loans

Learn about Itaú university credit

Itaú university credit allows you to finance your semester with low rates or completely interest-free! Learn more about its main features in this post!

Advertisement

Finance your semester and pay in up to 12 months

Banco Itaú is one of the largest and most consolidated banks in Brazil, where it can offer various financial services. Among them, there is Itaú university credit for students to complete their courses.

Thus, from it, it is possible for the student to access student credit to complete his studies, where he can have different payment conditions and access several interest-free course options.

| Minimum Income | not informed |

| Interest rate | There are interest-free options |

| Deadline to pay | Up to 12 months |

| release period | Uninformed |

| Credit Amount | Equivalent to your semester fee |

| Do you accept negatives? | Uninformed |

| Benefits | Completely online process Up to 12 months or more to settle Hire at any time without accumulating installments |

How to apply for Itaú student credit

See here how easy it is to get your credit and achieve the dream of having a degree.

Therefore, if these characteristics of the Itaú university loan made you more interested in it, check out the post below for all the information about the loan to find out if it is the best option for your studies.

Discover the Iti Itaú card

See how this card with no annual fee and with a high limit helps you in your daily life

How does Itaú university credit work?

In short, Itaú university credit is a student loan program. In this way, it is possible to finance graduation courses, exchange programs and short-term courses.

In addition, to offer this credit to students, Itaú has been working in partnership with Pravaler since 2013. Thus, Pravaler is a large platform with financial services for students.

Thus, from this partnership, both are able to support young people who seek to improve their lives through education.

What is the Itaú university credit limit?

In short, to be able to take out good student credit, it is essential to know the limit it offers. Thus, it is possible to know if he will be able to pay for your course and allow you to continue with your studies.

Therefore, in the case of Itaú university credit, it is possible to finance the full amount of your monthly fee. In addition, you can accumulate the amount with your scholarship in college and even make the payment of interest-free credit.

Itaú advantages

By contracting the Itaú university credit, the student can access several incredible advantages, among which we have the ones described below.

- Installments that do not accumulate during the course.

- Access thousands of completely interest-free course options;

- Credit can be contracted at any time of the year;

- The request is made online without bureaucracy.

That way, he will be able to carry out his studies without worrying about finances and focus on doing well in college.

Itau main features

In short, among the main features of the student loan offered by Itaú bank is the fact that you can pay off the loan in 12 months or more.

In addition, your financing installments do not accumulate and you can take out a new loan even if the previous one has not ended.

Thus, you continue to pay the same amount as the first credit, and only start paying the second when you finish the previous one.

To whom the credit is indicated

By the way, Itaú student credit is the ideal option if you are looking for financing to cover your course fees.

Therefore, it is possible to finance undergraduate courses, exchange courses or short-term professional courses that you can use to enhance your curriculum.

In this way, the credit can be varied and help different students in their different stages of study.

How to apply for an Itaú university loan?

In short, Itaú university credit allows you to finance your studies with Pravaler. In this way, it is possible to access different payment conditions and options that allow interest not to be charged.

Therefore, in order for you to be able to take out the credit, we have separated in the post below all the guidelines for you to do so!

How to apply for Itaú student credit

See here how easy it is to get your credit and achieve the dream of having a degree.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

AliExpress Men's Fashion: buy with up to 75% discount

AliExpress men's fashion came to offer unimaginable discounts. Read this article to understand how to get it!

Keep Reading

Doing Good, No Matter Who: check out how to participate in this framework

Find out how the Doing Good, It Doesn't Matter To Whom framework works in practice and learn how you can do good to those you love most!

Keep Reading

4 villains of your financial planning

Financial planning is the key to balanced personal finances. But click on meet 4 villains that can get in your way!

