Cards

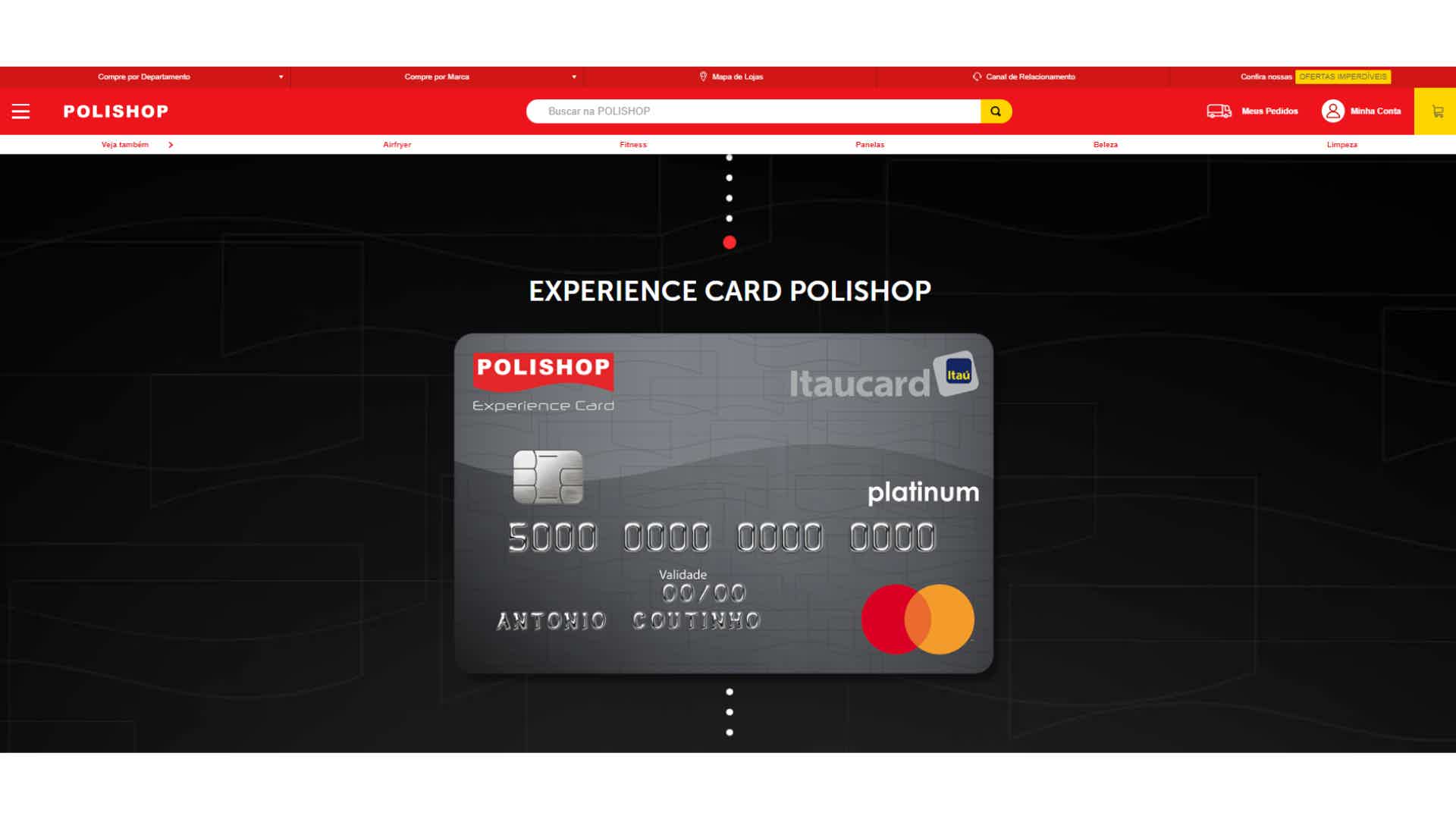

Discover the Polishop credit card

Discover the Polishop credit card, with an exclusive points program, installment payments on purchases at the brand's stores and the possibility of waiving the annual fee. Find out more about this option in the post below.

