Cards

Discover the Daycoval Payroll Card

Get to know all the details about the Daycoval payroll card right now and understand if it is the best option for you and your finances.

Advertisement

Daycoval Payroll Card

O Daycoval Payroll Card it has been conquering more and more users. The practicality it offers is one of the main reasons for this explosion in popularity. People are really enjoying everything it has to offer.

However, even with the success, some are not aware of this product. Therefore, it is interesting that it, as well as its functionalities, are better discussed. With that, you don't run the risk of missing out on such an opportunity.

So that's the purpose of this post. Here, you will know all the details about the Daycoval Payroll Card. See how it can contribute to your financial autonomy. Believe me, you will be surprised. So, don't waste time, follow along.

| Daycoval Consignment | |

| Minimum Income | Minimum wage |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Lower interest, installment purchases and exclusive margin |

Request a Daycoval payroll card

Want a card with no annual fee and low interest? So request the Daycoval consignment now and enjoy your purchases

What is a payroll card?

With it then, the payment of your account is deducted from your payroll or your INSS benefit. Everything automatically. Therefore, it is a great alternative to maintain your financial control. With him, your debts will never be late.

Also, this type of card is offered to certain types of people only. Are they:

- Retirees;

- Pensioners;

- Public servants;

- Workers of private companies;

- Military of the Armed Forces.

Now, therefore, to choose the right card, you need to keep an eye on the revolving interest. Generally, it doesn't usually exceed 4% per month. If you think this is a high rate, pay attention to the comparison.

Traditional cards can then go up to 14%. In other words, more than triple. Do you see the advantage of these products?

Still, there is a doubt surrounding these tools, including the Daycoval Payroll Card. Many people wonder if there is a difference between them and the popular payroll loan. After all, both deduct from the payroll.

However, there is indeed a difference. The loan grants a certain amount to the user that will be discounted per month. The card is a means of payment. In this way, it operates like a conventional credit card.

Still, it allows looting. So, it's like you make a “purchase” that will be charged later. Lastly, the interest rates between these two tools are different.

So, now that you understand how the card works, it's time to move on to the next topic. Therefore, you will know a little more about the institution that makes it available.

Getting to know the institution: Banco Daycoval

This bank has a long history. In 2018, he completed 50 years of experience in the financial market. Daycoval specializes in providing credit to companies and individuals. In addition, he dominates the foreign exchange products and investment sector.

It is a recognized company across the country. This in view of its conservative process management profile. Still, it is famous for the seriousness with which it treats all its business.

The bank's head office is, therefore, in the state of São Paulo. However, there are hundreds of other smaller service points. Thus, they are spread across about 21 states. Daycoval's mission is to offer financial solutions to its partners.

Therefore, everything within its standard of excellence, always helping in the growth of its members. However, the bank seeks to base its activities on social responsibility and economic responsibility. Check below, the values of the institution.

- Agility;

- Sustainability;

- Security;

- Integrity;

- Austerity;

- Relationship.

So, you must be wondering if knowing all this is important. Actually it is. Thus, the company's way of working has an impact on its products and services. With what has been said here, you can see that this is a serious company.

Thus, it is reliable. You don't have to worry about acquiring a quality credit tool with dubious origin.

How does the Daycoval Payroll Card work?

Basically, the pattern remains, therefore, the same as any payroll card. However, there are some elements that make it stand out from the rest. You saw that it is like an ordinary credit card. Now, the key is in the advantages that this product has.

What are the advantages of the Daycoval Payroll Credit Card?

This product has a set of very interesting benefits. They are what make the Daycoval Payroll Card so famous. Therefore, check out some of the main advantages that you can enjoy when acquiring this credit instrument.

zero annuity

Many other cards with the same proposal charge annuity. This is definitely something that weighs on your pocket. In the case of this one, you are completely free of this fee. The company chose not to require anything in this regard from users.

low interest

One of the main factors contributing to its popularity. The interest on this card is very low. Still, this compared to other products that work on the same payroll scheme.

No SPC or Serasa

Today, the country has a high number of indebted people. As a result, they have a lot of difficulty getting credit services. In the case of this card, you can rest assured. To request it, your name is not consulted at Serasa or at the SPC.

Practical transactions

Everything about this product exudes simplicity. Therefore, all transactions are done quickly and without bureaucracy. In addition, you can make direct withdrawals and transfers to your checking account.

Installment

As Daycoval Payroll Card, you can make purchases in installments. Still, you have about 40 days to make the payment. Therefore, it gives you more freedom when dealing with your own money.

international coverage

Another point that offers you more freedom. With this card, you are not limited to shopping at national stores. With international coverage, it is possible to buy in several establishments around the world.

exclusive margin

Many payroll cards do not work with exclusive margin. Here, this is a reality. Then you and the institution can make more interesting deals.

What are the downsides?

The negative points of this card are 2. First, it cannot be used in the debit version. So if this is something important to you, you might be disappointed. In addition, when making withdrawals and transfers, some fees and interest are charged.

Undoubtedly, you need to take this into account before purchasing a product like this. So, the disadvantages may weigh more for one person than for another. Everything will depend on the user profile of each one.

That way, what is not worth it for someone else can be very interesting for you. Therefore, analyze well before drawing any conclusions about the card.

Is the Daycoval Payroll Credit Card worth it?

Generally speaking, sure. It works in a simple, practical and fast way. Still, it is useful in various financial situations. This product helps you control your spending and gives you alternatives to handle your money.

Also, the advantages are many. Just the fact that you don't charge an annuity fee is already something that makes it interesting. However, only you can give the final opinion. So, a tip is to list your real needs when using this card. With that, it will be easy to come up with an answer.

