Cards

Discover the Sicoob Cabal Gold credit card

The Sicoob Cabal Gold card made for national purchases allows you to accumulate points and also have up to 40 days to start paying your invoice. Continue reading and check out all about it.

Advertisement

National card with exclusive points program

We all know that having a credit card is very important for your finances, as it makes it easier for you to access different products and services. And among so many options that exist, today you will learn more about the Sicoob Cabal Gold credit card.

This card allows you to keep your financial life stable and access very interesting benefits if you are a member of the cooperative.

| Annuity | not informed |

| minimum income | not informed |

| Flag | cabal |

| Roof | National |

| Benefits | Up to 40 days to pay the invoice Sicoob awards Withdrawals in the credit function |

How to apply for the Sicoob Cabal Gold card

See here how to apply for this card and take advantage of the exclusive points program.

In short, with it, you can make withdrawals in the credit function and you can request additional cards to use with whom you trust the most!

Therefore, in this article you will learn more about the Sicoob Cabal Gold credit card, its advantages and how to apply. Follow!

Main features of Sicoob Cabal Gold

First of all, the Sicoob Cabal Gold credit card has very interesting features for you to know. One of them is its points program where all purchases made on credit generate points that can be exchanged.

Thus, with each purchase made with the card, you can exchange the points for airline miles, products, more invoice credit, travel packages, among other benefits.

In addition, the card offers its users a longer period to start paying their bill. With the Sicoob Cabal Gold credit card, you can start paying within 40 days.

Another interesting feature of the card is that it allows you to pay your invoice in up to 12 installments and you can even make withdrawals using the credit function. This can be done on the Banco24Horas network or you can request withdrawals in installments at the cooperative.

Finally, the credit card allows you to enjoy its features with friends, co-workers or family members. Here you can order additional cards and choose the limit for each of them.

Who the card is for

In short, to have access to the Sicoob Cabal Gold credit card, you must be a Sicoob customer. As he belongs to a cooperative, only its members can access his credit card.

Therefore, it is important to check how to become a member, if you are not already, in order to apply for this card.

Is the Sicoob Cabal Gold credit card worth it?

Certainly knowing the pros and cons of a card is the best way to know if it is an option that fits your life.

Therefore, we separate below the main positive and negative points of the Sicoob Cabal Gold credit card for you to choose wisely.

Benefits

First, among the advantages of the Sicoob Cabal Gold card, we can highlight its points program, which allows you to always be earning when making purchases using the credit function.

In addition, we managed to find other advantages in their additional cards. In addition to being able to share the benefits of the card with another person, it is also possible to determine their credit limit and check the transactions made.

Finally, making withdrawals in installments using the credit function is also a great advantage of the card, which is rarely found in other options on the market.

Disadvantages

Despite the advantages, the Sicoob Cabal Gold credit card also has some negative points that should be considered before applying for the card.

The first is the fact that the card is only available to those who are members of the cooperative. Thus, those who do not have this association cannot access the same benefits.

In addition, in the card application process, a credit analysis is carried out to better understand your profile and thus approve the card. This process may end up not approving some people according to their financial behavior.

Finally, despite allowing withdrawals in installments, it is important to consider that these resources have built-in interest. Therefore, you will have access to the money, but you will have to pay more than the amount you withdraw.

How to make a Sicoob Cabal Gold credit card?

In summary, the Sicoob Cabal Gold credit card is a good option if you want to make domestic purchases and have access to some differentiated benefits that are not always found in other cards.

Therefore, if you are a member of the cooperative and would like to have access to this card, check in the post below how the card application process works in the main channels.

How to apply for the Sicoob Cabal Gold card

See here how to apply for this card and take advantage of the exclusive points program.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Protest Card

Proteste Card is an excellent option for negatives, which has cashback and more benefits. Click and find out how to order yours!

Keep Reading

Is it safe to borrow from Serasa eCred?

Do you want to know if it's safe to borrow from Serasa eCred? In it you will find personalized offers and your data will be protected. Look!

Keep Reading

How to prepare for IRS exams

Learn all about Federal Revenue contests and check out information about the selection process that will take place in 2022!

Keep ReadingYou may also like

Find out about CGD's personal credit

In need of a loan for health, training, travel or any other purpose? So, take the opportunity to discover the CGD multipurpose personal loan and see how to apply for one.

