loans

Discover the Rebel loan

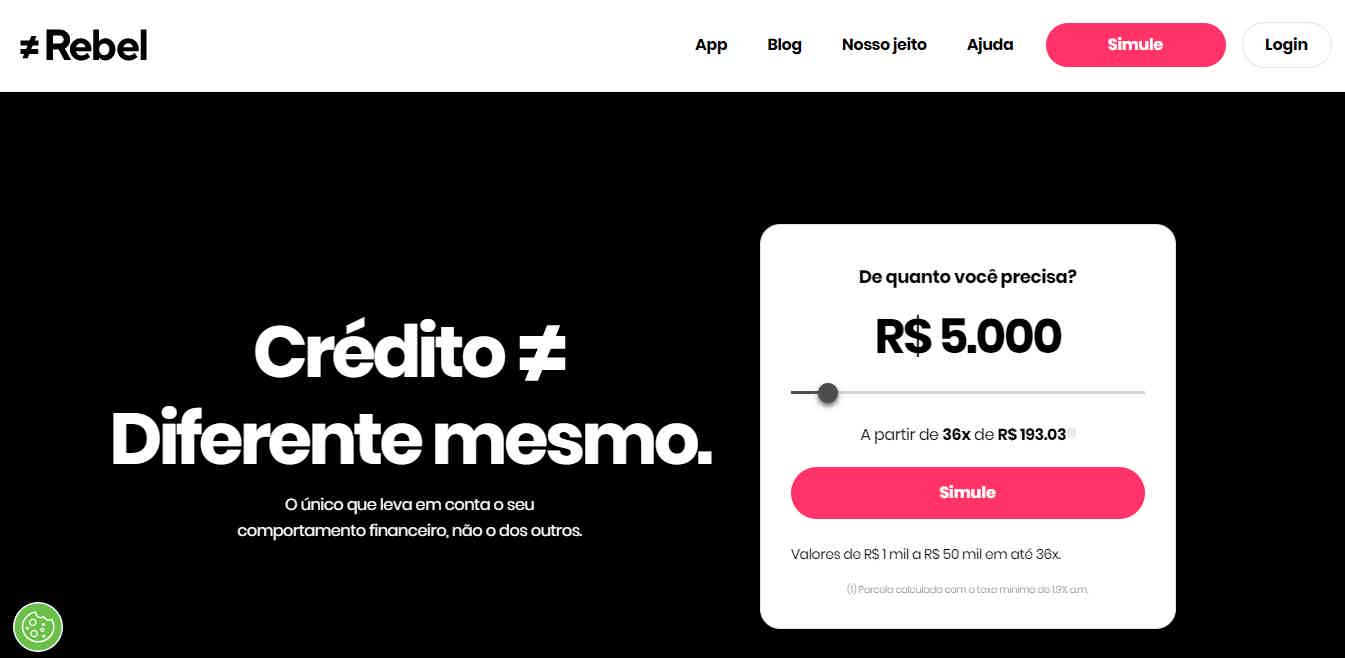

The Rebel loan is an option that can approve your request in minutes, in addition to offering up to R$ 50 thousand of credit with an interest rate starting at 1,90% per month to be paid in up to 36 months. Learn more about him below.

Advertisement

Receive the loan amount within 24 business hours

Rebel is a company that connects financial institutions that offer loans to people interested in hiring them.

In this way, this fintech is able to offer loans with higher amounts that fall into your bank account within 1 business day.

In addition, it has an approval of just 15 minutes and the user has up to 45 days to start paying!

| Minimum Income | not informed |

| Interest rate | From 1.90% to 9.90% per month |

| Deadline to pay | Up to 36 months |

| release period | Up to 1 working day |

| loan amount | From R$ 1,000.00 to R$ 50,000.00 |

| Do you accept negatives? | Uninformed |

| Benefits | Personalized analysis of your financial behavior Discounts on in-app installments Fast credit approval |

How to apply for the Rebel loan

See here how easy and fast it is to apply for this credit to enjoy its exclusive benefits.

