Cards

Discover the Coop Fácil credit card

The Coop Fácil credit card is international, has a Visa flag and does not require opening a bank account. See, today, pros and cons and how to order.

Advertisement

Coop Fácil credit card

The Coop Fácil Visa credit card is a Bradescard and Coop option. It offers some common card perks. Know more about him.

Although it belongs to Bradescard, it does not require you to be a Bradesco client. Thus, it is not linked to a checking account. Therefore, it also does not offer the debit option. Despite this, it is quite comprehensive due to the Visa International flag.

Another important point is that it is not restricted to Coop consumer cooperative stores. It allows purchases at the brand's establishments with the advantages normally offered to cooperative members.

However, it also allows purchases in other establishments in Brazil and in the world, since it is international. Interested? So keep reading to see all about this option!

How to apply for the Coop Fácil card

Coop Fácil is a card that emerged from the partnership between the consumer cooperative and Banco Bradesco.

How does the Coop Fácil credit card work?

This card only works with the credit option. With this, you receive a limit that the bank establishes, as we will see below. Afterwards, he makes purchases in cash or in installments and then pays the invoice at the end of the month.

Also, it is worth remembering that this card allows for in-person and online purchases. And this on websites or establishments around the world, as it is international. Therefore, its operation is quite simple, following a traditional line.

What is the limit of the Coop Fácil credit card?

The Coop Visa credit card limit is established by Bradescard. As with most credit options, the limit varies by customer. This will depend on proof of income, on the score in entries such as Positive Registration. Also, there is credit analysis.

Is the Coop Fácil credit card worth it?

Such a card has quite traditional advantages. Therefore, it does not differ so much from other options on the market. See below the main pros and cons of the Coop Fácil Visa card.

has annuity

First, this card does not waive operating fees. So he charges for using the credit option. This goes against the grain of many cards that today offer the same possibilities.

The annual fee for the Coop Fácil credit card is 12 installments of R$ 17.99. The total value, then, is R$ 215.88.

Face-to-face membership only

Another not-so-attractive point of the Coop Fácil card is that it does not allow you to sign up online. Thus, it restricts the request for the credit option to the face-to-face form. Again, this goes against the grain of modern services and digital banks.

Visa International Flag

On the other hand, the Coop Fácil credit card also has advantages. However, the main ones are due to the presence of the Visa International flag. This includes several benefits, see the main ones:

- Vai de Visa points program, to exchange for services, products and discounts;

- Comprehensive card, accepted at more than 42 million establishments worldwide;

- Travel accident insurance;

- Emergency withdrawal;

- Price protection and others.

Up to 40 days to pay the invoice

However, another benefit of the Coop Fácil card is that it gives you 40 days to pay the invoice. With this, gain more time and convenience to settle the amounts without this leading to the incidence of interest.

Installment of purchases at Coop stores

Finally, another advantage of Coop's Visa card is that it allows payment in installments at cooperative stores. Thus, you can make purchases in up to 24 fixed installments.

How to make a Coop Fácil credit card?

As we pointed out above, unfortunately the Coop Fácil card only has a face-to-face membership. That is, you have to go to one of the stores. Also, you need to cooperate with the cooperative.

All you need to do is have an identification document with a photo, proof of residence and proof of income.

However, those who do not have a fixed income payslip can submit other payment booklets or invoices from other credit cards, according to Coop.

Still, it will be necessary to wait for the credit analysis. In this way, if approved, the credit card will be sent to your home address.

How to apply for the Coop Fácil card

Coop Fácil is a card that emerged from the partnership between the consumer cooperative and Banco Bradesco.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to save on car insurance

Car insurance is essential and can bring you many benefits! But if you need to save on value, check out our tips.

Keep Reading

Neon account: how it works

Learn about the exclusive advantages of the Neon account, such as free monthly fees, free transfers and the possibility of waiving withdrawal fees. Check out!

Keep Reading

Discover the Digio digital account

Get to know the Digio digital account and learn everything about this account that allows transfers and payments with free and unlimited QR Codes.

Keep ReadingYou may also like

How to enroll in the CadÚnico Program

Do you want to register in the CadÚnico program and enjoy all the benefits it has? The process is simple and free, here's what to do.

Keep Reading

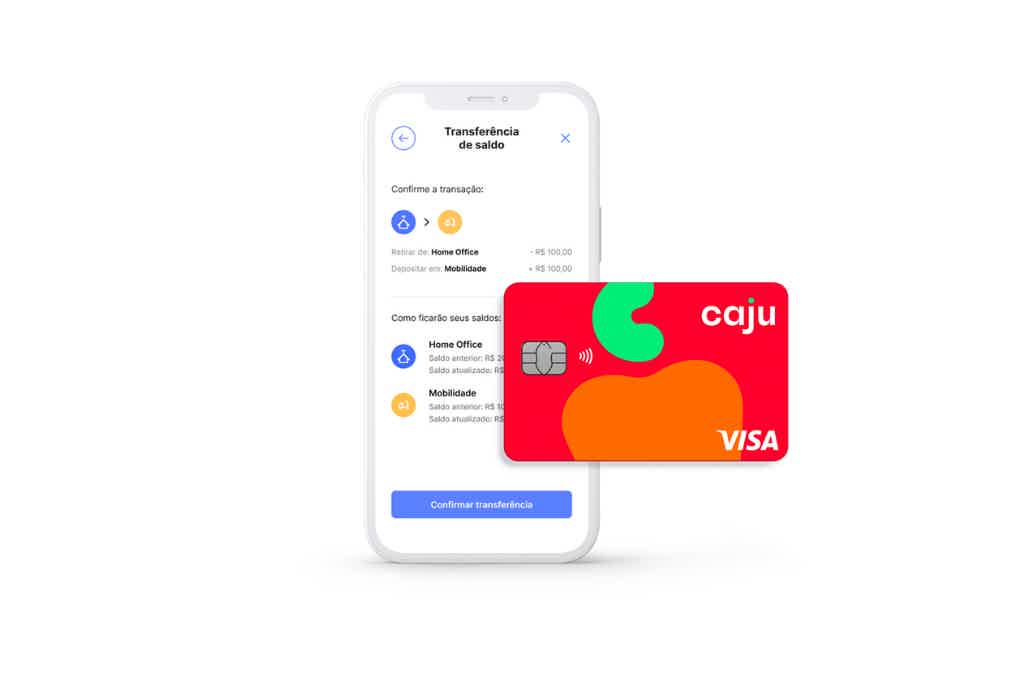

How to apply for the cash card

The Caju card is national with the Visa flag, so it is a complete option to unify the benefits of your employees. Plus, it's free and accepted in thousands of places. To find out how to apply, just continue reading below!

Keep Reading

Discover the Elo Nanquim Credit Card

Do you like to accumulate points on your credit card and exchange them for airline tickets and hotel rates? Then, you will want to know about the Elo Nanquim card. Read below!

Keep Reading