loans

Get to know the personal loan Banco do Brasil Consignado

Get to know the Banco do Brasil payroll-deductible personal loan and guarantee a period of up to 96 months to pay, low interest and first payment of installments in up to 180 days. And, still, take the opportunity to hire without leaving home!

Advertisement

Banco do Brasil Consignado: 180 days to pay the first installment

The personal loan from Banco do Brasil is ideal for CLT workers or retired by the INSS and public servants. Well, it guarantees the payment of installments directly on the paycheck after the release of the assignable margin.

The most important thing is that you guarantee credit for payment in up to 96 months, with the benefit of not having to leave home to hire.

So, if you are interested, follow this post with us!

How to apply for a BB Consignado loan

Click below and request a loan with fixed installments, low interest and up to 180 days to start paying!

How does the Banco do Brasil Consignado personal loan work?

First, this loan is directed to workers of private companies that have an agreement with BB. On the other hand, civil servants and INSS retirees also guarantee hiring.

Know that whether you are an account holder or not, you must have a consignable margin informed by the employer. In addition, BB must also provide a pre-approved limit for the money to fall into the account.

So, talk to your company's HR to have margin release. After that, access the BB application or look for your agency.

Certainly, it will undergo a credit analysis and after defining the installments, observe the payslip monthly: after all, that is where the monthly discount is made.

What is the limit of the Banco do Brasil Consignado personal loan?

It is not possible to know the limit before running the simulation, since each customer is analyzed by the bank. That is, the pre-approved limit depends on the monthly salary and the agreement signed between the company and the bank, in addition to the assignable margin that indicates the maximum amount to be committed from your income with installments.

Is the personal loan Banco do Brasil Payroll worth it?

Among the main advantages is the possibility of acquiring a loan without weighing your pocket. In other words, guarantee low installment payments for a long time, plus many months to pay the first installment.

Benefits

- Pay off the loan in up to 96 months;

- Pay the first installment only in 180 days;

- Hire through the app or internet banking;

- Do not be surprised, that is, the installments are fixed;

- Have money in the account without informing the reason for the loan.

Disadvantages

- Available only for BB affiliated companies;

- In addition to the payable margin, BB only releases with an approved credit limit;

- For non-account holders, approval can be more bureaucratic.

How to get a personal loan at Banco do Brasil Consignado?

If you happen to be an account holder and work at a partner company, talk to HR. First, they must inform the assignable margin. Soon after, look for your agency or decide by the deadlines and installments in the application or internet banking.

In the case of public servants and retirees, just access the application or internet banking and simulate the payroll loan. On the other hand, non-clients should go to a BB branch and consult the available conditions.

Finally, is this option right for you? So, take the opportunity to learn how to apply for the Banco do Brasil personal loan at the link below and have money to pay off debts or make dreams come true!

How to apply for a BB Consignado loan

Apply for this line of credit with reduced interest, up to 96 months to pay and apply without leaving home!

Trending Topics

Discover the Ourocard Universitário credit card

The ourocard university credit card is an exclusive product for higher education students created by Banco do Brasil - BB. Look!

Keep Reading

Havan Card Review 2021

Do you want to know a financial product with exclusive discounts and installments, in addition to ZERO annuity? Then check out our Havan card review!

Keep Reading

Itaú Click Card online: no annual fee and many benefits

Discover in this post the benefits of the Itaú Click card online and find out how this card helps you buy your dreamed iPhone!

Keep ReadingYou may also like

7 best pharmacy cards of 2020

In times of coronavirus, having a credit card with exclusive discounts on hygiene products and medicines becomes a great ally. Check out some of them!

Keep Reading

Discover the Banco Best Star Plus current account

The Banco Best Star Plus current account is a great alternative for managing your finances, with no commission fees and a Visa Electron debit card with no annual fee. To learn more about this opportunity, just keep reading!

Keep Reading

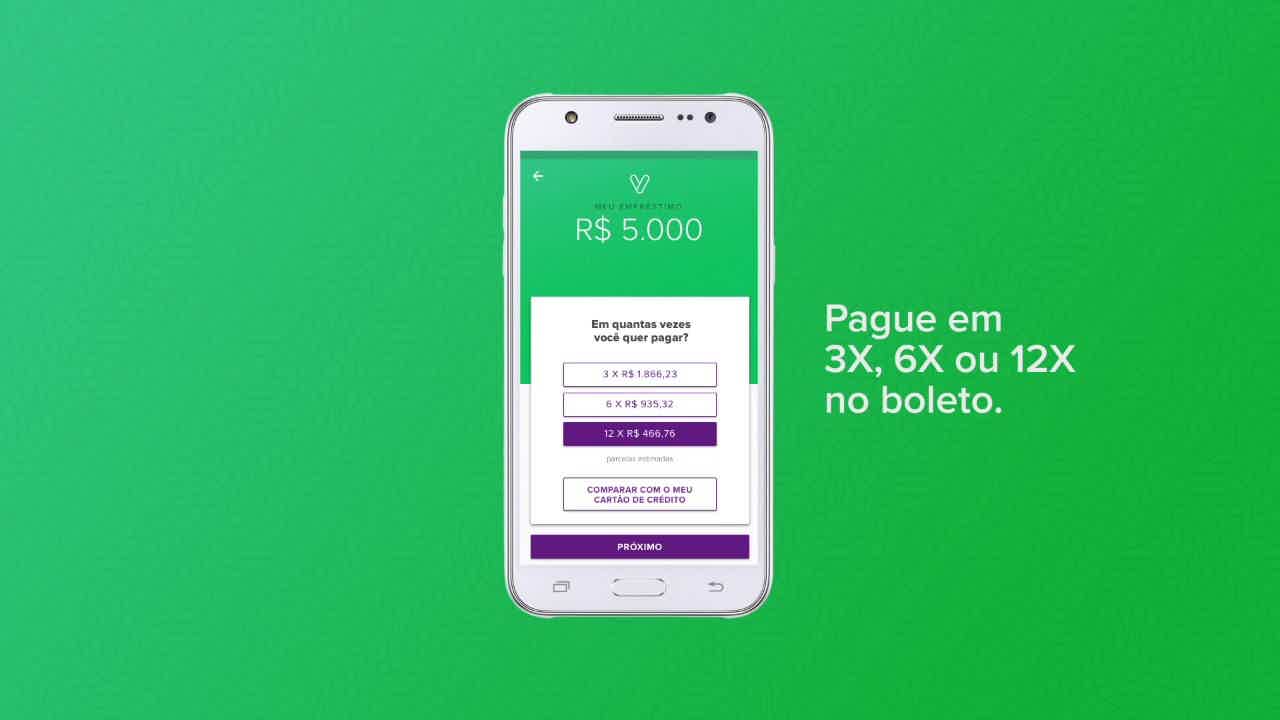

How to apply for a loan online Noverde

Need to pay off a debt? The Noverde loan grants you up to R$4 thousand reais and installments in up to 12 months. Find out how to apply in the text below.

Keep Reading