Cards

Credit card I want money: what is I want money?

Do you already know the I want money credit card? No? So read on, because we're going to tell you all about this card! Check out!

Advertisement

Credit card I want money

So, the credit card I want money is an ideal card option for INSS retirees and pensioners looking for a secure card, with no annuity or maintenance fees, a deadline for payment of purchases in up to 45 days and several other advantages!

Today, we are going to show you another useful information about this card! Check out!

How to apply for a card I want money

Do you want to learn how to apply for the card I want money with fast and secure release? Then continue reading to learn the step by step!

| Annuity | Free |

| minimum income | Uninformed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Deadline for payment of purchases within 45 days Exemption from annuity or maintenance fees Security and Transparency Revolving interest rates of a maximum of 3.06% interest per month A lot more |

Advantages I want money

So, the first advantage of this card is that it works like a payroll credit card, that is, credit card installments are deducted directly from the benefit sheet or paycheck.

Therefore, it is an ideal card for INSS retirees or pensioners who need a card that offers security, transparency and benefits such as:

Firstly, it is a card that has the Mastercard brand and international coverage, that is, you can use it for purchases in Brazil and in international stores.

And besides, it is free of annuity or maintenance fees and the revolving interest rates are a maximum of 3,06% of interest per month! It saves a lot, right?

Another advantage is that you don't pay late payment fines and you can even withdraw up to 70% from your limit on Banco 24 Horas networks!

Therefore, the credit card I want money is the ideal card if you are looking for a card that will help you save by spending money!

Main Features of I Want Money

Well, the I want money card is a card created to provide the best service and care for INSS pensioners and retirees.

That's because, it has all the security, practicality and accessibility so that these people can enjoy great benefits.

Plus, you can withdraw up to 70% from the BMG Card credit limit to your account with fees starting at 2.7% per month on the withdrawal amount, and the charge will be posted on the next invoice!

Who the card is for

So, as it is a payroll card, it is indicated for INSS pensioners and retirees, as the invoice is deducted directly from the payroll or from the INSS benefit.

So apply for your credit card today I want money! But if you are in doubt, in the recommended content below, we bring you a post with even more information about this card! So check it out.

Meet the credit card I want money

Get to know the Eu Quero Grana credit card and see if this card is what you need right now! Ah, he has unique conditions! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Condor loan

Get to know the Condor loan, a secure line of credit, with digital 100% contracting and the lowest rates on the market. Learn more here.

Keep Reading

How to open bb account

Are you looking for how to open a BB account? In today's article, we'll show you step-by-step how to open it. Check out!

Keep Reading

Leader card invoice: how to consult?

Do you have a Leader store credit card, but don't know how to issue an invoice? Learn here how to check your Leader card bill.

Keep ReadingYou may also like

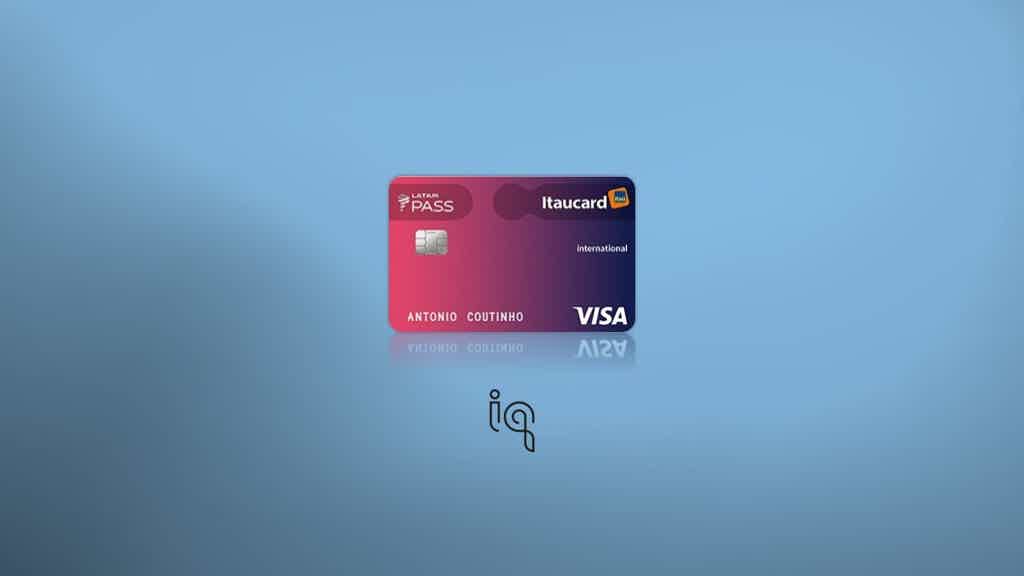

Get to know the Itaú Latam International card

Do you already know the partnership between Latam Pass and Itaú? It's the Itaú Latam Internacional card that offers you several benefits in accumulating points and 50% discount in cinemas and theaters!

Keep Reading

Discover the CTT credit card

Discover the advantages of the CTT credit card and get yours without leaving home.

Keep Reading

Meet the Necton brokerage

Necton does not charge a charge for pension funds and has even zeroed the custody fee for government bonds. Want to meet her? Then read on.

Keep Reading