loans

Get to know Sicredi Renovation Credit

Get to know Sicredi credit for renovation and how it can help you buy those materials and pay for services that you need so much! Check out!

Advertisement

Credit for renovation Sicredi

At first, when it comes to renovating your house or building it, having financial help is always good. Thinking about it, Sicredi retirement credit is the best option to get extra money from the market with the lowest interest rates!

So, let's show you how Sicredi can be the best option for you! For this, continue reading until the end, to find out how this financing can help you build your home once and for all! Check out!

How to apply for Sicredi construction credit

Learn how to apply for Sicredi construction credit and other useful information about this type of credit, ideal for buying construction materials! confirm

How does Sicredil Renovation Credit work?

Well then, Sicredi retirement credit is a form of personal credit.

That is, to gain access, all you have to do is make the request, specify the amounts and how the investment will be made.

Then, the credit request will be analyzed and if approved, the amounts will be released into the account immediately, very quickly!

Well, renovation credit is used to finance construction materials used in renovations, as well as to pay for renovation or construction labor.

However, this credit is only used for that purpose, so to apply for it, you must have the basis of all the amounts necessary to complete the work.

Therefore, it is a great option for those people who have not been able to finish a work for months or even years!

What are the advantages of Sicredi credit for retirement?

Well then, Sicredi renovation credit is a great opportunity for you to finish that renovation you've been putting off for years.

And in addition, the interest rates are very low, calculated according to the Sicredi financing, with the amounts and the number of installments, with little variation per month!

It also has fixed installments and fees, so you don't have any surprises and you know exactly how much to pay.

And yet, you can divide it into up to 60 months, varying according to the credit analysis and the value of the installments!

What are the downsides?

So, one of the disadvantages of credit for Sicredi reform is that to access credit you need to be a member.

And in addition, the credit analysis is thorough, so we recommend that you have a high score and that your name is not negative.

Therefore, despite several advantages, there are also cons to this financing model!

How to contract financing?

So, to contract financing, you need to look for an agency, talk to the manager of the cooperative in your city and request the request for credit opening based on the best option according to your income.

After that, just wait for the financing to be approved or not! If approved, release is immediate!

In this, it is a safe process that guarantees that the entire work will be completed!

Is Sicredi Renovation Credit worth it?

Well, according to our research, Sicredi renovation credit is worthwhile for those who are going to build or renovate and need extra money.

That's because, there are several advantages, and you can still install everything without having to compromise the budget.

Therefore, to fulfill the dream of finishing that work that has been stopped for some time, the Sicredi credit for renovation is very worthwhile!

How to apply for Sicredi construction credit

Learn how to apply for Sicredi construction credit and other useful information about this type of credit, ideal for buying construction materials! confirm

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Losango payroll loan: how it works

Find out how the Losango payroll loan works with simple contracting, up to 72 months to pay and interest from 1.35% per month.

Keep Reading

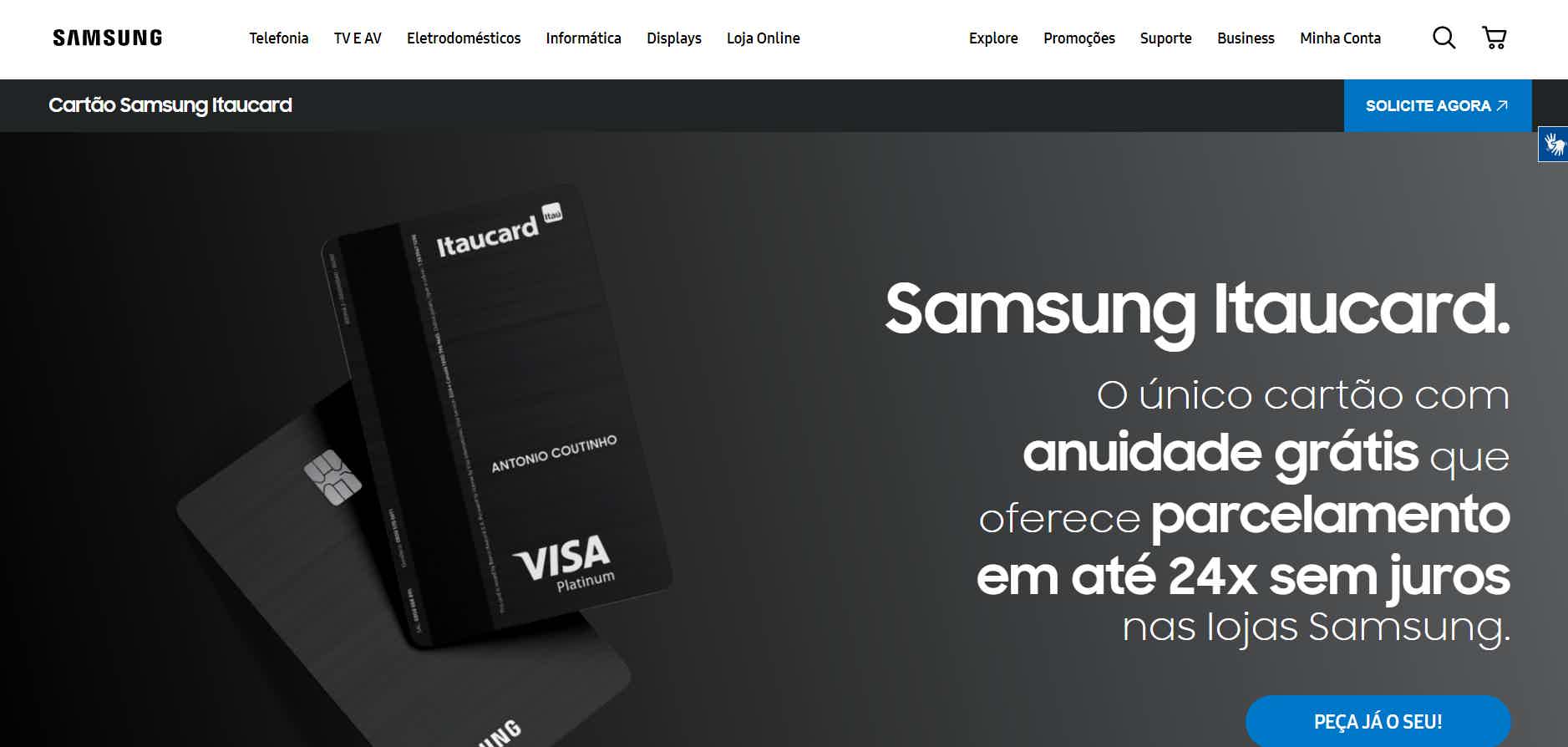

How to apply for Itaú Samsung card

Learn the step-by-step process to apply for the Itaú Samsung card, which is ideal for store customers, as it is international and free of annual fees.

Keep Reading

Mais credit card: what is Mais?

Mais credit card has international coverage, Mastercard brand and differentiated annual fee. Check out more card benefits here!

Keep ReadingYou may also like

What is the cost of living in the United States? Check it out here!

Before deciding on your trip to the US, be sure to assess the cost of living in the country to see if the move is really worth it. For more information on the subject, just continue reading the article.

Keep Reading

I can't access Caixa Tem: what to do

"I can't access Caixa Tem" has been a constant complaint in your daily life? Read the post below and understand the most common reasons why this happens and learn what to do in each situation.

Keep Reading

How do I apply for the Bank Norwegian VISA credit card?

Get Exclusive Advantages With a Credit Card: Apply for the VISA Bank Norwegian Card Now! Waived annual fees, welcome bonus, global ease and more. Transform your financial life with a simple click.

Keep Reading