Financial education

Get to know Serasa Limpa Nome

Are you negative and want to get out of this situation? Get to know Serasa Limpa Nome and stay positive right now, get rid of debt once and for all.

Advertisement

How to clear dirty name

Have you ever wondered how to clean up a dirty name and restore financial health? If the answer is yes, know that you are not the only person with this question.

In recent years, thousands of Brazilians have not been able to settle their debts, for various reasons, and thus have their names entered with credit protection companies.

So, if you want to learn once and for all how to clear a dirty name and restore your financial life, you need to follow this entire post to learn about Serasa Limpa Nome and understand how to use it!

What is Serasa Limpa Nome?

This is a platform that seeks to help you organize your financial life. Through it, you can negotiate all your debts simply and quickly.

There are several companies that are partners in this project. On the website, you can check the entire list, with 56 members in total. So, if you have any debt with one of these companies, don't worry.

You can make a new agreement on top of your debt. In this way, this platform works as a kind of mediator. So, the whole trading process is done online.

You can talk about your debts with banks, universities, credit cards and so on. The most interesting thing is that you can get surprising discounts.

In addition, you can print the slips and pay them immediately. All within the norms of the new agreement. O Serasa Clean Name allows you to get up to 90% off.

In summary, this site can provide you with very advantageous ways to deal with your debts. Understanding how it works is important so that you can take advantage of every detail of it.

The next topics will talk more about how this scheme happens. See what your opportunities are within this site and how to clean up a dirty name.

How does Serasa Clean Name work?

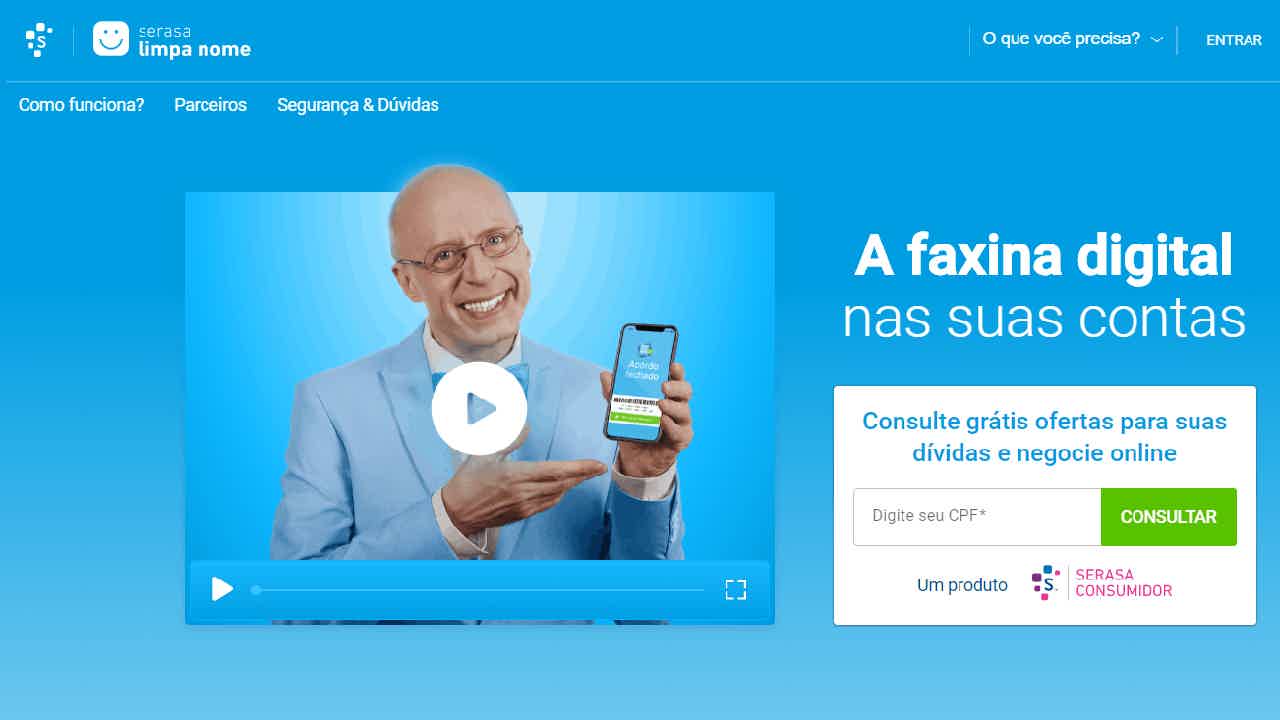

There is no secret to using the platform in question. It is very simple and practical. First of all, you need to know everything about your debt.

