Construction Credit

How to apply for Banco do Brasil Crediário

BB Crediário gives you the opportunity to make your dreams come true, such as doing a postgraduate course or even buying construction material for your new home. That's because it offers up to R$ 10 thousand to pay in up to 48 installments. Want to know how to apply? Check it out here!

Advertisement

BB Crediário: reduced interest rate and great payment term

First of all, Banco do Brasil Crediário works as a loan. With it you have the opportunity to make dreams come true, such as buying construction material for your new house or apartment. Or, it can help you pay a higher-value bill with reduced interest.

So, BB Crediário allows you to purchase goods or services, such as books, equipment that increases energy and water efficiency, tablets, smartphones, among others, except vehicles. You can divide the purchase amount in up to 48 installments, with interest starting at 1.98% per month.

In addition, you have 59 days to start paying. And what is more practical, the payment is made through direct debit.

Super practical and fast, Banco do Brasil Crediário can help you finance a ticket or purchase a service or goods such as courses, tablets, books and even trips. Keep reading to find out more.

Order online

There is no online application process, because in order to use the financing amount, you must have an Ourocard credit card with a Visa or Elo flag, as well as an active checking account at Banco do Brasil. The request is made at the time of purchase of the desired good or service.

That's right! You go to an affiliated commercial establishment that has a Cielo machine and ask to use your credit card. In this way, it is possible to pay your purchases in up to 48 installments.

But don't forget to check your available credit limit at a Banco do Brasil self-service terminal, on Internet Banking or on the BB app.

Request via phone

So, unfortunately, it is not possible to apply for BB Crediário over the phone. But you can contact the BB Relationship Center to find out more information through the numbers:

- 4004 0001 (capitals and metropolitan areas);

- 0800 729 0001 (other locations).

Request by app

There is also no request process via the app, but you can use BB Crediário to pay bills in installments via the Banco do Brasil app, as long as the maximum amount is R$ 10,000.

For this, when paying the bank slip, you must select the option “Payment in Installments – CDC”. Incidentally, it is possible to pay the amount in up to 48 installments.

Construcard credit or Banco do Brasil Credit Card: which one to choose?

In this sense, both Construcard and BB Crediário are great options if you are looking for financing to build or renovate. However, BB Crediário helps you not only when carrying out renovations. With it you can purchase goods or services.

Well, check out some features of both loans below and see which one is better for your consumer profile.

| Construcard | Bank of Brazil Credit | |

| Minimum Income | On request | It is not necessary |

| Interest rate | From 2.5% per month | From 1,98% per month |

| Deadline to pay | From 1 to 240 months | Up to 48 months |

| Where to use the credit | Accredited stores Caixa for construction materials | Purchase of miscellaneous goods and services, except vehicles |

| Benefits | Ease of shopping; Six months to start paying; Flexible term of up to 240 months to pay. | Practical, you only need to use the Ourocard credit card; Start paying after 59 days; Payment by direct debit; Does not use the card limit. |

How to apply for Construction Credit Construcard

Credit Construcard Caixa helps you when buying building materials for your renovation. That's because it offers up to 240 months for you to pay.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover Paypal Prepaid

Get to know the Paypal prepaid card, a card option free of annuity and minimum income, totally digital and safe for users.

Keep Reading

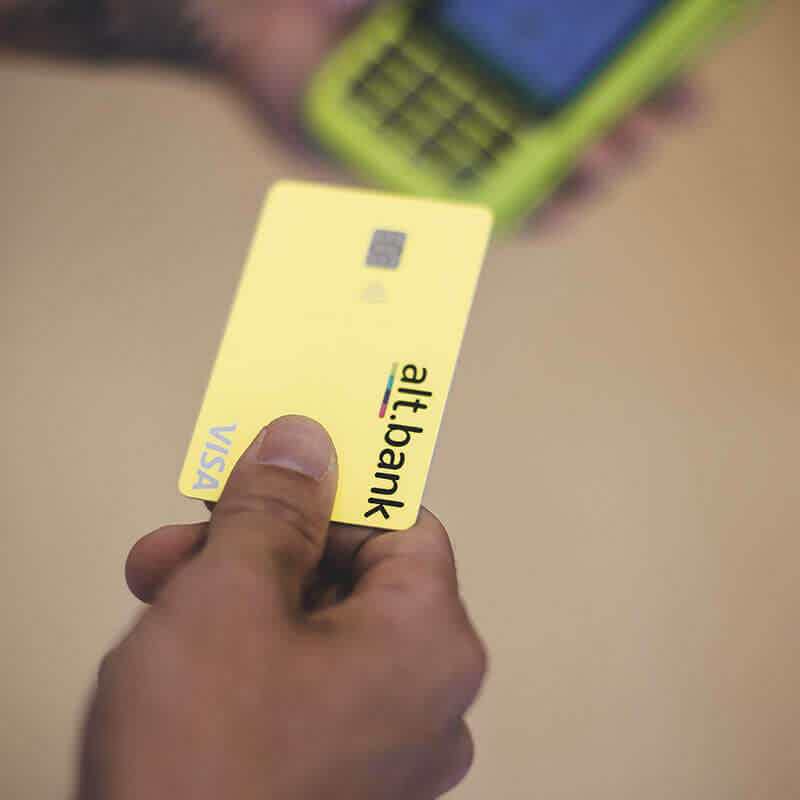

How to apply for the Alt Bank card

Find out in this post how to apply for your Alt Bank credit card in advance and be one of the first to use this feature!

Keep ReadingYou may also like

Discover the Girabank credit card

With the Girabank credit card, you have everything you need in just one place, from annuity exemption, national coverage, access to the digital account to the benefits program. Learn more here!

Keep Reading

Atacadão card or Magazine Luiza card: which one to choose?

Atacadão card or Magazine Luiza card? Want to know which is the best financial product? So read our post and check it out!

Keep Reading

Startups offer more than 300 job openings in different sectors

In January of this year, hundreds of vacancies were made available in several different areas of companies and startups across the country. Understand more here!

Keep Reading