Cards

Discover the Zencard card

Do you want to know a facilitated credit card that serves you and facilitates your purchases? Then get to know the Zencard card

Advertisement

Zencard card is it a good alternative?

O zencard card has gained more and more space in the financial market. People are preferring to use prepaid options. After all, they are simpler.

So, this product is one of the best tools with this proposal. It has a number of advantages that are worth checking out. Now, it is necessary to know more about him.

This post will tell you all about this news. see how the zencard card it might be useful for you. Check out how to get one of these. You will see that everything is very practical and easy.

This is a question that hits many people. PagBank is also a very interesting card. However, it differs from Zencard in some ways. So, to help you with that decision, we separate some important features.

| Characteristics | Zencard |

| Minimum Income | not informed |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Digital account, withdrawal, recharge, bank transfers |

How to apply for the Zencard card

If you want to know how to apply for the Zencard card and enjoy its advantages, see the step-by-step guide now.

How does the Zencard card work?

Before we talk about this product, it is interesting that you know everything about prepaid cards. Only then will you know at the end if the one we are talking about is in fact of quality.

So, a prepaid card works very similarly to a traditional card. With it, you can shop both in physical and virtual stores. However, this card does not have a credit limit.

The point is that you, first of all, deposit an amount x on the card. That way, it is possible to spend only within what was put in. This refill scheme is one of the biggest advantages of this product.

That's because it helps you have greater control over your accounts. In addition, it is not possible to pay in installments. In short, you only spend what you have. That's why prepaid is so interesting. This is mainly for those people who are going through complications in their financial life.

What are the advantages of the Zencard Credit Card?

Okay, now you know very well how this card works. So, it's time to find out what are the advantages that the zencard card can provide.

1- There are no national limits

With it, you can shop at millions of stores. The most interesting thing is that you have complete freedom to buy in national establishments. Many cards do not offer this type of option.

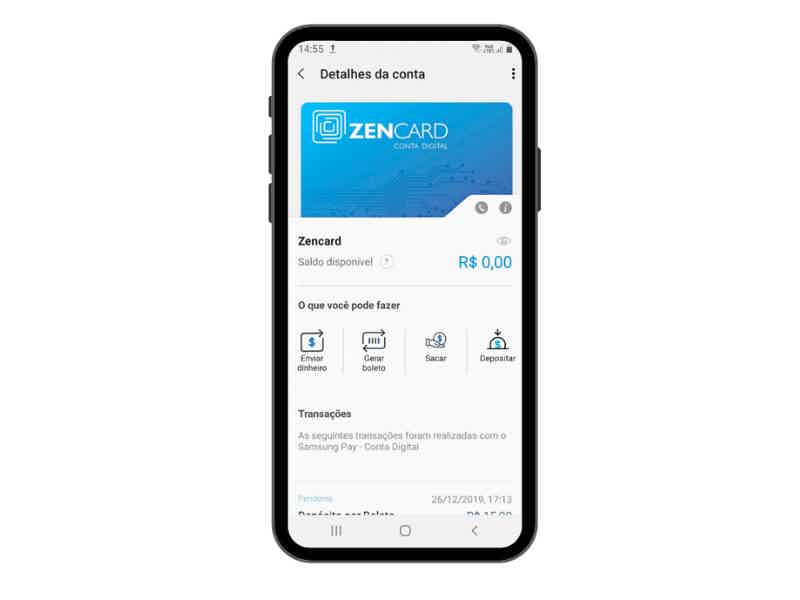

2- Digital account

You can track everything about your card in your digital account. It is coupled with this tool, to make everything as transparent as possible. So whenever you have a question, just access it. It even helps a lot when trying to control expenses even more.

3- Withdrawal and recharge

Many people believe that recharging prepaid cards is something that cannot be done anywhere. However, this is not true. You can charge it at lottery shops.

These establishments are spread all over the place. So, you shouldn't have any difficulty using your card, believe me. In addition, it is possible to recharge via boleto.

If you have internet banking, you can do everything you need without leaving your home. With regard to withdrawals, lottery outlets also meet this need.

4- Transfers

This product allows you to make transfers via TED and DOC. In this way, there are many alternatives within a single tool. Realize that with a prepaid like this, you have nothing to lose.

What are the disadvantages of the Zencard card?

Just above, you must have realized that the benefits are many. Now, everything has its pros and cons. In case of zencard card, the disadvantage lies in the fees charged.

They are not of great value. However, if you make a lot of transactions it is possible to end up losing a significant amount. So this is a point you need to pay close attention to.

