Financial education

Find out how Serasa Score works

Do you want more access to credit products on the market? So you need to understand how Serasa Score works and how to increase yours. Learn more in the text below!

Advertisement

How does Serasa Score work?

When it comes to shopping, being right in front of the financial market is one of the biggest concerns of consumers, so, “show me your score, and I'll tell you who you are”, don't you understand? Don't know how serasa score works? Then continue with us.

The credit analysis system, serasa score, is used to help both consumers and companies in business.

So, let's explain to you what the credit score is for, and other useful information to understand how this system works.

What is the Serasa score?

The Serasa score is a tool that works as an analysis for granting credit and doing business.

Of English origin, the word "score" means punctuation, since the word "credit score" is a system through points that indicates whether you are a good or bad payer.

Thus, the lower your score, the worse payer you are, and the higher your score, the better payer you are.

This is because, through this system, consumers receive a score and thus indicate greater or lesser confidence in banks and companies.

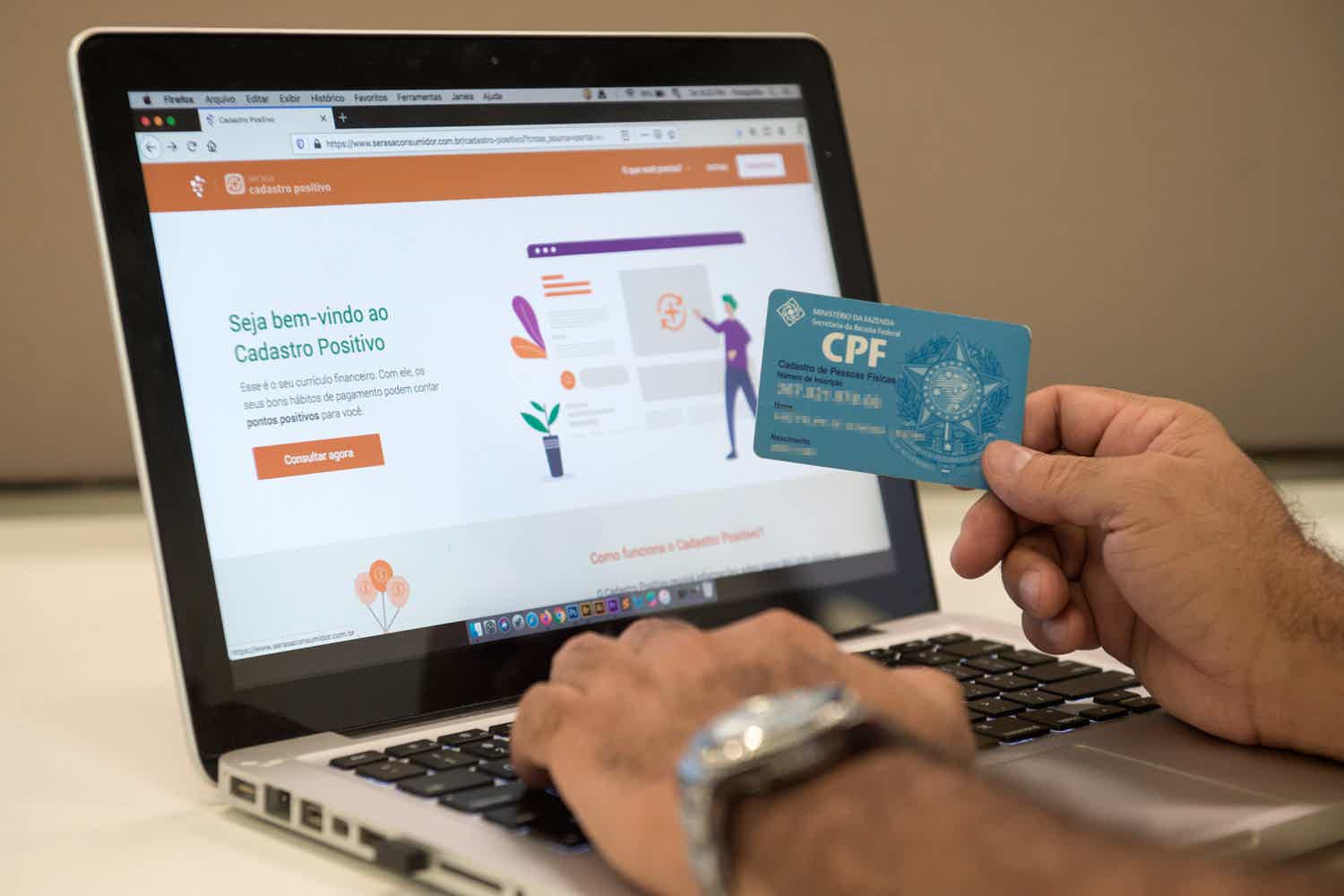

But how does Serasa have access to this data? It's simple. They manage to have access to the data, through an analysis made in their CPF.

