loans

Agibank loan or Itaú loan: which is better?

The Agibank loan and the Itaú loan have low interest rates and exclusive benefits to help you get out of the red! Want to know more? Meet here!

Advertisement

Agibank x Itaú: find out which one to choose

Without a doubt, personal loan interest always makes anyone think twice before borrowing a little money, doesn't it? Well, did you know that there are payroll credit lines with much lower interest rates? Today we are going to talk about two of them: the Agibank loan and the Itaú loan.

So, do you want to know more details about these two loans to assess which is the best option for you? So, read on!

How to apply for the Agibank loan

The Agibank loan offers low interest rates and installments of up to 84 installments to help you turn your dreams into reality! See here how to apply!

How to apply for an Itaú loan

The Itaú loan does not consult the SPC/Serasa and offers 90 days to start paying! See here how to order yours!

| Agibank loan | Itaú loan | |

| minimum income | Uninformed | Uninformed |

| Interest rate | From 1.2% per month | Around 2,72% per month |

| Deadline to pay | Up to 84 months | Up to 84 months |

| release period | 3 to 5 business days | 2 to 5 business days |

| loan amount | Up to R$10,000.00 | Up to R$70,000.00 |

| Do you accept negatives? | Yes | Yes |

| Benefits | Reduced interest, flexible payment. | 90 days to start paying, you can anticipate installments. |

Agibank loan

First, let's talk about the Agibank loan. In this sense, the company promises a line of credit with many advantages, such as reduced interest, and offers a fully digital service through an application. However, unlike other fintechs, Agibank also has physical branches if you prefer face-to-face service.

So, the bank offers two types of credit for retirees, INSS pensioners, military personnel or civil servants: the payroll loan and the personal loan.

In this way, the payroll loan is paid in up to 84 months and is available to those who are negative, because the installments are deducted directly from their payslip, so Agibank does not consult the SPC/Serasa. The personal loan is indicated if you have already reached the payroll margin (about 35%) and need an extra amount. However, the total effective cost of this type of loan is slightly higher and the installments are up to 72 installments.

So, if you want to do a loan simulation to find out the amount and what interest rates are available for your financial profile, you can do it through the official fintech website for free and without bureaucracy.

Itaú loan

In principle, Banco Itaú is one of the most credible financial institutions in Brazil and in the world. So, according to the company itself, one of its goals is to encourage the personal growth of its customers and help you make your dreams come true.

Therefore, it was with its financial needs in mind that Itaú bank created the Itaú payroll loan. In other words, a type of loan for those who are retired, INSS pensioners or work in the public and private sectors whose company has an agreement with Itaú.

In this sense, the institution offers a period of up to 84 months to settle the installments depending on your benefit, and you only start paying 90 days after hiring. In addition, you can choose the amount of installments and get a discount if you pay in advance for the month.

Furthermore, the service is only available if you have an account opened at Itaú or if you receive your benefit there. So, if that's your case, you can apply for the loan via the internet, ATM, app or at one of the physical branches.

What are the advantages of the Agibank loan?

So, in addition to the ease of applying for your Agibank loan, fintech offers reduced interest from 1.2% per month and a great payment term, which can be divided into up to 84 installments. Thus, you have more time to pay off your debt and the installments are more affordable.

Also, you don't need to justify to the bank why you want to acquire the money. That way, after approval of the loan, the amount will be credited to your account within 24 hours for you to use as you wish.

Furthermore, the bank offers a personal loan for those who have already used the payroll margin and want an extra amount. So, this modality can have the installments deducted from a current account and offers installments in up to 72 installments.

What are the advantages of the Itaú loan?

Well, the Itaú payroll loan offers interest of 2,72% per month, which is lower than your other lines of credit, in addition to a period of 90 days for you to start paying the installments. This way, you have time to organize your finances before making payments.

Furthermore, the bank gives you freedom to choose the value of the installments so that they fit in your pocket without compromising your income. So, you can also anticipate payments if you want and also get a discount for anticipation.

In addition, the payment period can be up to 84 months depending on your benefit and the money will be credited to your account within 48 hours after the loan is approved.

In addition, if any unforeseen circumstances arise, you can apply for a credit renewal. That is, Itaú settles the active loans and releases another credit in your account.

What are the disadvantages of the Agibank loan?

At first glance, a negative aspect of the Agibank loan is that unlike other options in the same category, it does not offer debt refinancing and it is not even possible to delay or pause the payment of installments. Therefore, the amount will be deducted from your independent payroll if you have any financial unforeseen circumstances.

In addition, the Agibank loan can only be taken out by those who are retired, pensioners, military personnel or civil servants. Therefore, it is not an affordable line of credit for many people.

In addition, the interest on the personal loan is higher than the payroll loan and offers a shorter term installment, so you have to be careful when asking for yours so as not to run the risk of not being able to pay the installments.

What are the disadvantages of the Itaú loan?

