Consortia

Get to know the Porto Seguro real estate consortium

Do you want to know why you should hire the Porto Seguro real estate consortium? Here you will find the lowest administrative fees, letter of credit of up to R$ 560 thousand, without interest and without down payment. Find out here how it works.

Advertisement

Consortium Porto Seguro: conquer your property in up to 200x

Has it ever crossed your mind that you don't have to pay rent? If so, you've probably gone through some perrengues with the bills to buy your own home or even land. You are not alone. Many people often go through the same situation, even if it is not necessary, because the Porto Seguro real estate consortium can help you.

Some people still don't know the consortium, but this is one of the smartest ways to buy a high-value asset, such as houses or apartments. We have prepared a complete guide on this subject and in it we will address the Porto Seguro consortium and its advantages!

Keep it up with us and happy reading!

| Minimum Income | not informed |

| Interest rate | Exempt |

| Deadline to pay | Up to 200 months |

| release period | Uninformed |

| Consortium Value | Up to R$560 thousand |

| Do you accept negatives? | Uninformed |

| Benefits | Credits of up to R$560 thousand, plan options with smaller installments, use of FGTS |

How to apply for Porto Seguro real estate consortium

With the Porto Seguro real estate consortium, you have high credit values, flexible installments, payment via credit card. Apply!

How does the Porto Seguro real estate consortium work?

Very similar to other consortium modalities, the Porto Seguro real estate consortium offers several plans for those interested in escaping rent.

Real estate self-financing works in a very similar way to standard financing: the consortium member pays monthly installments to acquire the property. Therefore, the big difference is that, in this case, we have several people within the same consortium group and both help each other to fulfill the dream of owning their own home.

In turn, the administrator of the consortium fund, Porto Seguro, manages the monthly payments to draw a letter of credit each month to one of the participants in the group.

Contemplation is the moment that all members are waiting for. Therefore, it can happen by drawing lots, as we said above, or by bidding. In this last modality, the consortium anticipates some payments to receive the letter without counting on luck.

In addition, the Porto Seguro consortium does not charge interest and much less requires entry to participate in a raffle plan. Instead, the only requirement is that you pay the installments, otherwise you will not have access to the letter of credit in cases of contemplation.

What is the limit of the Porto Seguro consortium?

The values released by the Porto Seguro real estate consortium range from R$70 to R$560 thousand. The consortium member who receives the contemplation does not necessarily need to buy the same reference property of the contract.

Instead, you can buy any property of your choice, as the credit is fully credited to your account. It is worth remembering that many contemplated get lower prices by opting for cash purchase.

Porto Seguro Advantages

The main advantages of the Porto Seguro real estate consortium are:

- Credits from R$70 to R$560 thousand;

- Plans with reduced installment until contemplation;

- Zero interest charges and reduced fees;

- Use your Severance Indemnity Fund (FGTS) to pay installments or bid.

In addition, we can highlight that Porto Seguro offers some other differentials such as good service, less bureaucracy and accessibility.

Main features of Porto Seguro

This is usually a positive point of consortia in general and not just Porto Seguro. Do you know when you decide to finance something good? Generally, you pay an amount X that can even correspond to the value of another good in the same segment, but you cannot exchange it.

In the consortium it is different, as the contemplation is in credit, you can purchase any good available in the market, as long as it is from the same segment as the consortium. In the case of real estate, it is possible to buy houses, apartments, land, lots, sheds, slabs and other buildings in the segment.

For whom the consortium is indicated

The consortium is mainly indicated for those who want their own home, but are in no hurry to make it a reality. Because contemplation by lottery can often take a while.

In addition, it is necessary to reach the age of majority to be able to sign a contract with individuals or legal entities, thus, only adults can contract the Porto Seguro consortium.

If you already have some money saved to make a good bid and anticipate contemplation, the consortium is also a good option. In this way, the participant receives his good faster.

In general, these are the profiles of the consortium members.

How to make a Porto Seguro real estate consortium?

First, before hiring Porto Seguro's consortium management services, you need to carry out a financial simulation of the plan. For this, it is necessary to access the Porto Seguro website and fill out the form that is available to all interested parties.

Then, the company will contact you with more information and already offering possible closing offers. Also, if you want to know more details about the process, access our recommended content below.

How to apply for Porto Seguro real estate consortium

With the Porto Seguro real estate consortium, you have high credit values, flexible installments, payment via credit card. Apply!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get an unlimited credit card

Do you know if there is an unlimited credit card? Read the post and find out the answer to this question and also check out 3 ways to get a high limit.