That is, when you make a purchase with your credit or debit card, when you don't pay a water bill, for example.

Then, through your CPF number, Serasa will have access to your financial and banking transactions, and thus, it will know if you are a person who honors your commitments or not.

What is the credit score for?

When borrowing money from the bank, for example, the one who will make the loan needs to know if you will be able to honor your debts.

That's because, the credit score is like a note that is given to the person for the bill payment history.

Then, this score will be analyzed to find out the probability of that person paying their bills on time in the next twelve months.

And remember that the higher the score, the greater the types of credit available to you, as well as other advantages.

How can I access my score?

Anyone can access your score, just access the Serasa website and follow the next steps. Look:

- Access the Serasa website;

- Click on “Check Free CPF”;

- Add your CPF;

- Inform your password.

Note: If there is no registration, just fill in the registration with personal data on the site itself, which is very simple.

After that, you will have access to your score number, which may vary as we will show later.

Another curiosity about this question is that you can see your score, as well as the average score of people in your zip code and age.

However, you cannot see someone else's score, only yours, according to your data.

What information makes up the Serasa score?

The Serasa score is made up of data that is relevant for credit risk analysis for banks and companies in their business.

So, as mentioned above, if you are going to ask for a loan from a financial institution, however, you owe another one, the serasa score will show this information to the current financial institution, and your loan will certainly be denied.

That is, through this system you can find data on debts paid off, whether you are punctual, and whether you pay your bills on time, among other data.

However, some information may change, for example, when there are changes in the Serasa base, such as:

- Update of registration data: In this item, data such as CPF, address, full name, can be changed;

- Entry or exit of your participation in the company: In this item, any legal change is also included in the Serasa database;

- Presence or absence of queries to the Serasa database;

- Presence or absence of negative overdue debts.

This means that, when there is any financial transaction with Serasa, your score may change, depending on this change.

What is the Positive Register?

The Positive Register has been used for years in several countries around the world, such as the United States, Canada, China and England.

In Brazil, it was created in 2011 as the “Good payers database”, and works as a financial behavior history.

In this history, all financial transactions you make will be registered, whether paid bills or unpaid bills or paid late.

That is, the positive record is an excellent way to stay well in the credit market.

So, how it works is as follows: your history will be managed by the credit bureaus, which are:

- Stores;

- Business;

- Banks;

- Other financial institutions.

And, they will query your data to generate credit, loans or business.

It is important to say that the inclusion of data occurs automatically, and you will be notified by email or sms to inform about the positive registration, however, there is the alternative of withdrawing from the positive registration.

What is a good credit score?

There are three levels of scoring, the low level, the intermediate level, and the high level, which is considered a good score, as we will see:

So, come on, the score ranges from 0 to 1,000, divided into three levels according to default, see:

Above 701 points – Low risk of default

This level is the most favored by banks and finance companies, as it indicates that the customer has a low risk of default.

That is, the chances of this client not making payments to the institution are lower than that of a client with a lower score.

So, to get out of this bad debt situation, just follow the steps that we will mention below, and increase your chances of getting loans.

Between 300 and 700 points – Medium risk of default

This level is considered intermediate, that is, it indicates that the customer pays the bills, but maybe delays a little, or leaves some unpaid.

In this case, the customer is not a good paying customer, but it's not that bad either, you know?

There are companies that accept lending and do business with people who are at an intermediate level.

Below 300 points – High risk of default

At this level, unfortunately, most customers cannot get loans from banks.

This is because the high risk of default “dirty” the image of these people in the face of financial institutions, being considered people who do not honor their commitments.

For this purpose, the amounts considered are all financial transactions, whether paid or not paid.

However, there is no need to be afraid, because, regardless of the score you are, you can solve the score.

Thus, a score considered good is one above 701 points, which presents a low risk of default, and thus, more advantages.

Among these advantages we have: greater chances of getting loans and financing, interest negotiation, among others.

What makes Serasa Score go up?

The Serasa score is calculated dynamically, that is, considering the data available at the time of the query.

