loans

Loan on electricity bill: how does it work?

Did you know that your electricity bill allows you to borrow easily and quickly? See right now how this modality works.

Advertisement

Find out how to get a loan on your electricity bill

Have you ever imagined taking a loan on your light bill? Probably not. Despite being possible, this modality is still not very popular among Brazilians and many do not even know that it is allowed.

Your light bill needs to be paid every month, doesn't it? With this, companies can provide you with credit and request payment via account to guarantee receipt on the correct date every month.

But, there are details about this grant that you need to know before applying. See all the information about this type of loan and see if it is right for you.

What is an electricity bill loan?

Since 2019, this possibility has reached the Brazilian market, bringing the possibility of requesting a loan by configuring the debit from the monthly electricity consumption account.

This means that the loan installments will be paid monthly through your electricity bill. In this way, the amount of the loan installment will be added to the energy consumption of your residence in the month.

For example: if you normally spend 60 reais on electricity and take out a loan that totals 1,000 reais (with interest and fees included) to be paid in 10 installments of 100 reais, that means that for ten months your bill will be 160 reais (60 reais of energy consumption + 100 reais for borrowed money).

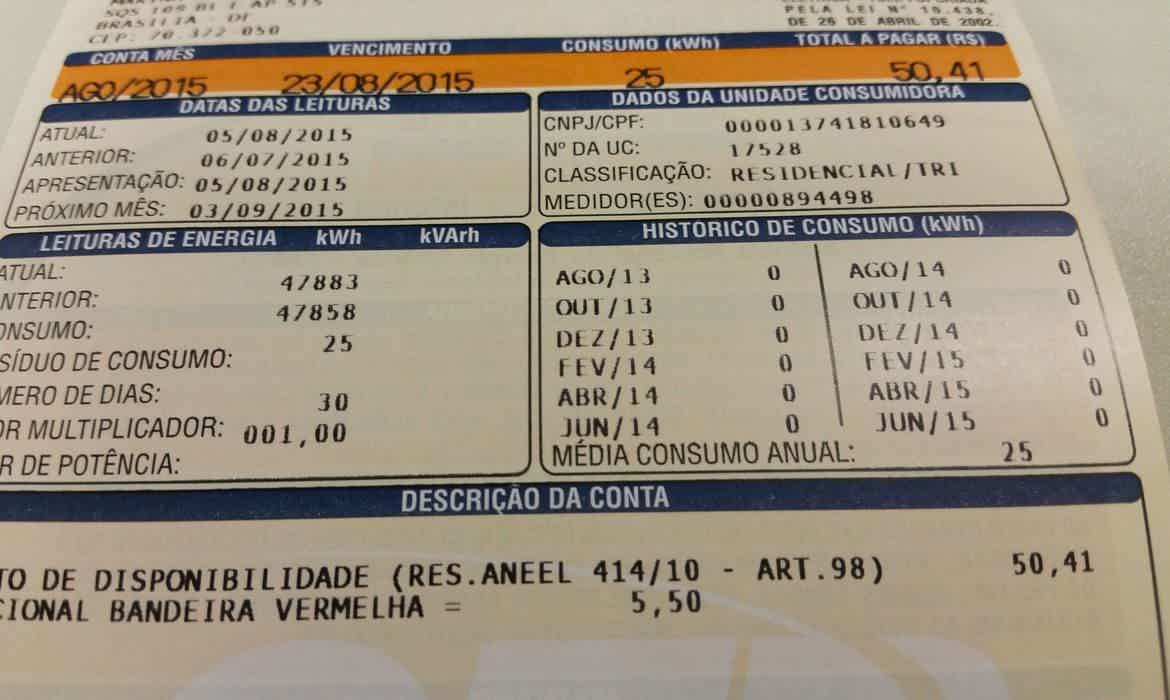

It is important to note that the maximum loan installment is normally limited to twice the average value of the electricity bill. This helps to minimize the possibility of default.

How it works?

As mentioned above, the electricity bill loan is a new type of credit. It allows the person to pay the installments of his loan along with his energy consumption. The sum of these values will be present in your monthly consumption bill.

Payment can be made as usual, debit, at an ATM or at a lottery.

It is important that you know that the maximum installment value is equivalent to twice the value of your energy consumption. For example, if your electricity bill costs R$50 reais, the maximum amount of your loan installment will be R$100.

Usually those who carry out this type of loan are finance companies that have partnerships with the company that supplies electricity to your home.

To take out this loan, you must seek an institution or company specializing in consumer debt loans and present the following documents:

- RG;

- CPF;

- Updated proof of residence;

- Bank receipt.

Usually the process for formalizing the loan takes place online, but remember to make sure the site is reliable.

Also, don't pass your document numbers through calls or SMS without knowing who you're talking to.

Another thing you should know is that the loan amount usually varies between R$ 500 and R$ 2500.

