. It is so popular because the installments are automatically deducted from the payroll or individual benefit.

This ensures greater security for the bank, as it is sure that you will pay. But you also gain practicality and time savings with the automatic discount. That way you won't need to go to an agency or run the risk of delaying payment.

With this type of payroll, there needs to be prior planning to know if the installments will fit in your pocket. Therefore, be careful, as BB's payroll loan is subject to registration approval, and changes can occur at any moment without prior notice in products and agreements.

And having all these advantages being negative is quite a help, isn't it? In addition, BB has the best interest rates on the market.

Examples of interest rates loan for negative

The deadlines for payment of the BB payroll loan therefore vary from 2 to 96 installments. The interest rates are between 2,51% am (34,36% pa) to 5,89% am (98,72% pa), “AA” means per year and “AM” means per month.

Let me illustrate with a brief example for you: a loan of R$ 5,000 in 24 installments, with interest of 2,99% per month equivalent to 42.41% per year will have installments of R$ 294.92.

That is, requesting an advance of R$ 5 thousand reais you would pay everything in installments of less than R$ 300.00 per month for one year. But of course everything will vary according to the amount of your monthly income, and according to the bank, changes are made without prior notice.

Stay smart!

Therefore, be aware and clear all your doubts with the bank before taking out the loan. Then read the contract carefully and do not miss anything.

Having clear and objective communication is very important. However, if the loan does not fit in your pocket, do not fall into temptation. After all, later you can get even more complicated with the debts that turn into a snowball.

Therefore, remember that the bank will make the automatic debit. So, if you are unable to pay the installments along with the usual monthly expenses, your debts can grow even more.

Have a financial plan

Here, we advise everyone to have good financial planning. Organizing your financial situation is very important before you apply for a loan, because with this planning you will have an overview of your finances, fixed, variable, superfluous expenses, etc.

If your goal is to pay off debt, then you won't be able to spend money like there's no tomorrow. It is therefore important to have control over your spending and never buy on impulse.

When you have your finances organized, you have a better view of the money coming in and going out. With this control you will not spend unduly, unless you want to get complicated at the end of the month.

Why apply for a payroll loan for negative at Banco do Brasil?

If you are in need of a loan to settle your debts, renovate or even for a trip, at Banco do Brasil you will find many possibilities to carry out your plans.

BB is a bank very well positioned among financial institutions for having the lowest interest rates. Here you can get loans that fit in your pocket.

And with BB's payroll loan, even those who do not have an account with the company can request this service. Among the numerous facilities are therefore the online loan, doing simulations before taking out the loan through the App and shorter time for release.

Credit with payroll deduction or payroll loan offers few risks for finance companies. For this reason the loans can be extended up to 8 years at very convenient rates.

About Banco do Brasil

Banco do Brasil was the first bank to operate in the country. Therefore, it was created to meet all the banking needs of Brazilians. At BB you have a credit card, current account, loan, investments, financing, consortia and much more.

There are more than 15,000 points spread throughout Brazil, including ATMs and branches. In addition, the bank employs more than 113,000 employees and interns.

In addition to all these possibilities, Banco do Brasil, being a national institution, is therefore committed to culture and to Brazilians. Acting and contributing to sustainability actions, sports and education projects for decades.

Concluding

Here we work to answer your possible doubts about the financial market, to make the best decision when it comes to a negative loan.

The advantages of taking out the payroll loan at BB are many, but in this case it is very important to be honest with your own financial situation.

Banco do Brasil is a reliable institution that has been in the market for many years. They guarantee you many facilities when you need money in advance, but be aware if it will be a good deal for you too.

Remember then that you already have debt. The loan is a great opportunity, but if you don't get smart it can become a big problem. Since if you don't get organized your debt can become a huge snowball.

So we say again, have a financial plan. In a spreadsheet on the computer, on paper, on your cell phone, wherever it is easier for you. Before taking out a loan, or rather, start organizing your finances right now.

Did you like our content? We have so much more! Follow the recommended texts.

Beware of Negative Loan Scams

Now that you know everything about the loan, see the tips and care needed to not fall into any negative loan scam

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Top card

See in this post how you can apply for the Top card and thus access a debit, credit and transportation card in one place!

Keep Reading

Financing for construction: find out how to do it!

If you are thinking about building a property, see how construction financing works and how you can make your own!

Keep ReadingYou may also like

How to open an ActivoBank current account Minimum Services

Do you want to make a current account that has a debit card and doesn't charge for maintenance? So, find out more and see how to join the ActivoBank Minimum Services account. Learn everything in the post below.

Keep Reading

Discover the Montepio + Vida credit card

Do you know the Montepio + Vida credit card? It has a great social responsibility project as well as good customer benefits. Want to know more? So, read the post.

Keep Reading

Nucoin: get to know Nubank's cryptocurrency

Nucoin is Nubank's cryptocurrency that will be made available on the platform in 2023. Were you interested in the subject? So, to know more about her, just continue reading the article!

Keep Reading