So, the main negative point of the Itaú loan is that you need to have a bond with the bank. In this way, you can only apply for the credit line if you have a checking account or if you receive your benefit there.

In addition, the loan amount and interest rates vary depending on your income and you need to have a pre-approved limit at the bank to access this information. In this sense, the simulation online or through ATMs is only possible for account holders. So if that's not your case, you'll need to go to a physical agency.

Furthermore, like any other payroll loan, the Itaú loan is only available to a limited audience. Therefore, if you are not retired, pensioner, or employee of public and private bodies associated with Itaú, this line of credit is unfortunately not available to you.

Agibank loan or Itaú loan: which one to choose?

Although the Itaú loan offers good advantages, such as the initial term of 90 days for the payment of the first installment and the freedom to choose the amount that will be debited monthly from your account, you need to have a relationship with the bank and its interest rates are more higher than that of the competitor. However, the Agibank loan offers lower interest rates, but does not allow the customer to refinance if you need more money or more time to pay the installments.

Before deciding between an Agibank loan or an Itaú loan, it is important that you have a good cost plan and carefully analyze all the information before applying for a payroll loan. So you are sure that you will be able to make all the payments and not run the risk of acquiring another debt.

However, if you want to know other lines of credit available on the market, check out the recommended content below.

Good Loan for Credit or BMG loan

Here you will find everything about the Bom pra Crédito loan and the BMG loan. For we list the advantages, disadvantages and main features. Check out!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the loan with vehicle guarantee Banco do Brasil

Check out in this post everything about the loan with vehicle guarantee that Banco do Brasil offers and learn how to apply for it!

Keep Reading

Agibank 2022 personal loan review

In this review about the Agibank personal loan, learn about the service's characteristics, advantages, disadvantages and learn how to apply for yours.

Keep Reading

Overview of indebtedness in Brazil

We prepared an overview of indebtedness in Brazil so that you understand the context of the current situation and how to settle your debts.

Keep ReadingYou may also like

New PIX 2023 rules: understand what the changes are

If you use the PIX frequently, it's essential to be aware of the new PIX rules, such as the new value limits and transaction hours. To check out all the changes in full, just continue reading the article!

Keep Reading

See some of the most anticipated series titles for 2022

The year 2021 is barely over and we're already thinking about the most anticipated titles of 2022 on streaming platforms. Some of the series that fans are most looking forward to seeing include the Game of Thrones spin-off, as well as the mysterious blockbuster The Lord of the Rings.

Keep Reading

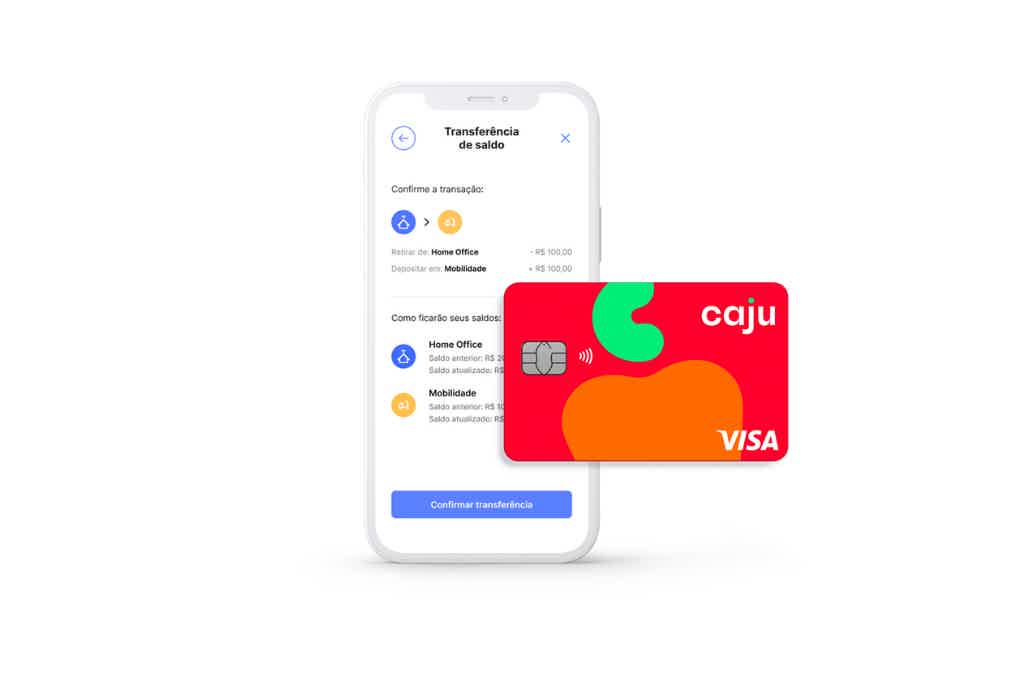

How to apply for the cash card

The Caju card is national with the Visa flag, so it is a complete option to unify the benefits of your employees. Plus, it's free and accepted in thousands of places. To find out how to apply, just continue reading below!

Keep Reading