Keep Reading

Discover the Leroy credit card

See how the Leroy credit card works, ideal for people who shop at Leroy Merlin stores and use the Mastercard brand!

Keep Reading

How to order the Stone machine

Find out how to request your Stone machine and receive it at your business within 1 business day to take advantage of its resources!

Keep ReadingYou may also like

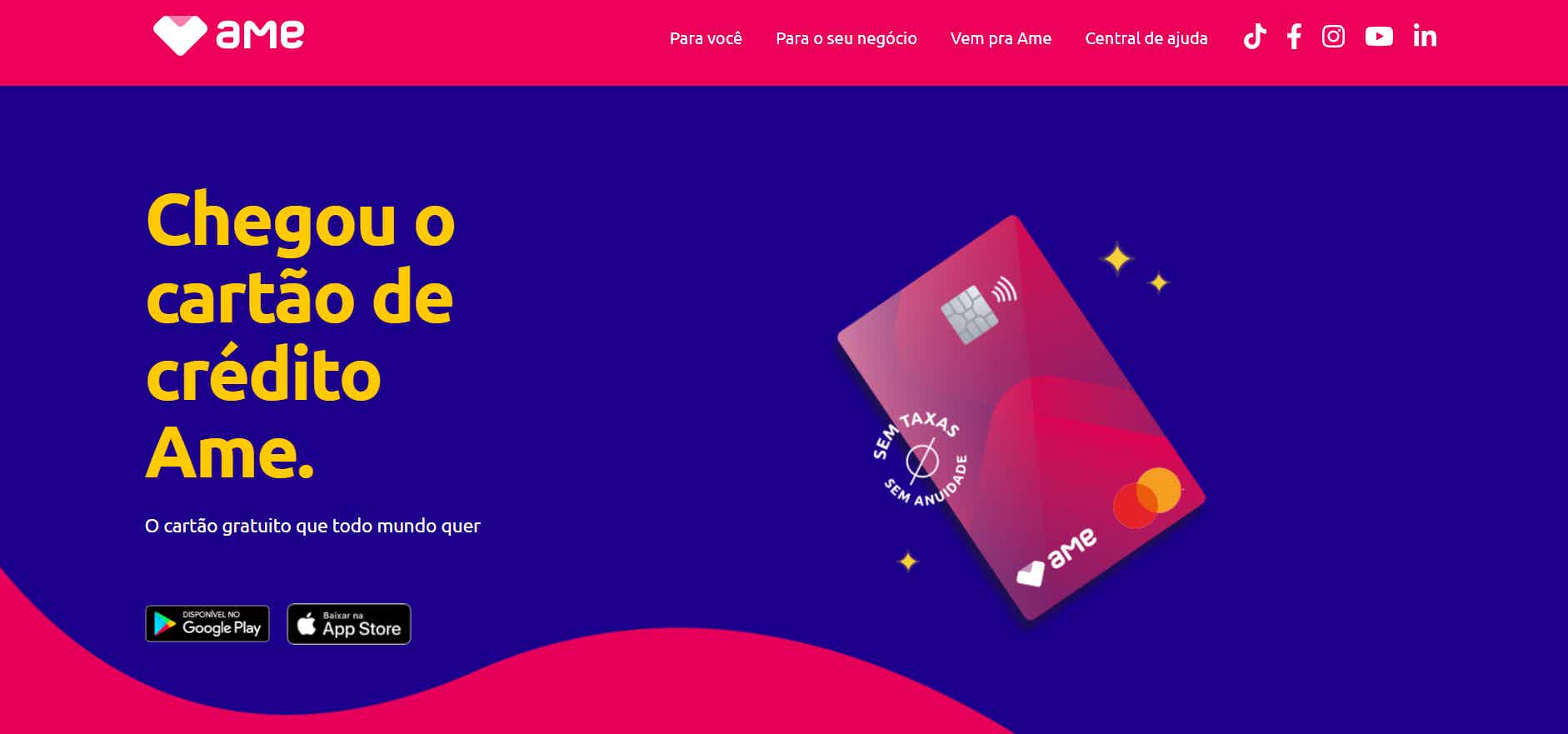

How to use the Ame Digital card?

If buying is already good, imagine buying and getting your money back? Yes, this and other possibilities you will find when using the Ame Digital card. Learn more about him here!

Keep Reading

How to apply for the Family Salary

The Family Salary benefit was designed for employees under the CLT regime who have children under 14 or children with physical disabilities. Find out how to apply here.

Keep Reading

How to apply for ActivoBank car credit

ActivoBank car credit is the opportunity you were looking for to buy your car or motorcycle. To learn more about and how to apply for credit, continue reading the article.

Keep Reading