Cards

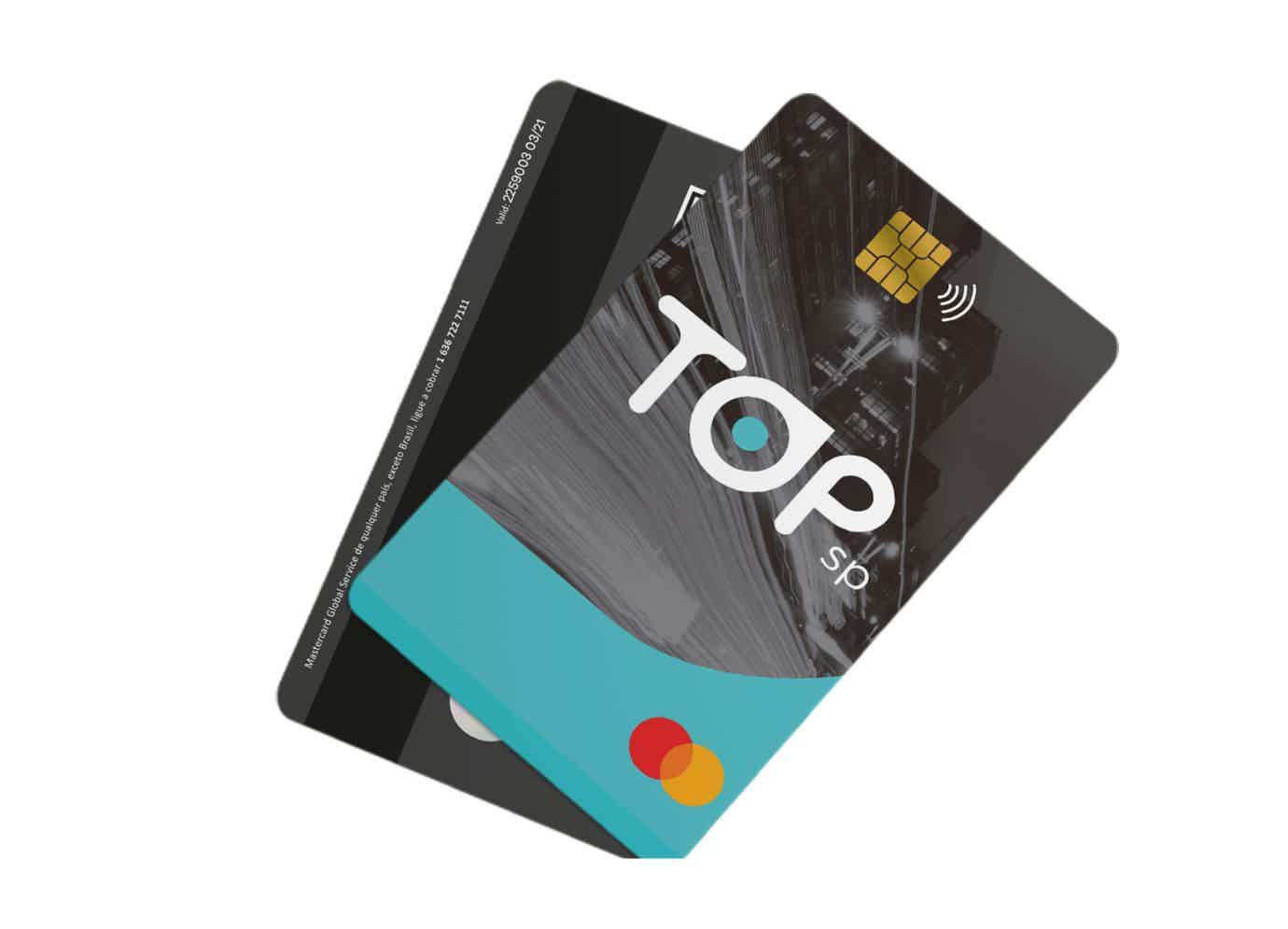

Discover the Top Credit Card

With the Top credit card, you can make your purchases in several establishments in installments and you can even use it on buses and subways. Learn more here.