Many people are negative and don't even know it. Therefore, checking your status is always the first step. For this, you will only need your CPF.

Consult your debt is a quick process and totally free. So, just access the Serasa Limpa Nome page and enter your CPF numbers.

Once this is done, you will know how much you owe. Then it's time to move on to the next steps.

How to access Serasa Limpa Nome?

Now, it's time to understand how to access this platform. For that, let's start from the query. See how the whole process is very intuitive, so you won't have any problems

Consulting the CPF

Enter the Serasa Limpa Nome website. Then enter your CPF and click on the consult option. Here, you must use the same password that is used to check your Serasa Score.

However, let's say you've never done this in your life. In this case, it is necessary to click on the register button. Thus, you will be directed to a page where you will need to answer some questions.

But don't worry, it's all very fast. Once registered, just go back and consult your debt normally.

Checking your debts

This is where you will analyze what all your debts are in detail.

After analysis, it's time to choose the best way of trading. Everyone has a different scheme. The ideal is that you find the best option for your pocket. Thus, it is possible to settle a debt without generating another one afterwards.

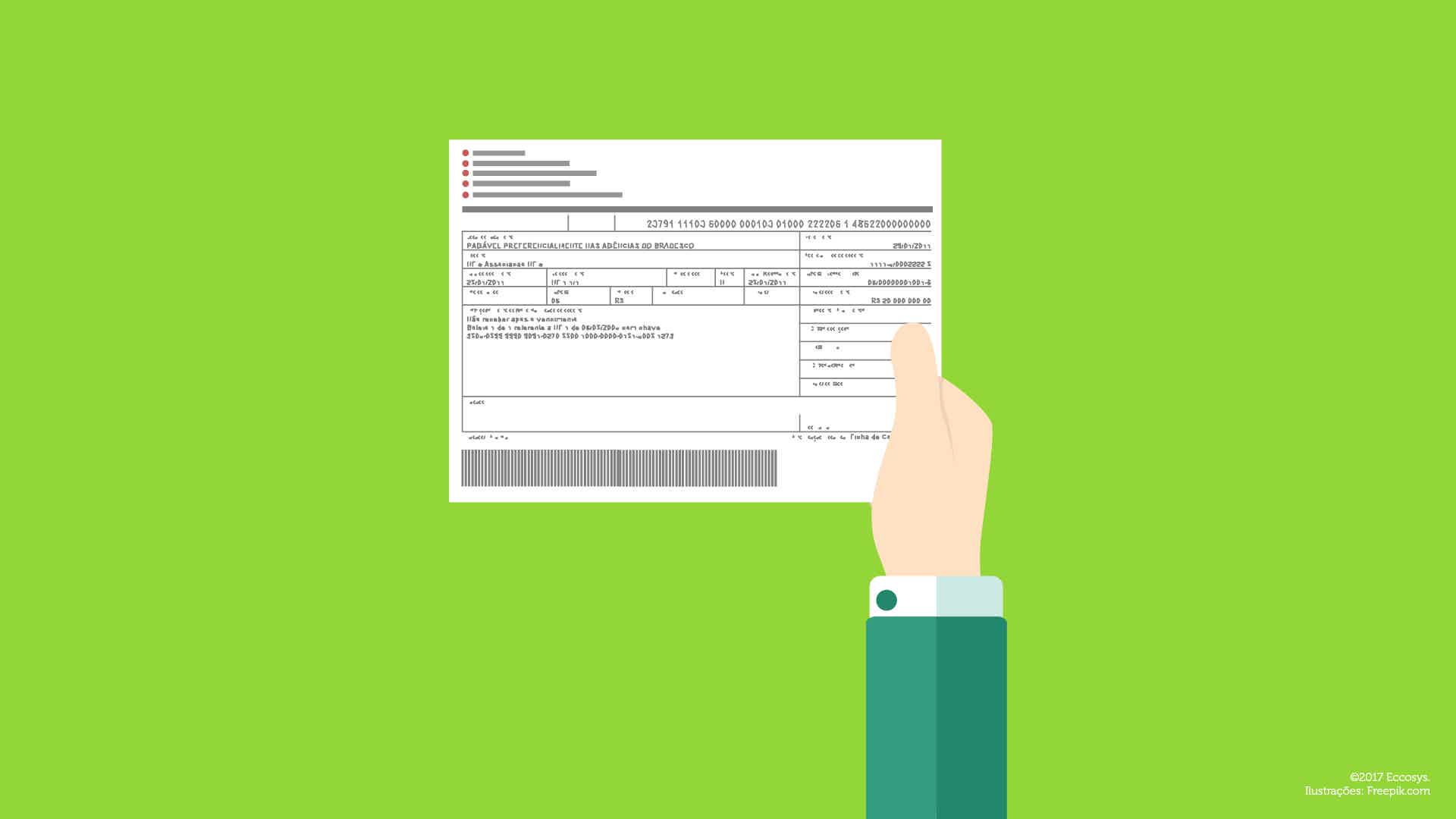

Ticket

Once the entire negotiation procedure has been completed, just print the slip. It will come fully within the norms of the new agreement.

Then just make the payment. Okay, after that the company will write off your debt. Thus, you will have completed the steps to learn how to clean dirty name.

It is important to point out one thing. Each company has a deadline to remove the debt from its CPF. It usually takes about 5 working days.

So don't be alarmed if your situation is not resolved right away. Finally, you will have access to a receipt to prove that the transaction was made.

What are the advantages of Serasa Limpa Nome?

Getting out of debt is always a positive thing. This gives you more freedom to invest in new projects.

In this way, Serasa Limpa Nome only has advantages. To make it even clearer, check out a short list of them below.

Healthy life

It seems distant, but organizing your financial life interferes a lot with your health. When you are in debt, it is common to go through situations of constant stress.

That way, you sleep less and get sick a lot more. Therefore, fixing this issue affects all aspects of your life.

Many people destroy relationships because of lack of financial control. Or even, day-to-day difficulties affect the dynamics of those involved.