Keep ReadingYou may also like

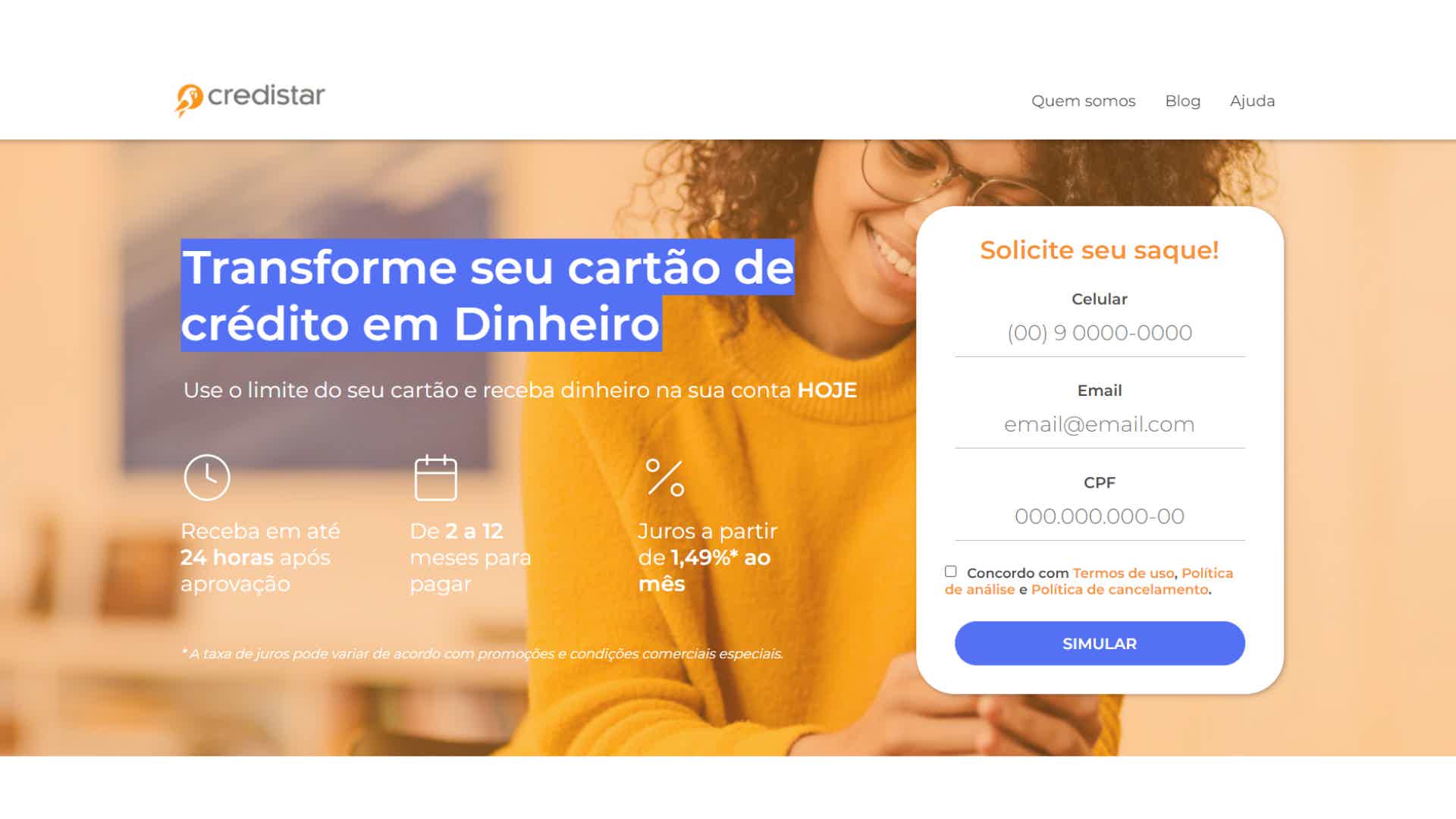

How to apply for a credit card loan

Do you know the Credistar loan? We tell you here how it is possible to get money easily, without bureaucracy and with the lowest interest rates on the market. Continue reading to check it out.

Keep Reading

Get to know the Grão App: Digital Savings Account

The Grão Investimentos app can help you make good deals with your money. Want to meet him? So, read on and check it out!

Keep Reading

Get to know Banco CTT Personal Credit

Banco CTT Personal Credit offers credit of up to €50,000 for 84 months with online contracting and no opening fee. Want to know more? Then check out our exclusive guide.

Keep Reading