loans

Get to know the loan with property guarantee Creditas

With the loan with Creditas property guarantee, you can transform your property into more credit and, thus, access low interest rates and a long payment term so you can invest in your projects with peace of mind. Learn more here.

Advertisement

Borrow up to R$ 3 million with very low interest

The Creditas property loan is a great credit solution for those who need access to a high amount, with a long term and low interest rates.

Namely, with the loan you can borrow between R$ 50 thousand and R$ 3 million and access interest rates that start with a rate lower than 1% per month!.

| Minimum Income | not informed |

| Interest rate | From 0.99% + IPCA |

| Deadline to pay | Up to 240 months |

| release period | Uninformed |

| loan amount | Between R$ 50 thousand and R$ 3 million |

| Do you accept negatives? | Uninformed |

| Benefits | Personalized service Online application Quick and efficient loan |

How to apply for the Creditas loan

Learn how you can access credit with Creditas property guarantee!

In addition, when taking out this loan, you have the possibility to combine income with more people in your family to get approval.

Come and learn more about the loan with Creditas property guarantee and find out if this is the ideal credit option for you.

How does the loan with Creditas property guarantee work?

In summary, the Creditas property loan works in a very simple way and is similar to other types of credit.

Therefore, with it you can simulate the values on the Creditas website, send your documents for analysis and wait for the credit to be released when approved.

But here, the main difference between this loan and the others is that with it you put your property as a guarantee of payment.

That way, you can access more attractive credit terms, as the risk of default and indebtedness is lower.

And while the loan lasts, you can continue to use your property normally.

What is the loan limit?

Namely, Creditas manages to offer an excellent credit limit with the loan with property guarantee.

Therefore, with this loan it is possible to access amounts that start at R$ 50 thousand and go up to R$ 3 million!

In any case, the total amount to be released will depend on your credit analysis and the current value of your property.

But even so, it is still possible to access high values to undertake, make reforms or take care of larger emergencies.

Who is the loan for?

In short, the Creditas loan is suitable for anyone who has a property in their name.

Namely, Creditas allows you to use properties that have not yet been paid off. But, the loan amount must be used to pay off the asset.

Thus, you can renegotiate an active debt and access a loan with lower interest rates.

Loan with property guarantee Creditas worth it?

To find out if the loan with Creditas property guarantee is really worth it for you, you need to check its advantages and disadvantages.

Benefits

In summary, the Creditas loan has great advantages for those who request it. From it, you can access the following benefits:

- It can be requested by your cell phone;

- It has one of the lowest interest rates;

- The credit can be used to pay off your asset;

- You can access high credit values;

- There is the possibility of the loan being approved for negatives.

Disadvantages

On the other hand, the Creditas loan can also have some negative points, such as:

- More analysis steps in the request making the process more bureaucratic;

- Credit release may take time depending on its value;

- The property must be in the name of the applicant.

How to take out a loan with Creditas property guarantee?

If you have analyzed the positives and negatives of the Creditas loan and decided that it is indeed the best solution, now is the time to learn how to apply for this credit.

Therefore, we have prepared an unmissable post that shows you the complete step-by-step of how you can apply for a loan with Creditas property guarantee!

How to apply for the Creditas loan

See how you can access the credit you need with low interest rates!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Barça Academy: discover Barcelona's football school for children and young people!

The Barça Academy is a football school that partners with FC Barcelona, making it a highly sought after school. Find out how to enter.

Keep Reading

How to enroll in ProUni

If you already know ProUni, it's time to find out how to apply for this program. Read this post and see the step by step!

Keep Reading

Credit card I want money: what is I want money?

Do you already know the I want money credit card? No? So read on, because we're going to tell you all about this card! Check out!

Keep ReadingYou may also like

Get to know Credihome Real Estate Financing

To be more practical when looking for real estate financing, nothing better than relying on the help of a consultancy such as Credihome, learn more below.

Keep Reading

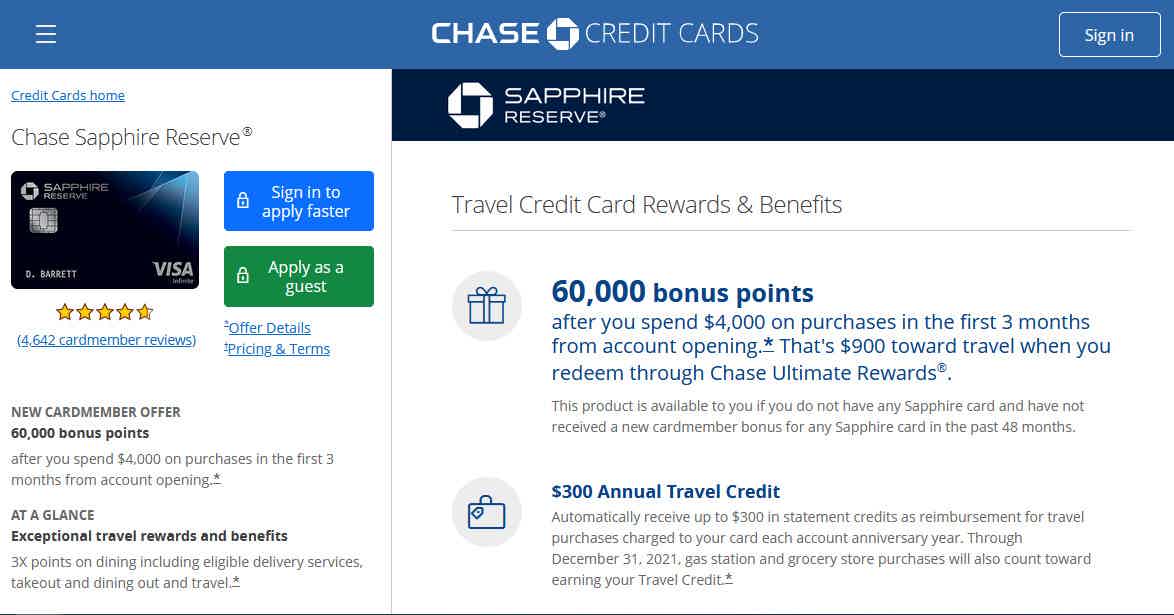

How to Apply for the Chase Sapphire Reserve Card

Traveling without worries, being able to receive part of the expenses back and even bonuses and points for the next vacation is all you need. Want to know how to have it? Follow here.

Keep Reading

Payment Schedule Brazil Aid 2022

With Auxílio Brasil, families living in poverty have an income to guarantee access to services such as health, education and food. See here the program calendar for 2022.

Keep Reading