So, solving this type of problem will always be a catalyst for a good relationship. This goes for any individual.

productivity at work

Being up to date with your debts also affects your professional life. That's because you won't be thinking about how to pay for something all day long. Anyone who has been through this situation knows how complicated it is to focus on something else.

Nerves are on edge, trying to find solutions to clean up a dirty name. That's why this Serasa platform is so essential. Thus, it is possible to focus on what really matters and look for ways to leverage your career.

Building a new story

This platform allows you to obtain a fairer credit analysis. In addition, some institutions offer lower interest rates for those within the positive register.

That way, you have all the tools to invest in new goals in a more flexible and practical way. So, it is possible to conclude that having a clean name is a gateway to countless opportunities.

How to negotiate discounted debt at Serasa Limpa Nome?

Given the number of advantages within this topic, it's time to learn how to negotiate your debt. Start your journey on how to clean dirty name.

In this process, you need to pay attention to some specific points. See what they are.

Look first for negative debts

Being negative is something you should be concerned about. Therefore, any chance to get rid of this status must be seized. Therefore, it is essential that you prioritize the accounts that are in this situation.

Prioritize debts overdue for less than 5 years

Within the set of overdue bills, first look for those that are overdue for less than 5 years. This is an excellent alternative to prevent debts from becoming negative. So your name remains clean.

Now, time for a bonus tip. It refers to debts that are overdue for more than 5 years. Although they may not be negative, this does not take away their weight.

Therefore, if you want to maintain a good relationship with the creditor, it is essential to settle them. Not to mention that this attitude shows that your financial life is getting on track.

Believe me, taking a next step with a pending issue like that is never a good idea.

Are you a debt-ridden person?

This is a very common profile to find. Anyone looking for financial stability needs to know if they fit into this status.

So, the debtor is that person who owes much more than his ability to pay. This is a very big danger.

So, looking for a way to contain the damage, she uses credit to settle everyday bills. There are some signs that could indicate that you might be that person. Check out what they are.

- You find yourself rescuing money from savings or asking someone you know for help.