Advertisement

Polishop Card: exclusive installments and Mastercard Platinum benefits

With revenue of 1 billion reais per year, Polishop is one of the largest retailers in the country. It has certainly achieved this position through the innovation of its products. Furthermore, thinking about expanding its market, it invested in the Polishop credit card.

Through it, the company bet on customer loyalty, as it offers many benefits, such as a points program in which your purchases are transformed into a score that can be exchanged for discounts on products later.

Then you will learn about other benefits. So, keep reading and check it out!

How to apply for Polishop card

Apply online for the Polishop card and enjoy exclusive benefits, such as a points program, installments and the possibility of waiving the annuity.

How does the Polishop credit card work?

Firstly, the Polishop credit card has an annual fee of R$ 180.00 in the first year and R$ 360.00 in the second. But you can be exempt from this fee if you spend at least R$ 1,500.00 per month on your invoice.

Additionally, it requires a minimum income of R$ 800.00 to apply. However, credit approval depends on the status of your CPF, meaning restrictions may hinder your application.

Furthermore, order your card online. After that, approval is made and you can use the card to buy in any store, as it has an international Mastercard Platinum brand.

In short, Polishop customers also enjoy a points program, where each dollar is worth one point. This way, you can guarantee discounts on store products, as well as exclusive installments.

What is the Polishop credit card limit?

There is no standard pre-approved credit limit, meaning you must undergo a credit analysis. Therefore, you need to wait for the request process to complete to find out what your limit value is.

Is the Polishop credit card worth it?

Certainly, having a credit card with immediate approval, low annual fees and an international brand is interesting. However, how about being sure of the decision by knowing the advantages and disadvantages? So, check it out below.

Benefits

Among the main advantages of the Polishop credit card, we can highlight those mentioned below.

- National and international use;

- Online application process;

- Polishop points program;

- Mastercard Surprise Program;

- Up to 40 days to pay the invoice;

- Exemption from the annual fee if you spend at least R$ 1,500.00 per month;

- Exclusive installments in the brand’s stores;

- Benefits associated with the flag;

- Benefits associated with Itaucard;

- Between others.

It is worth noting that in the Polishop points program 5% of the value of your purchases in the brand's stores are transformed into points, as well as 1% of purchases in other establishments. Thus, it is possible to exchange the accumulated points for up to 30% discount on future purchases at Polishop.

Disadvantages

The main disadvantage is proof of minimum income, which can be a barrier for those who cannot prove it, such as, for example, the self-employed. Additionally, there is an annual fee charge, but you can get an exemption as we mentioned previously.

Therefore, it is essential that you carefully analyze the characteristics, advantages and disadvantages of the card before requesting it. This way, you will be sure you got a good deal.

How to get a Polishop credit card?

There are several ways to apply for the Polishop credit card. The main one is through the store page, for example. In this case, the customer is redirected to the Itaú website, where they complete the request by filling out the forms.

Furthermore, do you want to know more details about the application process? So, click on the recommended content below and find out!

How to apply for Polishop card

Apply online for the Polishop card and enjoy exclusive benefits, such as a points program, installments and the possibility of waiving the annuity.

Trending Topics

How to send resume to Cocoa Show? Check it out here

Find out how to send your resume to Cacau Show completely online and see what the main requirements are for job openings!

Keep Reading

LiberaCred financing: how it works

Find out about LiberaCred financing without bureaucracy or proof of income. Guarantee the motorcycle of your dreams by paying in installments until the entrance!

Keep Reading

All about the Proteste card, ideal for negatives

Have you heard about the Protest card? If not yet, then it's time to get to know one of the best cards for negatives. Know more!

Keep ReadingYou may also like

Discover the Porto Seguro account

Security is one of the key elements for those looking to open an account at an institution. In this sense, Porto Seguro offers a quality service and free insurance to its users. Come check out more information here.

Keep Reading

When does the fourteenth salary come out

Want to know when the tenth salary 2021 will be paid? Just continue reading. Here you will find all the information on this subject, come with us!

Keep Reading

Nubank or Inter account: which is the best digital account?

Choosing a good digital account to take care of and manage our finances can be a difficult task, as we currently have so many options. However, two alternatives that bring many benefits to customers and are zero annuity and abusive fees are the Nubank or Inter account. Do you want to know more about the two accounts and a comparison of their main features? Continue with us throughout the post!

Keep Reading