Cards

Discover the Sou Barato credit card

The Sou Barato card is easy to approve and guarantees exclusive offers on the brand's outlet website. Understand in this post how it works, as well as its advantages and disadvantages.

Advertisement

Sou Barato Card: exclusive benefits program and special discounts

At first glance, the Sou Barato credit card, also known as the soub card, is a financial product like any other. Its flag is Visa or Mastercard, and it is issued by Cetelem bank.

Well, the Sou Barato card has several benefits and exclusive discounts. You can still use it in more than 2.3 million establishments that are accredited in the Visa or Mastercard network.

However, are you still in doubt if this card is really ideal for your consumer profile? So, continue reading and check out everything about this plastic. Let's go!

How to apply for Sou Barato card

The Sou Barato card is easy to apply for and has special offers and discounts for customers. See here how to order yours right now!

How does the Sou Barato credit card work?

Above all, the Sou Barato card works like a regular credit card. At the same time, it guarantees you exclusive discounts at the Sou Barato outlet. The site is an outlet that brings together companies such as Americanas, Submarino and Shoptime. Therefore, there you will find products with special discounts and you will be able to take advantage of the promotions using the card.

Of course, as a Visa or Mastercard brand, you can still shop at millions of other stores if you so choose.

However, remember that this credit card has an annual fee, and you can find other options on the market that are exempt from this fee.

What is the limit of the Sou Barato credit card?

Well, to acquire your Sou Barato card, you will need to go through a credit analysis.

Therefore, your limit will be defined based on this analysis.

In addition, the card also offers a benefit called Mais que Limite. In this sense, customers have an extra limit to use only on the Sou Barato website.

Is Sou Barato credit card worth it?

Are you still in doubt about the Sou Barato card? So, check out the advantages and disadvantages before joining, below.

Benefits

First, the Sou Barato credit card is a Visa or Mastercard card and is therefore accepted in millions of establishments.

Even more, as it is a product from the Sou Barato website, it has exclusive benefits for purchasing at the online outlet. With it, you have access to products with special values.

In addition, you still participate in the Que Barato program. In this sense, your purchases earn points that you can exchange for gift certificates on the brand's website.

By the way, you even have daily discounts on this site.

In addition, you can withdraw money from Rede Banco 24h ATMs, or you can request the deposit of the amount through Web Saque.

Disadvantages

Without a doubt, the biggest disadvantage of this card is the annual fee. According to the official website, an annual fee of R$10.99 per month is charged for the first year. And the value increases in the second year of using the card, and goes to R$15.99 per month.

What's more, you still have to go through a credit review which can take up to 7 business days for approval.

Therefore, it is important to remember that there are other options on the market that are free of annuity and may serve you better.

How to make a Sou Barato credit card?

Well, if you are 18 years old or older and have an income of at least one minimum wage, you can apply for the Sou Barato card. That way, just access the Sou Barato website and fill out the request form.

However, you must wait for the credit analysis to find out if it has been approved. Then you receive your card and home and can use it after unlocking.

So, do you want to know more details on how to apply for a Sou Barato credit card? Well, just click below and we'll help you!

How to apply for Sou Barato card

The Sou Barato card is easy to apply for and has special offers and discounts for customers. See here how to order yours right now!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

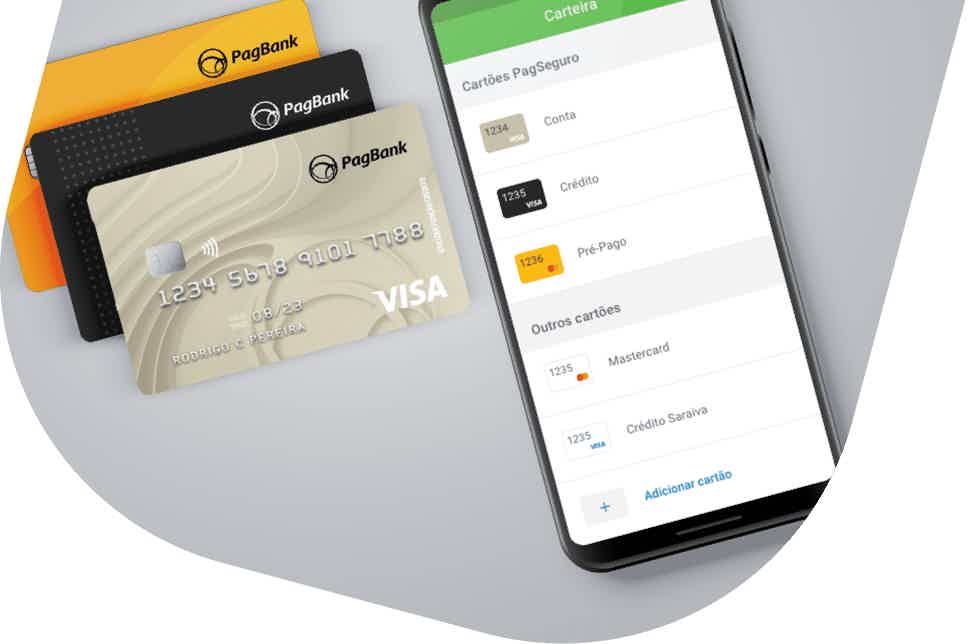

How to apply for PagBank card

Do you dream of financial independence and don't know which card to choose? How about requesting the PagBank card without annuity? Read this post and find out how.

Keep Reading

Lanistar Card or PagBank Card: which is better?

Choosing a card can be a daunting task. Therefore, we will help you choose between the Lanistar or PagBank card. Read this post and learn more!

Keep Reading

How to apply for the Recarga Pay card

Do you want to know how to apply for the international Recarga Pay card and enjoy all the advantages it has to offer? So see how to do it

Keep ReadingYou may also like

How to track C6 Bank card

Are you worried about the delivery of your long-awaited C6 Bank card? Rest assured, because in this post we will teach you what you must do to track the order. So, read on and check it out!

Keep Reading

Abanca Gold credit card: what is Abanca Gold?

What is the Abanca Gold card? This is a Portuguese financial product with many benefits, such as insurance and assistance. Read this post and check out everything about it.

Keep Reading

How to apply for the BTG+ Platinum Card

BTG+ Platinum offers a series of advantages, Find out how to apply for your BTG credit card in our article.

Keep Reading