loans

Discover the personal loan Inter Cash Personal

With the Inter Cash Personal personal loan, you can get credit to deal with everyday unforeseen circumstances quickly. This is because it can be done through the bank's app. Read more here!

Advertisement

Inter Cash Personal: ideal for you

Well, the Inter Cash Personal personal loan is the perfect opportunity for anyone who needs extra money. Whether it's to resolve an unforeseen event or to pay some bills at the end of the month, credit can be a good financial solution for you.

Therefore, Banco Inter aims to make life easier for its customers and make granting credit a fair and accessible process so that everyone has the opportunity to take care of their financial life.

So, find out below the pros and cons of the loan. This way, you will be able to make the best decision for your financial life. Let's go?

How to apply for the Personal Inter Cash Loan

The Inter Cash loan is ideal for you who need short-term money without bureaucracy. See how to order yours through the app!

How does the Inter Cash Personal loan work?

Well, the loan works simply and without bureaucracy. This is because you make the request directly through the app and don't need to worry about going to a bank branch.

Thus, the loan is a type of short-term credit and was created for those financial emergencies that may occur in our daily lives.

What is the limit for the Inter Cash Personal loan?

Therefore, the credit limit will vary for each customer. This way, you will have a personalized and pre-approved amount according to your profile and relationship with Banco Inter.

Furthermore, you can check the limit directly through the application in a practical and easy way.

Is the Inter Cash Personal loan worth it?

Now, you must be wondering if Inter Cash Personal is worth it for you, right?

Well, a loan is a good option for those who find themselves without money, but need to resolve an unforeseen financial situation. Thus, credit is a quick way to get out of trouble.

However, any loan needs to be analyzed carefully. Therefore, you need good financial planning to avoid ending up with more problems.

Furthermore, the payment deadline is up to 30 days after the amount is released by direct debit. Therefore, it is essential that you know all the payment conditions to avoid any surprises.

Therefore, pay attention to all the conditions and evaluate whether it is the best choice for your current financial life.

How to take out an Inter Cash Personal loan?

So, if you are interested in applying for your loan, you must download the Banco Inter app, which is available on both Google Play and the Apple Store. Thus, the entire process is done online, without bureaucracy and with greater practicality.

Furthermore, the product is only available to people who receive their salary directly from the bank or who transfer it.

Therefore, check all the conditions and characteristics of the loan to make your decision consciously. Furthermore, plan well to avoid unnecessary debt.

And if you want to know more about how to apply for your loan and get rid of unforeseen circumstances in your financial life, check out our recommended content below.

How to apply for the Personal Inter Cash Loan

The Inter Cash loan is ideal for you who need short-term money without bureaucracy. See how to order yours through the app!

Trending Topics

How to calculate vacation: step by step

Want to know how to calculate your vacation? We will show you what vacations are and also how to calculate them step by step. Check out!

Keep Reading

How do I know if I'm on the Cadastro Único by CPF?

Find out how to consult the Cadastro Único by CPF, how the government data system works and what to do if your CPF is suspended.

Keep Reading

How to apply for the Bxblue payroll loan

Even if you are negative, apply for the Bxblue payroll loan with the lowest interest rate on the market, in addition to a long payment term.

Keep ReadingYou may also like

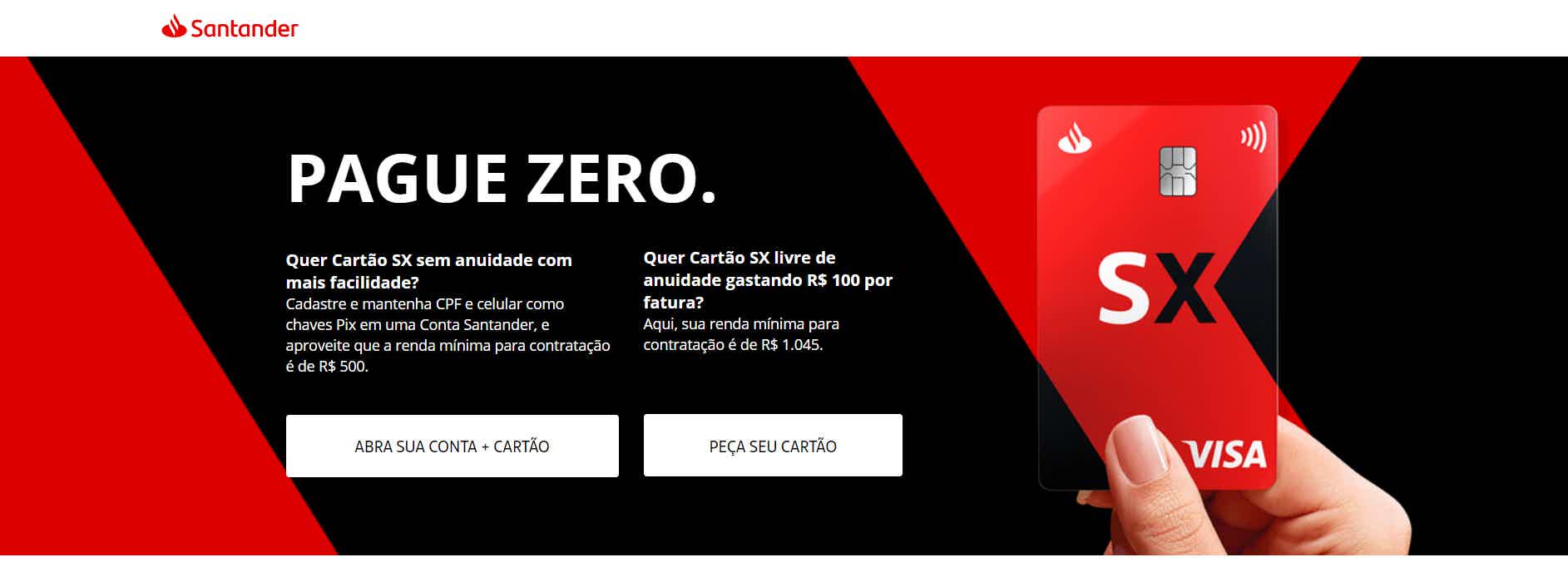

Discover the Santander SX card

Santander Free is now Santander SX. This change was mainly due to the launch of PIX, the Central Bank payment system. But, the product also presents other changes. Check out what they are in our article!

Keep Reading

Walmart Credit Card: How It Works

The Walmart card is a partnership between the network and Capital One Bank. For brand customers, the card offers cashback, among other advantages. Want to know more? Follow our content.

Keep Reading

Discover EuroBic Personal Credit

Want more money to carry out your personal projects? So, take the opportunity to discover EuroBic Personal Credit and have up to €75,000 in the Standard modality to use as you wish. Learn more now!

Keep Reading