loans

Discover the Ali Credit payroll loan

The Ali Crédito payroll loan is a platform that allows you to apply for credit quickly and securely. Beforehand, it is important to say that this modality represents one of the lowest interest rates on the market!

Advertisement

Ali Credit Payroll Loan

First, the Ali Crédito payroll loan can be taken out by employees of partner companies.

And, in addition to being agile and safe to hire, it deposits the money in your account in 24 hours!

However, the loan is fast! In addition, it has the best interest rates. This guarantees a lasting relationship with the customer.

And, even though it is available to employees of partner companies, Ali Crédito also offers personal loans. Therefore, if you do not work for any of the companies, it is still possible to take out the Ali personal loan with peace of mind.

How to apply for a loan with Ali Credit

Ali Crédito is a digital platform that facilitates the payroll loan agreement, which has several benefits and advantages for its customers.

How does the loan work?

First of all, there is no need to leave your home to take out an Ali Credit loan. You solve everything via WhatsApp, the company's application or through the website.

However, when submitting your request, the credit analysis is carried out, so that later, the money falls into the account, within 1 business day. It is even possible to make reductions during the contract.

According to Ali Credit, it is common for large expenses to exceed the total amount of your savings or salary. And, for this reason, the company works on offering a platform that reduces operating costs, guaranteeing attractive interest rates.

In this sense, the process to apply for the loan is easy and fast. First, go to the official page and do a free simulation.

According to the pre-approved limit, you select the amount you need and how many installments you want to pay off the debt.

Soon after, just sign the digital contract and wait until the approval is made. After that, the amount will be deposited within 24 hours in your account.

What is the Ali loan limit?

However, regardless of the reason for applying for the Ali Crédito payroll loan, the commitment is to offer greater financial freedom! For this reason, the loan limit is up to R$100,000.

In addition, one of the biggest advantages of Ali Credit is the release of money, which usually occurs on the same day. Not to mention the attractive interest rates guaranteed through the technology used by the company.

Above all, Ali Credit allows even consumers with name restrictions to apply for a loan.

Therefore, in addition to having the most attractive interest rates on the market, the whole process is fast, safe and simple to hire!

Is Ali loan worth it?

At first, the Ali Crédito payroll loan is one of the most advantageous options on the market. This is because it has a safe, simple platform and the interest rates are one of the most attractive on the market.

So, if your goal is to take out a payroll loan, go to the Ali Credit website or app and do a free simulation. In this way, it is possible to analyze the value of each installment.

After the limit is approved, select the amount, sign the digital contract, and wait for the credit analysis to complete. Then the amount will be credited to your account.

This is definitely a great payroll loan option! Therefore, go to the company's website right now and do your simulation.

As an Ali Credit payroll loan?

First, to take out the payroll loan, interested parties must access the official platform.

Here's how to hire:

- First, go to the official page of Ali Credit and do a free simulation. Next, register;

- Inform all personal data so that a credit analysis is carried out;

- You receive proposals for your loan, as well as the total amount and term to pay off the debt;

- Sign the contract for the credit to be released;

- Within one business day, the money will be deposited into your account;

- In Ali Crédito's control panel, follow the payment process.

How to apply for a loan with Ali Credit

Ali Crédito is a digital platform that facilitates the payroll loan agreement, which has several benefits and advantages for its customers.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the Decolar Santander credit card

Find out in this post everything about the Decolar Santander credit card and learn about the main advantages it can offer you!

Keep Reading

Santander vacancies: how to check the options?

Get to know the open Santander vacancies, the average salary for positions and see the labor benefits that the bank offers its employees!

Keep Reading

Discover the PagSeguro Card

The PagSeguro card has been one of the preferred credit tools today. Know everything about it and see why to have one

Keep ReadingYou may also like

Leaving money in savings: 5 reasons to avoid it

Learn why saving makes you lose money and learn about more advantageous alternative investments. Thus, you can increase your purchasing power. Check out!

Keep Reading

How to apply for the Caixa Azul card

The Caixa Azul card has one of the lowest interest rates on the market. Want to know how to acquire yours? Read the post below and stay on top of all the most important information on the subject!

Keep Reading

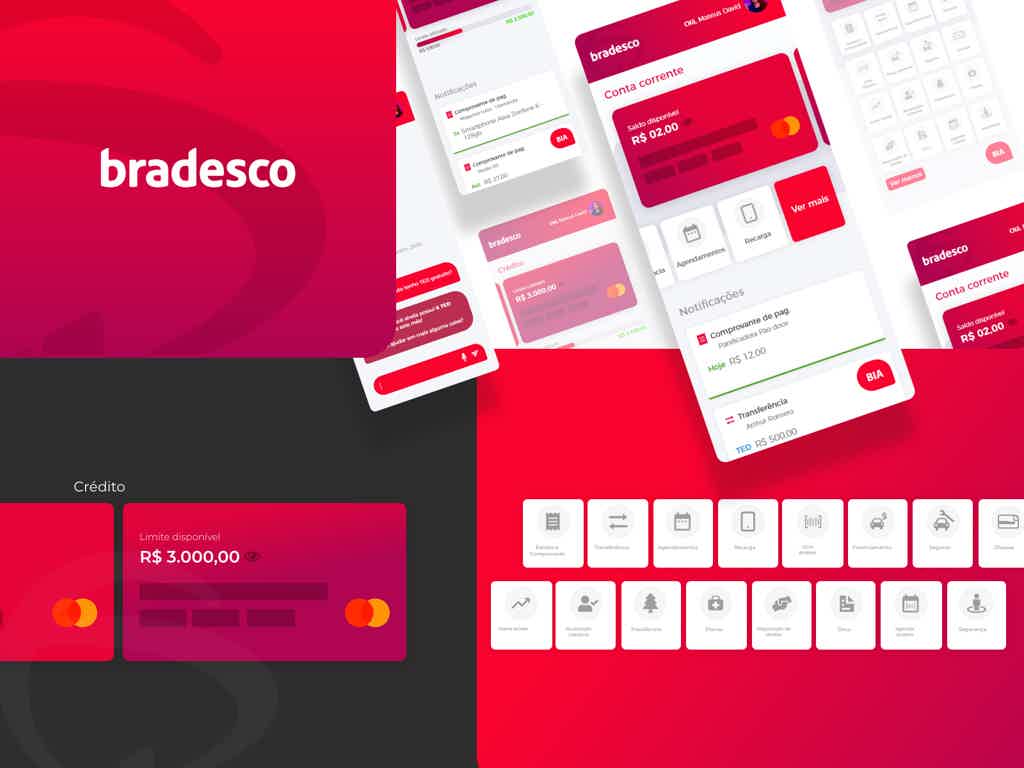

How to apply for a Bradesco digital account

You can request your Bradesco digital account completely online, and count on the app and useful telephone numbers. Click and learn more about it!

Keep Reading