Due to all these features, Rebel has been drawing the attention of more and more people who need credit to resolve their financial lives.

In this way, in this post we separate all the information about the personal loan that Rebel offers and its advantages. And if you stay until the end, you can even check how you can apply for the loan!

How does the Rebel personal loan work?

In summary, the Rebel personal loan works in a similar way to the others. However, it uses different technologies that allow you to analyze your credit profile more objectively.

For this, Rebel allows you to register and connect your bank account to their system. So, by doing this, Rebel has access to all the purchases you've made in order to analyze your financial behavior.

Thus, based on this analysis, the company's artificial intelligence is able to show you the main financial products that are already pre-approved for you!

Thus, Rebel manages to innovate in the way it analyzes credit, since it only considers your behavior and not the shopping habits of people with characteristics similar to yours.

That way, you get access to financial products that are customized to your behavior!

What is the Rebel personal loan limit?

When taking out a loan, it is essential to know the amounts that the company is able to release to the public.

Therefore, in the case of Rebel, you can borrow from R$ 1,000.00 up to a maximum amount of R$ 50,000.00.

Regardless of the contract, you will always be able to pay off your loan in up to 36 installments, allowing you to have a good amount of time to pay off.

Advantages of the Rebel loan

First, one of the biggest advantages of taking out a Rebel personal loan is the fact that you can be approved in a matter of minutes!

With the technology that the company uses, you can receive your approval in up to 15 minutes!

In addition, when using the Rebel application and consuming its financial education content, you can have discounts to use in the amount of your loan installments!

And, speaking of the app, you can follow everything related to the loan in a totally easy and transparent way!

Rebel main features

First of all, it's important to know more about the company that offers so many advantages for loans, isn't it?

Well then, Rebel is a very new fintech, being created in 2015 in order to offer fairer bank loans, with affordable rates for the population and that manage to solve people's financial problems and not bring others.

The company is part of the Lecca Crédito Financiamento e Investimentos group, being a simpler version, fully digital for loans and consolidated with the experience of a large group.

Who the loan is for

In summary, Rebel's personal loan is indicated for individuals who need access to credit to resolve financial issues, make purchases, renovations, among other objectives.

The loan is also an ideal option for those who ended up contracting debts with the card bill or who entered the overdraft.

The company offers special services for those situations where Rebel manages to pay your invoices or overdraft and offers you up to 30 days to pay without interest.

How to get a Rebel personal loan?

In fact, Rebel's personal loan is a differentiated loan option that performs a more objective analysis of financial behavior and, still, manages to be very affordable.

Therefore, if you liked the option it has to offer, check out the post below on how to apply for this loan!

How to apply for the Rebel loan

See here how easy and fast it is to apply for this credit to enjoy its exclusive benefits.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Méliuz Card or Neon Card: which one is best for you?

If you are in doubt between the Méliuz card or the Neon card, know that both have very different proposals such as cashback and digital account. Check out!

Keep Reading

How to find the best mechanic jobs

Find the best mechanic vacancies here, understand how to apply and how to have a resume that attracts the attention of the recruiter.

Keep Reading

How to apply for Zap card

Check out the complete step-by-step and learn how to apply for your Zap credit card from a simple WhatsApp conversation!

Keep ReadingYou may also like

Users of the NuInvest brokerage report the disappearance of applications

After a bug that affected the system of several financial institutions in early March, the one who went through a hard time in the last week was Nubank's investment brokerage, NuInvest. Learn more here!

Keep Reading

How to open an account at Órama Investment Brokerage

In order to have an account at the Órama investment brokerage, you need to complete the registration on the website. After that, you can take advantage of zero brokerage and invest in fixed and variable income. See how to have your account right now!

Keep Reading

Car loan Banco CTT or Cofidis: which is better?

For those who want to buy their car more easily and with less bureaucracy, Banco CTT or Cofidis car loans can be a great alternative. If you want to know more about credit, just keep reading.

Keep Reading