loans

Discover the Good Credit Loan

The Good for Credit loan is ideal for anyone who needs money to pay off debts or put a project into practice. See below how it works, and how to request it.

Advertisement

Good Loan for Credit

The Good for Credit loan is a good solution for anyone who needs extra money to pay bills and other charges. Anyway, it allows you to find the credit you need to get out of a difficult financial situation.

Thus, through this Bom para Crédito product, you can access more than 30 financial institutions that are partners with this institution. In this way, after analyzing your financial profile and needs, the company indicates the best option for you.

In addition, with rates starting at 0.75% per month, Bom para Crédito presents interesting credit offers in just 5 minutes. So, learn more about this type of loan just below.

How to apply for a Good Credit Loan

The Bom para Crédito personal loan has installments that fit in your pocket and easy payment! See how to apply.

| Values | From R$500 |

| Installment | From 3 to 36 installments |

| minimum income | Minimum wage |

| Accept Negative | No |

| Interest Rates | From 0.75% am |

How does the Good for Credit loan work?

Bom para Crédito acts as a correspondent for banks and finance companies. So, when you make a personal loan proposal, it is sent to more than 30 companies that analyze it and respond with the amount and payment terms.

However, in order to apply for a Good for Credit loan, the user must inform the amount he wishes to contract and in how many installments he intends to pay. In addition, the site requires you to provide your personal data, as well as financial information to formalize the order.

In this way, in just 5 minutes, the company returns contact with the response of the banks and finance companies it represents. Thus, upon receiving the proposals, you can evaluate the payment terms and choose the one that best suits your needs.

Finally, after choosing the ideal proposal, you just need to send the required documents and formalize the contract with the bank or finance company. If approved, the money will be available in your account in just 48 hours.

What are the advantages of the Good for Credit loan?

In addition to offering the best loan options, Bom para Crédito also provides a series of advantages for its customers. Check out what they are below.

- Installments with fixed value;

- Line of credit for negatives;

- Installment of the loan in up to 36 installments;

- Possibility to receive proposals from up to 30 partner companies;

- Release of the amount in the bank account within 48 hours after approval;

- Process of searching and receiving credit offers in 5 minutes;

- Interest rates from 0.75% per month, depending on the credit line and the contractor's profile.

What are the downsides?

Despite the exclusive advantages offered by Bom para Crédito, there are also some disadvantages that may weigh when choosing this company to apply for personal credit.

Such disadvantages may vary according to the chosen line of credit. In the case of the payroll loan, it was developed only for INSS beneficiaries and civil servants, for example.

On the other hand, to apply for a secured loan, the applicant must have a clean name. In addition, it is also necessary to have a property or car paid off to have access to this type of credit.

Is Good Loan for Credit worth it?

So, the Good for Credit loan is worthwhile for anyone who needs money quickly, easily and safely. In addition, it is a good option if you want to avoid hours of research between banks and finance companies to choose the best proposal.

After all, this digital credit platform displays the best loan options for customers in just 5 minutes. In addition, it is an intuitive, safe and efficient tool to get the credit you need with excellent conditions.

According to data from Bom para Crédito, more than seven million people used the company's resources, which has the support of more than 30 financial institutions to offer the best customer service.

How to make a personal loan Good for Credit?

It is very practical to take out the loan Good for Credit. Well, you just need to register with the company and fill in your personal and financial details carefully before submitting the proposal.

Then just analyze the conditions most compatible with your profile. Then, after choosing the ideal one, you can proceed with the credit application process with the bank or financial institution of your choice. To learn more about how to apply for the loan, click the button below.

How to apply for a Good Credit Loan

The Bom para Crédito personal loan has installments that fit in your pocket and easy payment! See how to apply.

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out about the Single Father Allowance benefit

Who is entitled to the Single Father Allowance benefit? Check out all the details about this aid in this article and see if you are eligible to receive it.

Keep Reading

How to apply for the BV Visa Gold card

The BV Visa Gold card offers a points system and other benefits exclusive to the Visa brand. Find out how to request yours without bureaucracy.

Keep Reading

Sicredi Gold Card or Nubank Ultraviolet Card: which is better?

Customers who choose between the Sicredi Gold card or the Nubank Ultravioleta card take advantage of incredible reward programs. Learn more here!

Keep ReadingYou may also like

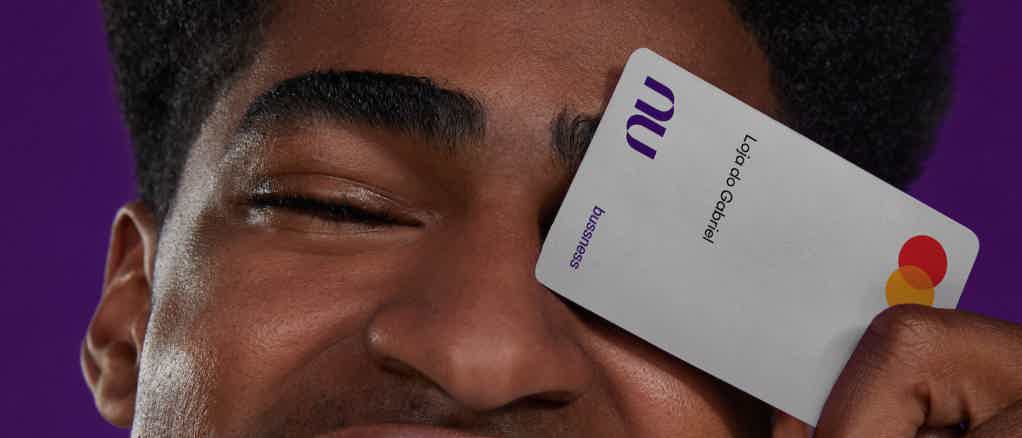

Discover the Nubank PJ Prateado credit card

The silver Nubank PJ credit card is Nubank's new bet to organize the company's finances and bring more advantages to customers. Continue reading and check out more information!

Keep Reading

Leaving money in savings: 5 reasons to avoid it

Learn why saving makes you lose money and learn about more advantageous alternative investments. Thus, you can increase your purchasing power. Check out!

Keep Reading

Learn all about the task force to renegotiate debts with financial institutions promoted by Febraban

The National Task Force for Negotiating Debts and Financial Guidance takes place from March 7th to 31st and is the perfect opportunity for anyone wishing to settle any outstanding debt with one of the more than 160,000 participating financial institutions. Check out!

Keep Reading