- Use overdraft to cover basic bills.

- He has been preferring “in installments” in the things he used to buy “in cash”.

- Only pay the minimum credit card amount.

- Not being able to pay routine bills like water and light.

If you identified yourself with these points, it's interesting to pay more attention. It may be that in a short time the situation gets worse and you reach negative status.

This is why the Serasa Limpa Nome platform is extremely useful. It is the best way to avoid this kind of scenario.

Is Serasa Limpa Nome reliable?

Without the slightest doubt. It is a platform derived from Serasa Experian. The latter is one of the largest private database companies in Latin America.

In this way, its reputation is well consolidated in the market. Thus, any and all transactions made within the site are protected. They are treated as official by partner companies.

To access the platform, you are aware that you need to provide some data. Among them are the CPF, full name, date of birth and so on.

Serasa Experian itself claims that this information is requested to guarantee credit protection. Also, it is a way to combat fraud.

What many don't know is that this is an alternative to further improve data quality. With them, it is possible to make a more accurate and efficient market analysis. Finally, all your data is stored for 15 years.

Avoiding scams and fraud

The platform suggests a series of instructions so that you don't fall into fraud situations. Unfortunately, there are institutions that take advantage of some carelessness that can affect people.

In order to avoid this, here are some important tips.

- Whatsapp: Serasa's official network is verified with the guarantee seal of WhatsApp itself. So it's round and green with a white check right in the middle. If you spot something out of this description, be careful. Do not pass on your data or try to negotiate any debt.

- bills: The platform does not send invoices via email at any time. So always check the sender before anything else.

- Charge: The email is not the network used to perform billing. No financial institution has this custom. So, be suspicious if you receive something like that. Never pay for something without first checking the origin.

- Information: Many people have the habit of paying a bill without checking the information on it. This is a very serious mistake, so never do something like that. At worst, you could have problems with paying off the debt.

So, take the time to review this information. If you have any queries or data that you do not recognize, contact Serasa's Call Center. This simple action can get rid of many headaches, believe me.

Conclusion

Learning how to clear your name is not complicated. However, a lot of care and planning is needed to reach the long-awaited financial stability.

Now then, let's say you want to achieve a positive status on Serasa's platform. Understand that when things get out of your control, you need to take a break. This allows you to rethink your entire relationship with money.

Therefore, you need to plan and outline everything you spend and earn. It is a task that takes a lot of time. However, believe me, the result is always worth it.

Still, it's ideal for your whole family to participate in this process. That way, everyone can start from the same principle and work together. Then look for ways to save.

Also, earning an extra income is always a good alternative. Even after clearing your name, you shouldn't let go of these habits. They helped you save money and who knows, make a good financial reserve.

So, do not waste time and seek to negotiate your debts. After all, you've already seen that it's not complicated. Then start the saving process.

Finally, you already know everything about how to clean up a dirty name. Now it is your turn. Always look for ways to stay out of debt. Believe me, this is the best option to make your money work for you. And if you need one, get one personal loan for negative to help you clear your name!

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Hurb app: learn how to buy cheap tickets and accommodation

Check out all the benefits of the Hurb app here, such as Disney tickets, travel packages, tickets and more. And see if he's trustworthy.

Keep Reading

What is the entry fee for Casa Verde e Amarela?

Do you know the entry fee for Casa Verde e Amarela? Find out here how the down payment and the reduction in interest rates work.

Keep Reading

Check out how to buy tickets for 123 Milhas with up to 50% discount

Stay on top of the step-by-step guide on how to buy a 123 Miles airline ticket, as well as all the services and advantages that the company has.

Keep ReadingYou may also like

15 Wealthy Brazilians Who Work Remotely

The 15 rich Brazilians who work remotely work with investments, blogs and YouTube channels. Learn more and get inspired!

Keep Reading

How to apply for the Santander Business Credit Card

Applying for the Santander Business Credit Card is the first step to optimizing your business finances. Discover how to obtain financial flexibility and exclusive benefits for your business.

Keep Reading

Check out how to enjoy up to 50% discount when buying tickets at MaxMilhas

Do you want to know how to buy tickets with up to 50% discount? The MaxMilhas app is a good option for you! Continue reading the article and check out everything about it.

Keep Reading