card machines

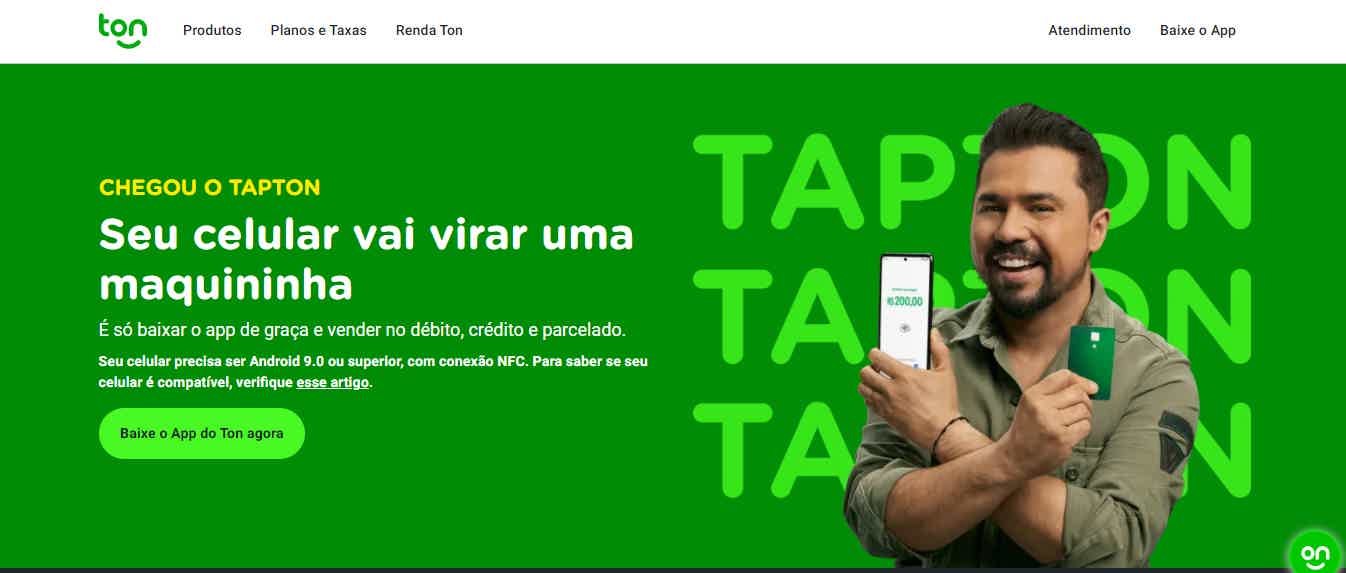

Discover the TapTon card machine

The TapTon card machine allows you to pay lower fees and still use your cell phone as a machine, thus avoiding many fees that are charged in this feature. Learn more here.

Advertisement

Complete orders on your mobile and access a free digital account

If you are looking for a card machine that does not have rent, membership fees and still allows you to use it immediately, it may be interesting to know the TapTon card machine.

From there, you just need to download an application to turn your cell phone into a card machine!

| debit rate | Starting at 1,39% |

| upfront credit rate | As of 3,29% |

| Installment credit rate | Starting at 13,75% |

| Additional per installment | R$ 0.40 |

| Benefits | free digital account approximation payments immediate use |

How to order TapTon machine

See how you can access it in a matter of minutes without leaving your home!

Thus, by downloading the Ton application, you can access the lowest rates on your sales to make your business more profitable.

In the following post, you will learn more about the TapTon card machine, its benefits and how it can help your business!

How does the TapTon card machine work?

In summary, the TapTon card machine works very simply. From there, you just need to download the Ton application and perform the initial settings on it.

That way, with the application activated on your cell phone, you can pass on your customers' purchases made by approximation.

To do this, when finalizing a purchase, you just need to configure its value in the app and define whether it will be done in installments or debit credit, as with common machines.

Once this is done, you just need to ask the customer to bring his card closer to his cell phone, or any other device he uses to make the payment by approach, in order to complete the purchase.

That way, your customer makes the payment much faster and you receive it automatically in the digital account that TapTon offers you!

Who is the card machine suitable for?

In summary, the TapTon card machine is an ideal option for anyone who works as a MEI or simply has a small business with customers who usually make payments by approximation.

In addition, it can also be the ideal option for those who would like to lower costs and earn more, as it offers lower rates.

Is TapTon card machine worth it?

If, after knowing the features of the TapTon card machine, you still have some doubts, check out the positives and negatives of this option below to make sure that your business can benefit from it.

Benefits

Let's start by checking out the main advantages that the TapTon card machine can offer you.

First of all, we can already highlight how easy it is for you to start using the machine. Here, you don't have to wait until it arrives at your house or pay rent for it.

Therefore, the only thing you need to do is download the application and everything will be ready to use.

In addition, through the application you can control all sales and even have access to a totally free digital account for you to receive from customers and make payments for your business.

Another interesting advantage is that the TapTon card machine accepts payment from Visa, Mastercard, Amex and Elo. This allows you to be able to access a large number of people.

Finally, the TapTon card machine also offers a referral program where you earn money by referring the machine to other customers!

Disadvantages

Now let's take a look at the negative points of this card machine option.

Despite TapTon having lower fees, it can still pose a hurdle for older entrepreneurs who are not digitally mature.

Thus, people who are not used to working with the application and prefer to take care of their business in a more traditional way, with physical machines, may feel a little uncomfortable when using the resource.

In addition, for you to be able to use Ton's card machine on your cell phone, you must have a smartphone that meets the application requirements.

Thus, if your cell phone model is a little simpler and does not contain approximation payment technology, unfortunately it will not be possible to use the application as a card machine.

How to order a TapTon card machine?

Despite the negative points of the TapTon card machine, it is still a very interesting option for many small businesses to be able to bring more agility to payments and access lower rates.

So, if you liked this option and want to learn how to request your Ton card machine, check out in the post below how and where you can carry out this operation!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Di Santinni Invoice: How to query?

Consulting your Di Santinni invoice is simple and can be done in the comfort of your home in just a few minutes. Click here and see how to do it!

Keep Reading

Neon credit card review 2022

Looking for a great credit card? Take a look at our Neon 2022 credit card review and see if it's right for you.

Keep Reading

Discover the forklift operator course

Learn more about the forklift operator course and see how to increase the chances of having a good job with it!

Keep ReadingYou may also like

How to apply for the Samsung Platinum Card

Samsung Platinum card is free of annuity and can be very advantageous! Click and find out more about it and how to order yours.

Keep Reading

What is it and how to buy fan token?

In today's post we will talk about the Fan Token. The asset is a great way to show your passion for your favorite team. Interested? Continue reading and check it out!

Keep Reading

BMG Card or Santander SX Card: which one to choose?

BMG Card or Santander SX Card? Want to know which is the best option? So, read our comparison post and check out everything about them.

Keep Reading