Keep Reading

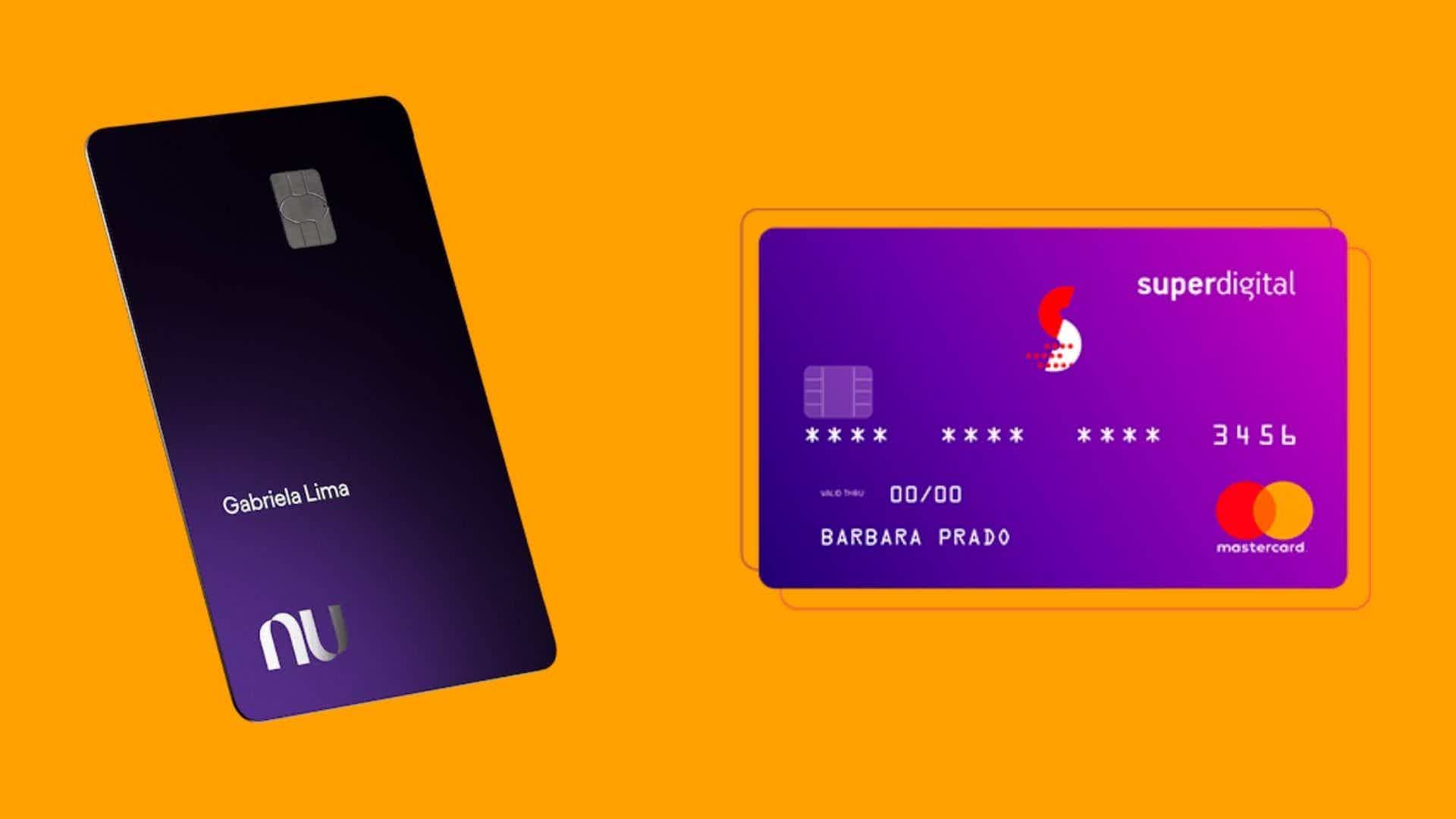

Nubank Ultraviolet Card or Superdigital Card: which is better?

Among the credit card options on the market, many offer exclusive advantages and varied conditions. Some are more demanding, and others not so much. In that case, what might be the best option: Nubank Ultraviolet card or Superdigital card? Find out here!

Keep Reading

Porto Seguro card or Caixa SIM card: which is better?

Choosing a card is not always easy, especially when you are in doubt between two products. For the decision to be good, it is important to look at several aspects, such as fees, benefits and more. Interested? Continue reading and check it out!

Keep Reading