Construction Credit

Discover BB Credit Credit

BB Crediário is a great option for you to finance bills and make higher value purchases with reduced interest. This is because you can use your Ourocard card to finance. Are you interested? Check out more here!

Advertisement

BB Credit: credit of up to R$ 10 thousand

BB Crediário credit can help you realize your dream of taking a postgraduate course or even buying construction materials for your new home. With it you can also buy various goods such as books, tablets, smartphones, among others with lower interest rates.

Want to know more? So, keep reading and check it out!

How to apply for Banco do Brasil Crediário

BB Crediário gives you the opportunity to make dreams come true, such as buying construction material for your new home. Want to know how to apply? Check it out here!

How does BB Crediário work?

Initially, BB Crediário works as financing with a pre-approved limit of up to R$10 thousand for the purchase of a good or service. Thus, with it you can pay the purchase price in up to 48 installments with reduced interest from 1.98% per month.

Furthermore, it can be used in Cielo-accredited stores, where you can simulate the value of the installments at the time of purchase. You can also use this credit to pay in installments for bills and bills at Banco do Brasil terminals, Internet Banking or the BB app. When you want to use it, simply choose the “Installment Payment – CDC” option when paying for your bill or service.

So, to use credit you need to be a Banco do Brasil customer, have a current account and an active credit card. Additionally, it is possible to check the available limit at a self-service terminal or Internet Banking.

What is the BB Crediário credit limit?

After all, BB Crediário is quick and practical to use. Each customer has a limit available for BB Crediário, and can find it on their card statement, at self-service terminals or through Internet Banking. The maximum limit for installments of purchases and bills is up to R$10 thousand.

Is BB Crediário credit worth it?

Well, BB Crediário is a quick and easy way if you want to pay a higher value bill in installments or purchase a service in stores or even a material asset, except a vehicle.

Therefore, if you want to finance, you can use the BB Crediário credit limit and divide the amount into up to 48 installments.

So, the advantages of this service start with the reduced interest rates that start at 1.98% per month.

Additionally, you only start paying after 59 days.

What's more, it is possible to carry out a credit simulation directly on the Cielo machine before making the purchase. It is worth noting that installments are available to customers with an Ourocard Visa or Elo credit card.

Also, there is no fee for hiring this service and the installments are debited from the current account.

Likewise, BB Crediário does not use your credit card limit, functioning as a separate credit facility.

The BB Crediário service is accepted in several physical or digital stores that use the Cielo machine or that are accredited by Banco do Brasil.

Therefore, credit can allow you to realize different dreams and projects, such as taking a postgraduate degree, a course, taking a trip, buying a smartphone, or even paying a high-value bill.

How to get BB Crediário credit?

Well, using BB Crediário financing is quite easy and quick. To do this, you need to be a Banco do Brasil customer and have a current account.

In addition, you must have an active Ourocard credit card with Visa or Elo.

So, if you meet the requirements, you need to check your invoice or go to a self-service unit or access Internet Banking to check if the credit amount is available.

The maximum amount for using BB Crediário is R$10 thousand. And to use it, you must choose the credit option on the Cielo machine when using your Ourocard card.

Furthermore, if you want to pay a bill in installments, you just need to select the option “Payment in Installments – CDC” when paying the bill at a self-service terminal, in the BB app or via Internet Banking.

Do you want to know more about how to acquire BB credit? So, click on the recommended content below and enjoy reading!

How to apply for Banco do Brasil Crediário

BB Crediário gives you the opportunity to make dreams come true, such as buying construction material for your new home. Want to know how to apply? Check it out here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Enjoy all the benefits of PIS/PASEP: sign up now

Do you want to know how to enroll in PIS/PASEP? It's very simple. Read this article and discover the step by step to receive the benefit.

Keep Reading

How to prepare for higher level contests?

Check out in this article the main practices that you can use to prepare and be approved in higher level competitions.

Keep Reading

Which financial institutions perform credit analysis?

Do you know how a credit analysis works? Because there are some institutions specializing in this, and it's important to know which ones they are. Look here!

Keep ReadingYou may also like

Cetelem Personal Credit or Cofidis Personal Credit: which is better?

Cetelem and Cofidis have personal credit lines that help you boost dreams with high amounts and a period of up to 7 years to pay. Check out the comparison between them below and choose which is best for you.

Keep Reading

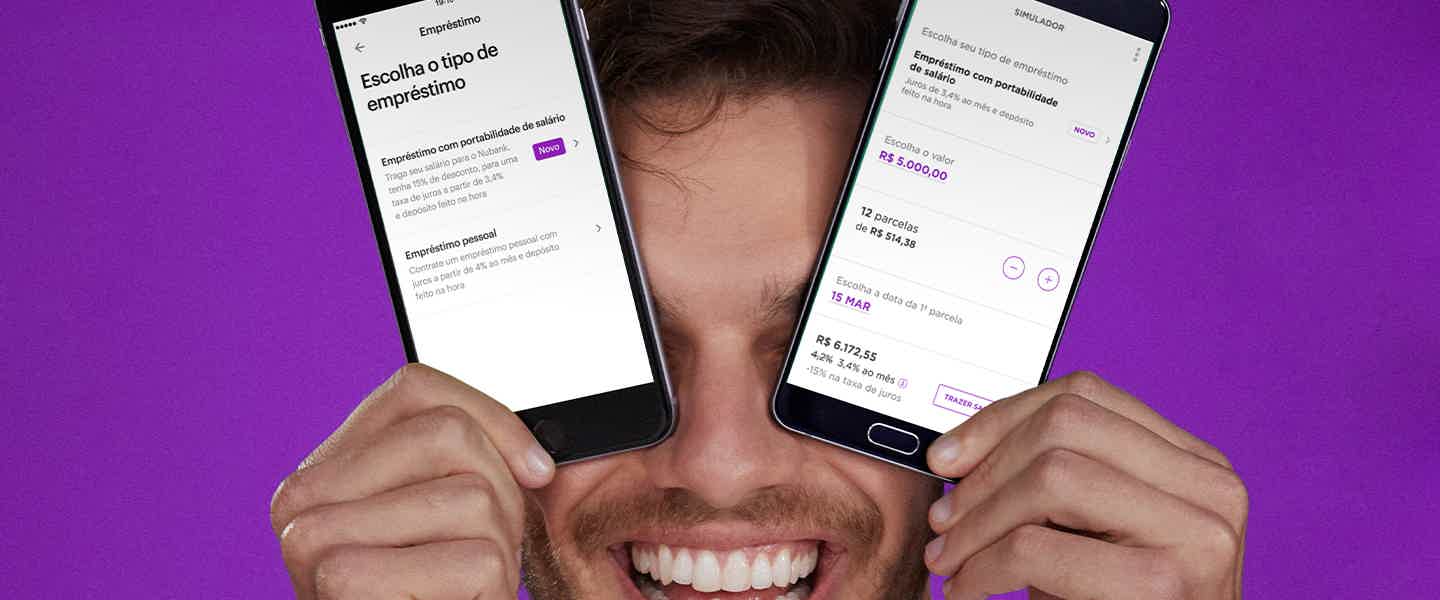

Nubank offers a personal loan in seconds and with zero bureaucracy on your cell phone!

Applying for a personal loan no longer needs to be a bureaucratic and time-consuming process. With Nubank, it is possible to apply for a credit line directly in the app and the amount is released within seconds after contracting. See more here!

Keep Reading

Find out about Credibom car credit

If you need help purchasing your car, Credibom car credit may be the solution you are looking for. If you want to know more about it and its advantages, just continue reading.

Keep Reading