Government Aid

Consigned credit Auxílio Brasil: check the rules

The Ministry of Citizenship defined the main conditions of the Auxílio Brasil payroll loan, such as interest rate and payment term. Find out more about them here.

Advertisement

Loan can be paid in 24 installments and will have low interest

If you are currently one of the beneficiaries of Auxílio Brasil, you can request the Auxílio Brasil payroll loan in the very near future.

The Ministry of Citizenship created this special loan for those who receive Auxílio Brasil and need to access extra money to undertake or carry out another project.

Get to know the Brazil Aid benefit

See how it works, how much beneficiaries earn and how to access it!

The measure was taken to guarantee access to credit for the program's beneficiaries, who had been facing difficulty accessing other types of loans available in banks and financial institutions.

Therefore, if you are a beneficiary of Auxílio Brasil and want to know how the payroll loan will work, just stay with us in this post and we will answer your main questions!

What is Auxílio Brasil payroll loan?

In short, the Auxílio Brasil payroll loan is a loan option that beneficiaries of this aid can request.

From there, it is possible for families to access credit of approximately R$ 3,000.00 to purchase a large item or undertake a business.

The emergence of this credit is being very important for families benefiting from Auxílio do Brasil. Most of them have a low income, which makes it difficult to approve credit in traditional loan types.

In this way, with the creation of the Auxílio Brasil loan, it is easier for them to access credit and, thus, achieve their goals.

Discover the CadÚnico Program

Understand how the program that brings together all the social benefits works.

How does the Auxílio Brasil payroll loan work?

To understand how Auxílio Brasil's payroll-deductible credit works, we need, first of all, to better understand what the payroll-deductible credit that is being offered to Auxílio do Brasil's beneficiaries is.

Therefore, payroll loans are a type of credit that salaried or retired people can access. In short, it is similar to other types of credit, the only difference is in terms of payment.

Thus, in the form of consigned credit, the payment of installments is automatically deducted from the salary or retirement that the person receives.

In this way, the Auxílio Brasil payroll loan works in the same way, where the value of the installments made on the loan are automatically deducted from the benefit received.

However, with Auxílio Brasil credit, banks and financial institutions that offer the loan will only be able to deduct up to 40% from the amount that families receive from the aid.

This way, they are able to take out the loan, pay it off and still have money left over to use for other needs during the month.

Who is this consigned credit suitable for?

In short, the Auxílio Brasil payroll loan can only be requested by families that receive the social benefit.

Therefore, only those who meet the program criteria will be able to access this type of loan.

Currently, to be eligible for the program, the family must be in a situation of:

- extreme poverty with monthly income per person of up to R$ 105.00;

- poverty with monthly income per person between R$ 105.01 to R$ 210.00.

Which banks offer this loan?

Namely, to date there are around 60 banks and financial institutions that are going through the screening process to be able to make Auxílio Brasil payroll loans available.

Among them, Caixa Econômica Federal is one that has already confirmed that it will make credit available to the public.

In addition to it, there are other banks such as Agibank, Crefisa, Pan, Safra, Daycoval, among others that have confirmed that they will provide credit.

What are the credit conditions for the Auxílio Brasil loan?

An important part of knowing about credit is its main characteristics and existing conditions.

Therefore, whoever takes out the Auxílio Brasil payroll loan can close a contract with installments that go up to R$ 160.00 including an interest rate of up to 3.5% per month that banks can apply.

Furthermore, the Ministry of Citizenship informed that the loan can be paid in up to 24 installments.

Therefore, the total amount of credit that Auxílio Brasil beneficiaries will be able to access is approximately R$ 3,000.00. The total amount will depend on the interest rate applied to the installment.

What are the advantages?

By now, you have already been able to better understand how Auxílio Brasil’s payroll loans work in practice. But, what are its main advantages? That's what you can see below.

- Access to credit for those who were unable to apply;

- Lower interest rates compared to other modalities;

- Good deadline for making payment;

- Low loan installment amount.

And the disadvantages?

Despite the advantages, the Auxílio Brasil payroll loan also has some negative points. Get to know them below.

- Low loan amount that is possible to make;

- There are large and recognized banks that are not open to offering credit;

- If the client is not financially organized, it could harm their budget.

How do I request an Auxílio Brasil payroll loan?

In summary, the Auxílio Brasil payroll loan is an interesting option for those who receive the benefit and are unable to borrow money from other banks or financial institutions.

Therefore, if you liked this loan and receive Auxílio Brasil, check out the following post on how you can request a loan from Auxílio Brasil!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

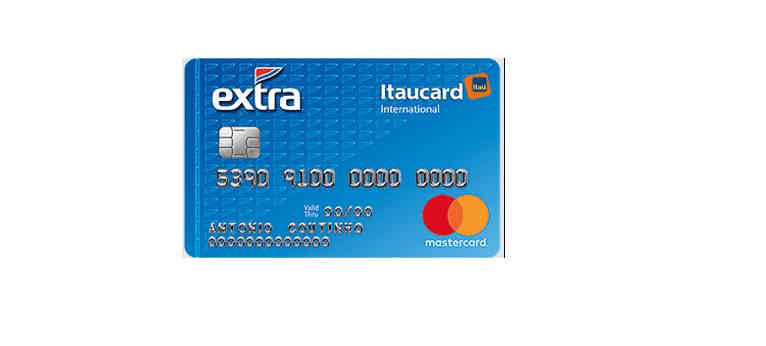

Discover the Extra Itaucard 2.0 card

Check out the advantages and disadvantages of the Extra Itaucard 2.0 card, the benefits and understand if it is worth requesting yours!

Keep Reading

Learn about the Best Youth Program

The Melhor Jovem Program prevents school dropouts by offering assistance to young people who are in high school. Learn more in this article!

Keep Reading

Discover the Credblack credit card

Discover in this post the Credblack credit card and learn about the exclusive advantages it offers to the public.

Keep ReadingYou may also like

How to get Parental Benefit

Parental Allowance helps parents and guardians maintain their income during their child's birth leave. To find out how to get Parental Allowance and make the most of it, read on.

Keep Reading

Find out about Santander car credit

If you want to acquire a new car with a longer term to pay and affordable rates, Santander car credit may be a good alternative for you. To learn more about the credit, just continue reading the application and check it out!

Keep Reading

After rumors about his participation in BBB22, Tiago Abravanel confirms that he will not be part of the program

A tip about one of the famous BBB22 participants caused an uproar among reality fans, who were sure that the quoted name was Tiago Abravanel. But, the artist recently confirmed that he was not cast in the program. Check the details here!

Keep Reading