Cards

Discover the Leroy credit card

Discover the Leroy credit card, ideal for customers of the Leroy Merlin network and the Mastercard brand, with unmissable offers and discounts! Check out!

Advertisement

How does the Leroy credit card work?

At first, the Leroy credit card came to bring advantages to customers who shop at the chain's stores, as well as at places that accept cards with the Mastercard brand.

And so, when choosing the best credit card option, several doubts may arise, such as minimum income, absence of annuity, scope and credit card application, so let's list the advantages and disadvantages when choosing this card! Check out!

How to apply for the Leroy Card

The Leroy card is ideal for customers of the Leroy Merlin network and Mastercard partners. So check out how you can apply for this card!

| minimum income | not informed |

| Annuity | 1st YEAR R$99 or 12x R$8.25 (Entitlement) R$49.50 or 12x R$4.12 (Additional) OTHER YEARS R$119.04 or 12x R$9.92 (Entitlement and additional) |

| Roof | National |

| Flag | MasterCard |

| Benefits | Exclusive discounts and up to 45 days to pay |

What are the advantages of Leroy credit card?

So, let's get to know the advantages that this Leroy credit card presents:

- At first, discounts on the first. That's because, right on the first purchase, the customer receives 5% discount, as long as it is up to 5 thousand reais;

- And in addition, there is also the option of installments for purchases in up to 30 installments with fixed amounts (but there will be interest in this case);

- Another advantage is that Leroy customers have a period of up to 45 days to start charging the card bill. The fact is that this period will depend on the date of purchase and closing of the invoice;

- Discounts at Cetelem bank partner stores and partnership with the Mastercard Surpreenda program;

- Another advantage is the additional limit given for purchases at Leroy Merlin partner stores, and for purchases at any other partner that accepts the Mastercard brand;

- To close, it offers a personal credit line and withdrawal.

To apply for a personal card loan, you can do it over the internet, through the Cetelem bank application, Banco 24 Horas or by telephone. Therefore, this card has several advantages, and many more that can be discovered by going to one of the Leroy stores!

What are the downsides?

So, among the disadvantages of this card are the annual fee, as well as high interest rates, and the request can only be made at Leroy Merlin stores.

Leroy credit card it is worth it?

Well, from what we've researched, this card is worth it, especially for customers of Leroy Merlin stores, and for people who buy at partner stores of the Mastercard network. This is because the card can only be used at these establishments.

And in addition, to apply for the card is very simple. That's because, you can apply through the stores, with the personal documents in hand and that's it!

The fact is that the card charges an annual fee, and has high interest rates, which can be a negative point, among many others on the market, but, for those who are customers of this network, it has several offers and discounts programs that make it worthwhile!

how to do Leroy credit card?

So, now that you already know about the advantages and disadvantages of this card, we will teach you how to access it, and be able to enjoy discounts; installment conditions at the time of purchases; limit increase request, and much more!

To apply for the card, you need to go in person to any of the Leroy Merlin stores. Below, we will explain in more detail how you can apply for a Leroy credit card.

How to apply for the Leroy Card

The Leroy card is ideal for customers of the Leroy Merlin network and Mastercard partners. So check out how you can apply for this card!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pan Mastercard Platinum credit card: how it works

Learn all about the Pan Mastercard Platinum card with the international Mastercard brand, cashback program and the possibility of waiving the annuity.

Keep Reading

Pan Mastercard Internacional credit card: how it works

Find out how the Pan Mastercard Internacional card works. With it, you can zero the annuity and also take advantage of several benefits, such as PAN MAIS.

Keep Reading

Top 10 Confidence prepaid card questions

Find out here the main questions about the Confidence prepaid card and learn how to use this card that can be your ally when traveling abroad.

Keep ReadingYou may also like

Visa benefits for travel: know the options

If you travel frequently and want more ease with your flights, accommodations and more, then Visa travel benefits are a great option for you. To learn more about them and their characteristics, just continue reading the article and check it out.

Keep Reading

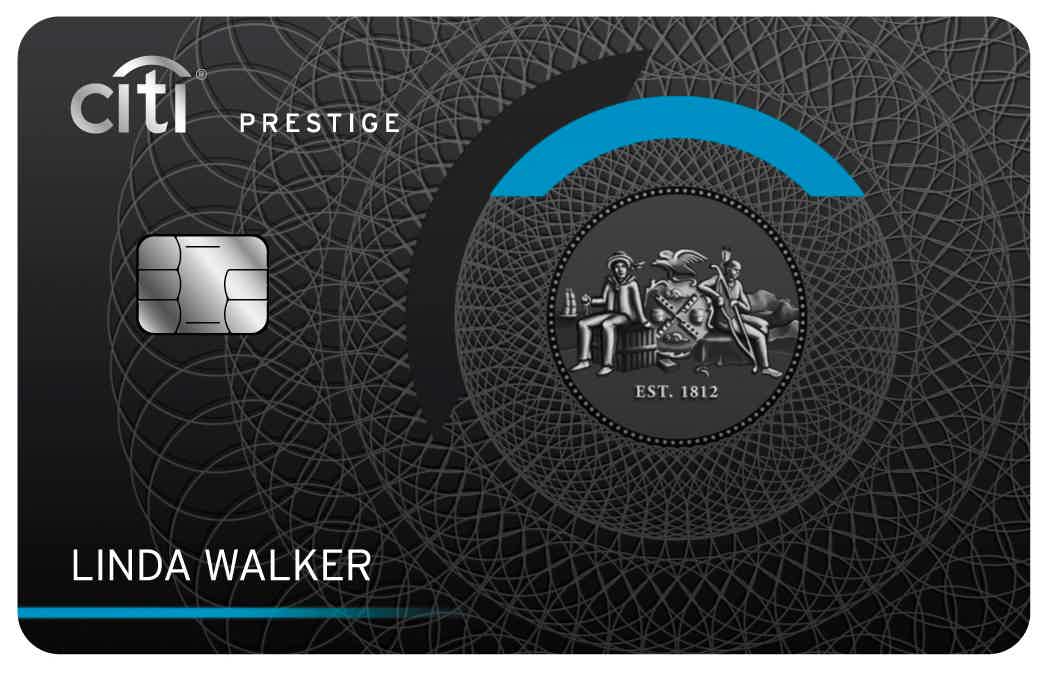

Citi Prestige Card credit card: how it works

The prestigious Citibank offers a variety of services and products worldwide. Among its luxury cards is the Citi Prestige Card. Do you want to know more about it and its advantages? Follow along.

Keep Reading

Caixa Mulher card or PicPay card: which is better?

The Caixa Mulher card and PicPay are great options for those looking for a product without much cost. Which one will be the best? Continue reading and check it out!

Keep Reading