Cards

Discover the Sicoob Cabal Classic credit card

The Sicoob Cabal Clássico credit card offers a long term payment for your bill, in addition to having additional cards and several exclusive benefits for you. Continue reading and learn more about him.

Advertisement

Install your invoice in up to 12 installments and pay within 40 days

If you are looking for a good credit card, which allows you to pay your purchases in several installments and also be able to request additional cards, the Sicoob Cabal Clássico credit card may be the option you are looking for!

This version of the Sicoob cards can offer you a lower annuity and a small minimum income, if compared to the other cooperative cards, since it is a simpler version. That way, it becomes more accessible to you!

| Annuity | not informed |

| minimum income | not informed |

| Flag | cabal |

| Roof | National |

| Benefits | Payment within 40 days additional cards Credit withdrawals in installments |

How to apply for the Sicoob Cabal Classic card

If you already know the card and want to apply, come and see how it is done!

But, to know if it really meets all your needs, it is essential to know the main characteristics of this card, its advantages and disadvantages and, above all, how to apply.

To find out about all this and much more, continue with us in this post and learn how this credit card can be a good solution for your financial life.

Main features of Sicoob Cabal Classic

First of all, the Sicoob Cabal Clássico credit card has great features for you to know. Here, we can start talking about your invoice payment term.

With the card, you can start paying within 40 days, giving you more flexibility when paying your bills.

In addition, it allows you to make withdrawals and installments in the credit function! So, when you go to a Banco24Horas network point, you can withdraw money even without having the debit balance, in addition to being able to pay your invoice in up to 12 installments.

Finally, the Sicoob Cabal Clássico credit card allows you to request additional cards to enjoy its benefits with other people!

Who the card is for

In summary, the Sicoob Cabal Clássico credit card is the ideal option for those who are members of a cooperative and do not receive high wages, but need a card with essential features to use on a daily basis.

In addition, the card is also highly recommended for those who do not travel often and, therefore, end up making more purchases in the national territory.

Is the Sicoob Cabal Classic credit card worth it?

One of the most important steps when getting to know a new card is knowing what its pros and cons are. Only then will you be able to know if it is the best option for your financial life.

Therefore, we separate below the positive and negative points of the Sicoob Cabal Classic credit card for you to know how to choose!

Benefits

Among the main advantages of the Sicoob Classic card, we can highlight its flexibility in defining the payment term for the card, where the user can pay within 40 days.

In addition, your additional cards also have the advantage of being able to determine the credit limit and check the transactions made, in order to have greater control over it.

Disadvantages

As much as the Sicoob Cabal Clássico credit card has great advantages, it also has some negative points that need to be known before applying for the card.

Therefore, one of its cons is that the card is not accepted in large countries outside of Latin America. As it uses the Cabal flag, it ends up being accepted only in Brazil, Argentina, Uruguay, Cuba and Paraguay.

In addition, there is also a downside to your installment withdrawals, as this feature has interest. Therefore, you will end up paying an amount more than the total that you made the withdrawal.

How to make a Sicoob Cabal Classic credit card?

In summary, the Sicoob Cabal Clássico credit card manages to offer interesting benefits to its users, in addition to being a very exclusive card for members of cooperatives.

Therefore, if you meet the credit card requirements and would like to apply for it, just check the post below for the step-by-step instructions for making this request!

How to apply for a Sicoob Cabal Classic card

Check here how the classic card application works and enjoy the benefits.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

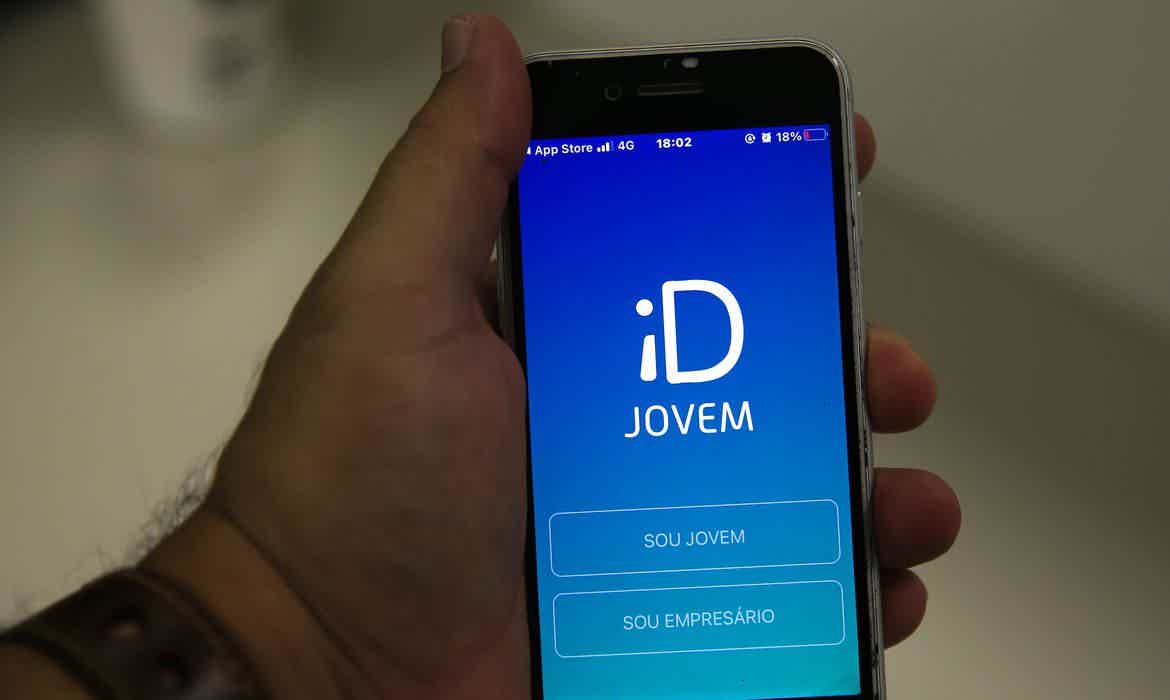

Meet ID Jovem

Find out how ID Jovem works, a Federal Government program for low-income youth between the ages of 15 and 29 registered at CadÚnico. Look!

Keep Reading

Dinheirama's financial monitoring program

The dinheirama financial monitoring program is designed to help people who do not know how to deal with money. Check out!

Keep Reading

What are the advantages of the payroll loan?

When it comes to payroll loan do you know what it is? How it works? How to get? What are the advantages? check it all out now!

Keep ReadingYou may also like

Discover the Caixa Elo Nanquim card

Do you want to have different experiences on your trips and accumulate points on your credit card bill? Caixa Elo Nanquim does this and much more for you. Continue reading and learn all about one of the best credit cards today!

Keep Reading

How to open a current account with Abanca Futures

At Abanca, you can subscribe to Conta Futuro through its app and then manage all your balances, statements, transfers and cards right there. See how to join this service in the post below.

Keep Reading

How to Apply for the Bahamas Card

Do you want to know how to apply for the Bahamas card and enjoy all the benefits of Clube Up? Read the article in full.

Keep Reading