Below, check out the values that the company charges. In the end, see if they are worth considering your needs with this card.

- To acquire the card: R$ 19.90;

- Top up of the product at the lottery: R$ 4.00;

- Top up of the product on the bank slip: R$ 3.00;

- Withdrawal: R$ 6.90;

- Monthly fee: R$ 5.00;

- Transfer between prepaid cards: R$ 1.50;

- Transfer between cards via internet banking: completely free;

- Withdrawal of duplicate card: R$ 19.90;

- DOC and TED transfers: R$ 8.90.

Also, be aware that there are some fees when it comes to the digital account. Therefore, they too must always be considered. Follow each one of them closely.

- Monthly maintenance fee: completely free;

- Generation of slips: R$ 3.90;

- Deposit via lottery house: R$ 4.00;

- Withdrawal at the lottery shop: R$ 5.90.

Okay, so those are all the fees you should be aware of. Remember that some of them will not be charged. Of course, everything will depend on how the user decides to use their card.

Is it necessary to have a clean name to have a Zencard card?

The answer is no. Imagine you have some restrictions to your name. Many card companies will not allow you to apply for this credit option. However, this does not happen with Zencard.

One of the main reasons for this freedom is, therefore, the fact that it is prepaid. Then again, you're only going to use it if you carry it. That way, the company is not taking a risk.

If you've been through difficulties and don't have a clean name, that's fine. With this product there will be no bureaucracy. You can use it however and wherever you want. Still, it helps you keep your bills up to date.

Is this product reliable?

Zencard is part of a financial solutions company. She is known for offering options for everyone. That is why its services do not require consultations with the SPC/Serasa.

In addition, the digital account of the zencard card was developed in partnership with Samsung. Now, you might be wondering why this matters. In fact, it is these characteristics that make it a company worthy of trust.

Another important point is that the institution has a great reputation in the financial market. Also, your status on Reclame Aqui is excellent.

The company is located in the city of São Paulo. Lastly, your site has the security symbol. So, we can conclude that this is indeed a reliable company.

It adheres to regulatory and legal standards. So you don't have to worry about it. All you need to do is avail their services.

Is the Zencard credit card worth it?

It depends on the needs of each user. Overall, this is a very worthwhile product. Understand that there are several types of prepaid digital accounts currently.

However, most charge absurd amounts of opening and movement. The company of this card does not follow this standard of operation. Still, if you're having trouble getting a traditional card, this is a great option.

Furthermore, it is an opportunity that should not be discarded. However, never forget to consider the pros and cons mentioned above. This is mainly talking about the fees charged. Even if they are not high, they exist.

How to apply for the Zencard card?

To apply for your card, you only need to follow 4 simple steps. This is a very easy and fast procedure. In this way, there should be no difficulty. See how to do it.

1- Access the official website of Zencard;

2- Click on the “Ask for your card” option. It is in the upper corner of the screen;

3- Fill in all requested data;

4- Print the ticket and pay. The purchase price is R$ 19.90.

Finally, that's all you need to know about the zencard card. Now it is your turn. Don't waste any more time and go in search of this opportunity. Allow your bank transactions to be done in a simpler and more practical way. To get yours, just access the request page.

How to apply for the Zencard card

If you want to know how to apply for the Zencard card and enjoy its advantages, see the step-by-step guide now.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to find the best mason jobs

See the best mason vacancies and find out how to apply for different vacancies and be quickly approved in a selection process.

Keep Reading

How to apply for Accident Assistance

Want to know how to sign up for Accident Assistance? In this article, we will show you how to apply. Read now and find out!

Keep Reading

Opportunities at KFC: see how to apply for jobs

Knowing what KFC offers is a great way to get the job! Discover more tips on how to get opportunities at KFC.

Keep ReadingYou may also like

How to open a current account Best Minimum Services

The Best Minimum Services current account has everything you need to manage your finances with more peace of mind, such as a debit card with no annual fee and main services at a reduced cost. To find out how to open it, just continue reading with us!

Keep Reading

COFIDIS Consolidated credit without opening adhesion

After all, do you know what it is and how to apply for your consolidated credit COFIDIS? We tell you all about the topic here. Keep with us and check it out!

Keep Reading

4 options for portability of payroll with online change

If you were looking for an opportunity to reduce the cost of an active debt and increase the payment period, the portability of payroll with online change is the best option for you. With the possibility of increasing the payment term and reducing interest, you also have access to online change, an amount received from the institution for the difference in the amount paid to the institution where you originally made the loan. Learn more here!

Keep Reading