Advertisement

3 in 1 card: debit, credit and transport

Have you ever thought about being able to have a card that allows you to make purchases using debit, credit and even use public transport? With a Top credit card you can access all of this and much more!

Namely, this credit card is one of the few on the market that offers the transport function along with the credit. That way, you can use it more often and make your financial life more practical.

| Annuity | 12x of R$ 16.90 |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise Program Built-in transport card |

In addition, as the Top credit card comes under the Mastercard flag, you can conveniently make your purchases at a large number of establishments, as the flag is widely accepted!

Therefore, in the following post you can learn more about the Top credit card and check if it is a good card option.

What are the main characteristics of the Top card?

In summary, the Top credit card is a card option that offers many possibilities for you.

That way, with just one card you can use it in the debit, credit and transport function.

Namely, the credit card also allows you to use the CPTM subway system. In addition, it is also possible to access the EMTU intercity bus lines in the metropolitan region of São Paulo.

And in addition to the transport function, you can use your credit card in several different establishments, since most of them accept Mastercard cards!

Who is the card for?

The Top credit card can be accessed by anyone interested in this option and able to pass the credit analysis carried out.

But, for those who live in the metropolitan region of São Paulo or use the subway system, the Top credit card can be the most practical way to deal with day-to-day expenses, since it is possible to leave them in one place .

Top credit card worth it?

Even knowing the main features of the Top credit card, it is common to have some doubts about this option.

Therefore, in order to solve all your doubts and allow you to be sure whether or not this card is for you, we have separated its main advantages and disadvantages below.

Benefits

As advantages of the credit card, we can highlight the fact that it is a 3 in 1 card. Therefore, with it you can make credit and debit purchases in several stores and even use it in public transport.

But, in addition, with a Top credit card you can also access a digital account that is super easy to use and that allows you to manage everything related to your card.

In fact, from your digital account, you can access a good investment platform and thus make your money multiply.

Finally, we must not forget that from the Top credit card you can access the Mastercard Surpreenda program.

From there, each purchase made on your card can give you a point to keep and use in the future. In addition, the program also contains several special promotions and discounts at partner stores.

Disadvantages

As much as the Top credit card has great positive points, we cannot forget that it also has some disadvantages.

Therefore, in the first place, the Top credit card charges an annuity.

Nowadays, it is easy to find credit cards on the market that do not charge this rate or offer ways for the user to get a discount on this rate.

In addition, there is also the fact that to apply for the Top credit card and have it delivered to your home, you will need to pay a delivery fee.

Therefore, before applying for the Top credit card, it is interesting to consider all the points listed above to find out if this card is worth it for you.

How to Make a Top Credit Card?

In short, you can apply for your Top credit card both online and in person.

That way, with Top you can request your card on the channels you like best or feel comfortable with!

Therefore, to learn how to apply, check out the complete step-by-step in the post below on how you can apply for a Top credit card!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Pan Mastercard Zero Annuity credit card

Learn all about the Pan Mastercard Zero Annuity credit card. It is international, has a free annual fee, Club Deals and a personalized app.

Keep Reading

The Key to Unlimited Internet: Discover Amazing Apps to Find Your Neighbor's Wi-Fi Password

Your connection dropped and you need internet? See in this post how to find out the neighbor's Wi-Fi password and thus stay connected!

Keep Reading

Discover the Disal consortium

With the Disal consortium, purchase cars of various models, with reduced installments and without interest. Learn here how it works and request yours!

Keep ReadingYou may also like

Casas Bahia Card or Atacadão Card: which one to choose?

Casas Bahia card or Atacadão card? Which card has the best value for money? Keep reading and discover these answers. Let's go!

Keep Reading

What is the PagBank credit card limit?

Did you know that the PagBank credit card limit can reach 100 thousand reais? See here how this limit works and what are the ways to consult it.

Keep Reading

Banco do Brasil real estate auction offers lots with up to 80% discount!

Banco do Brasil, in partnership with Lance no Leilão, is organizing a real estate auction with incredible offers for those who want to invest in the real estate market. With discounts of up to 80% and starting bids starting at R$15 thousand, the event will take place on March 30th. Learn more here!

Keep Reading