How to make the Daycoval Payroll Card?

To order yours, just access the bank's website. Then click on the request card option. Thus, you will be directed to a page where you must fill in some personal data.

Once this is done, your request will be sent and in a short time the institution will send a response. Okay, now you are a true expert on the subject. Your turn then. Don't waste any more time and go in search of your Daycoval Payroll Card.

Request a Daycoval payroll card

Want a card with no annual fee and low interest? So request the Daycoval consignment now and enjoy your purchases

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Saraiva credit card

Understand how the Saraiva credit card works, an excellent card option with no annual fee and two benefit programs. Check out!

Keep Reading

Get to know the 2021 Bolsa Família Loan

Meet the 2021 Family Scholarship Loan! Let's clear your doubts about it and how to apply for this loan from the Federal Government! Check out!

Keep Reading

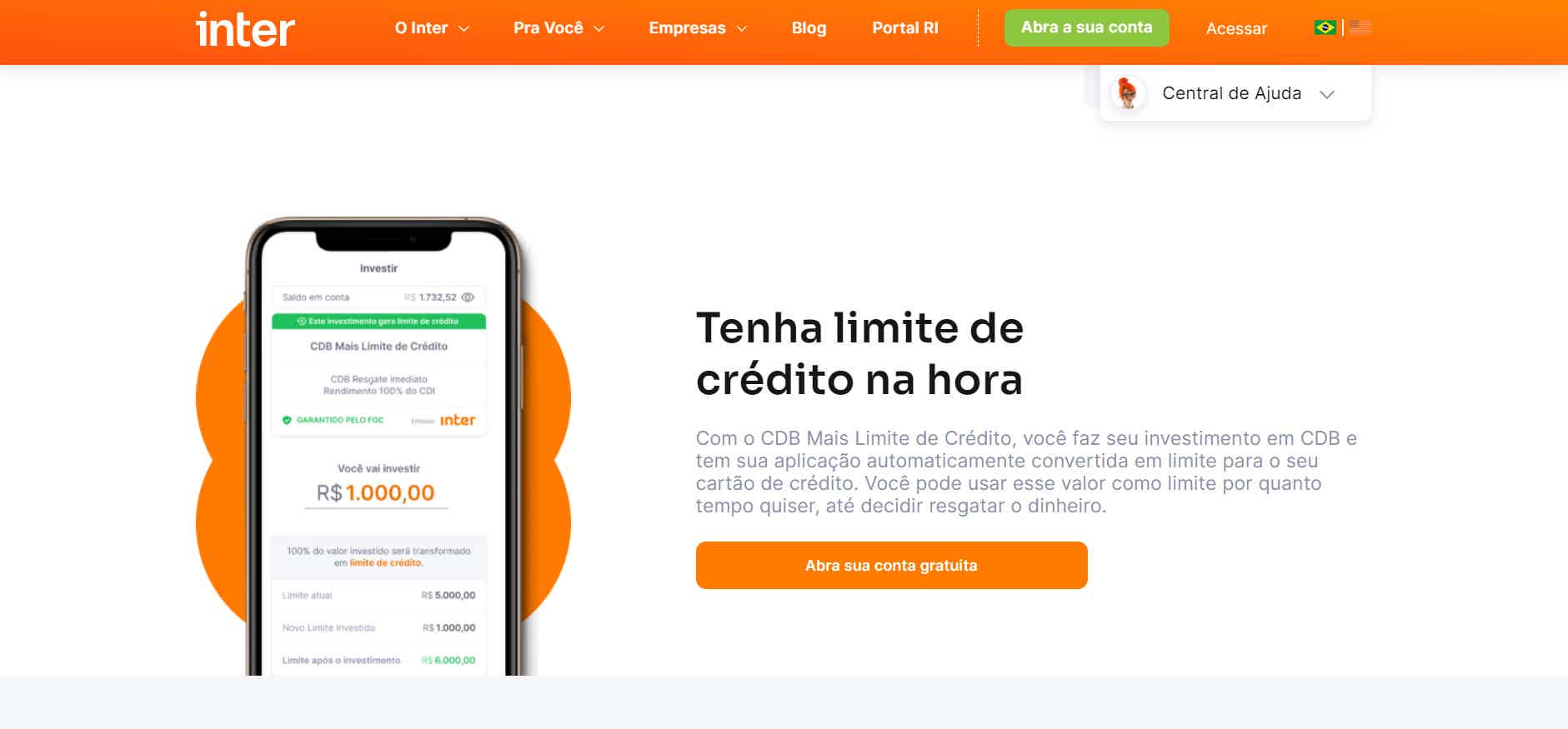

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Invested card in the comfort of your home, with all the security, practicality and ease you need.

Keep ReadingYou may also like

Pernambuco releases payment of the 13th salary of Bolsa Família

If you are a beneficiary of the Bolsa Família and received at least six months of installment last year, check out how the payment of the 13th salary of the Bolsa Família will work. The payment of the allowance has already been released and should take place between February 14th and 25th.

Keep Reading

Find out about the Itaú Construshop loan

Want to build or renovate? The Itaú Construshop loan can be a great ally right now. With long deadlines for payment and easy request, renovating your property is easier than you might think. Interested? We tell you all about it here, check it out!

Keep Reading

Nu Ultraviolet funds: how to invest?

The Nu Ultravioleta funds arrived to revolutionize the world of investments. So, with just R$ 100.00 you can start investing and diversifying your asset portfolio. So, check out its main features below and transform your financial life!

Keep Reading