Also evaluate which credit companies offer this service in your region and how to apply for the loan on the electricity bill according to the processes of each one of them.

Among the criteria that you can evaluate before closing the deal are:

- the amounts made available;

- the total number of installments;

- interest rates;

- the total effective cost (CET).

What are the advantages?

You must probably be wondering then what are the explicit advantages of this type of loan. Since it will involve something as private as your electricity bill. So, we separate some points of the advantages offered to you.

- After credit approval, the money can be in your account within 24 hours;

- The payment term is from 3 to 18 months;

- The application process is simple and online;

- The value of the installment will only be 2 times the value of your energy consumption.

What are the ddisadvantages ofthis kind of loan?

Like everything else in life, the electricity bill loan also faces its disadvantages. This information then becomes useful for you to compare benefits and non-benefits and decide whether to apply.

- When applying, you will need to undergo a credit analysis;

- Interest rates can vary greatly from person to person;

- You need to have a bank account to deposit the loan money;

- You must be at least 21 years old and at most 79 years old;

- It is not possible to apply if your electricity bills are overdue, it is necessary to settle the situation first;

- Currently this type of loan is only available for some Brazilian states, namely São Paulo, Rio de Janeiro, Ceará, Goiás and Rio Grande do Sul.

- Your consumption bill will be more expensive for a few months, as it will come along with the loan installment.

It is worth noting that you do not need to make any bank deposit to receive your loan. If the company or representative who is communicating with you asks you to make a deposit, be suspicious, as it could be a scam.

Loan worth it?

So, to know if it is advantageous to bet on a loan on the electricity bill, the first care you should take is to understand very well what fees will be charged before closing a deal.

Even though the interest rates are more attractive than those offered on personal loans, overdraft or credit card revolving, it is important to correctly calculate whether the installments fit in your pocket. In addition, it is essential to find out the final price of your loan and then assess whether it really is a good deal for you.

It can therefore be advantageous when looking for a value that is not too high, which is released quickly into your checking account. For those with a dirty name and need money to pay off some debt, it can also be an interesting option.

The important thing is not to forget that for a long time your consumption bill will be much more expensive than you used to pay. If the energy use in your home increases or the price goes up for some unforeseeable reason, this will also impact your monthly expense.

There are other options on the market for those who need money quickly, without bureaucracy and with lower interest rates. All you have to do is understand the rates and see if this is the most viable option for you right now.

Serasa eCred: best loan options

Did you know that it is possible to get a loan even if you are negative? That's right, get to know Serasa eCred and get out of the red

Companies that make loan for negative

To give you security, it is possible to apply for the loan with companies that offer security and results in the market. Therefore, you can count on companies linked to Serasa eCred.

This is a finance website that simulates loans. There, you can find all the trusted partners in one place.

To apply, simply access the website, register and request the simulation. Then, just wait for the response and contact the presented company.

Check the list of companies available through Serasa eCred:

- Legendary;

- BMS;

- Yes Simple Loans;

- Bari Bank;

- Super Yes;

- My everything;

- Biorc;

- Geru;

- Credits;

- Finmax;

- Jeitto;

- rebel,

- Financial BV;

- BCredi;

- Crefaz;

- Simplify;

- Ferratum;

- Value Financing.

Conclusion

Here you saw that your electricity bill can be more than simply charging your energy services for the month. This invoice can help you get the credit you need to pay off debts, make investments and others.

But, you also checked the disadvantages, necessary precautions and when to apply for credit or not so as not to complicate your financial life even more and get into debt.

Enjoy the content, do your financial planning and ensure the best choices. For this, with other content we produce to help you improve your finances!

5 tips to start your financial control

There are some ways to start financial planning, including apps that can help you with this process! Check out the unmissable tips that we have separated for you.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to register for Bolsa Familia

Do you know how to register for Bolsa Família? Today we will teach you the step-by-step to register in this Federal Government program!

Keep Reading

Discover the Pernambucanas credit card

The pernambucanas credit card is ideal for those who frequently use the brand's network of stores, and want to obtain benefits!

Keep Reading

How to receive the FGTS birthday withdrawal

The FGTS birthday withdrawal is available to all workers who already participate in the regular benefit. See now how to receive!

Keep ReadingYou may also like

How to Apply for Citi Chairman American Express Card

A business card with solutions and security for you and your company. Have you ever thought about it? If you've thought about it, it's time to find out how to apply for your Citi Chairman American Express. As? Look here.

Keep Reading

How to open a CTT Base account

CTT has a current account option with a lower maintenance fee than the traditional one and all the main banking services available. See, in the post below, how to join the CTT Base account.

Keep Reading

Discover the Caixa Visa Platinum credit card

Do you want a card with international coverage and annuity waiver? Get to know Caixa Visa Platinum in the text below.

Keep Reading