As we have already mentioned, it is important to maintain the score with a score for low risk of default, to be able, for example, to apply for a credit card.

So, if at the time of the consultation, you noticed that your score is low or at an intermediate level, and you need to increase it, don't worry, here are six ways to help you with that:

Clear your name and settle your debts

That's because, if you have debts or outstanding debts on your CPF, your score will remain low, precisely because you owe someone.

Furthermore, it sends a red flag to other finance companies that you are not honoring your commitments.

To do this, participate in “Clean name” fairs, or try to negotiate directly with finance companies, who usually offer discounts for this.

Another point, the credit agencies, look for consumer data for up to five years, so it's not just recent data to do the serasa score query.

Update registration data

This is because, when you update your registration data, you demonstrate that you are not running away from your commitments.

Thus, you are able to receive charges as well, as well as any credit agency notification.

So, it will demonstrate a positive point, that it is available to companies, and that helps to increase the score.

Pass the bills to your name

This is because, whenever an account is transferred to one's own name, more data is passed on to the credit agencies.

That is, if all accounts are in other people's names, bureaus will not have access to consumer data.

So, the greater the forms of contact, the greater the chances of demonstrating trust between the consumer and the agency.

Pay bills on time

There is a myth that if you pay your debts in advance, your score increases, this is a lie.

In fact, for the score to increase, debts need to be paid on time, that's all, you don't need to work great miracles.

That is, if the payment is late for a single day, it will already be a red light for the credit bureaus, such as Serasa, Boa Vista and SCPC.

Stay on the positive register

As we already mentioned, the positive registration was something that the user needed to register before, currently, it is automatic.

The Positive Register works as a record in which you authorize the credit bureaus to analyze your financial transactions, and how much payments you make.

Thus, for banks and finance companies, your status will be more detailed, whether or not you are a good payer.

That is, the tip is to remain on the positive record, so that the bureaus are aware of your financial transactions

Do not apply for credit

In this topic, we have an alert that few consumers know about how the serasa score works: avoid requesting credit from different banks in a short period of time.

That's because, the more credit you ask for, the more it will demonstrate that you are in need of money, and this can reduce your score.

So, if you are in need of credit, opt for just one financial institution, or wait a certain period to look for a second option, so that your score does not undergo major changes.

So, if you want all these tips, your score can increase gradually, as it does not increase at the time of the change made.

Remember that the score does not only work with settled bills, but also with bills that are paid on the right date.

What is a good Serasa Score for financing, loans and credit cards?

To answer this question, we need to understand that it DEPENDS!

This is because it will depend on each financial institution, being a subjective credit analysis, as long as it is at a low or medium level of default.

So, each company will have its own criteria, as well as ways of analyzing each person's credits, as long as that company does not pose risks.

That is, a company can grant credit to a person with a low risk of default, however, the other can refuse.

To find out, you need to know each company's operating policies, as well as their way of analyzing that person's financial health.

And, for example, a company can analyze and realize that there is an overdue debt from that consumer, however, the others are paid, so the overdue debt will be considered an exception, the loan can be granted.

Finally, we can see that the score is a tool that brings security and agility to consumers, as well as to companies.

And if you want to increase your score, check out the ebook below.

O Maximum Score Guide is a detailed step-by-step created by one of the best specialists in credit analysis of large banks and that will guide you to increase your score and be able to have credit again as you always wanted.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 card options without annuity for negatives

Get to know the 7 best card options without annuity for negatives. They do not consult the SPC and SERASA, and they also offer many benefits.

Keep Reading

How to make money instantly online 2021

Did you know that you can earn money instantly through apps with just your cell phone and an internet connection? Click here and find how!

Keep Reading

Balaroti financing or Bradesco Reforma financing: which is better?

Get to know Balaroti financing or Bradesco Reforma financing and understand which is ideal for you to carry out your renovation. Learn more here!

Keep ReadingYou may also like

Discover the Caixa Consignado Card

Do you have a dirty name? The Caixa Consignado card can be the solution, with reduced interest rates and international coverage. Learn more about below!

Keep Reading

Discover the Neon digital account

The Neon account is fully digital and offers unlimited and free transfers via PIX, credit card and international debit card with no annual fee, in addition to many other benefits! Read this post and learn more about it.

Keep Reading

How to apply for the Riachuelo credit card

Riachuelo card offers 10% discount on first purchase. Find out how to order yours easily!

Keep Reading