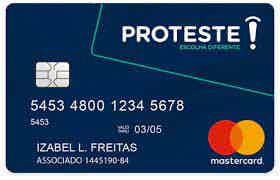

Cards

All about the Proteste card, ideal for negatives

Have you heard about the Protest card? If not yet, then it's time to get to know one of the best cards for negatives. Know more!

Advertisement

Protest Card: one of the best for negatives

For those who are negative and can't get a credit card, know that your problems have been solved with the Proteste card. Considered one of the best on the market for those with CPF restriction, its approval is done without consultation with the SPC or SERASA, being perfect for those who find it difficult to get credit. Let's meet him?!

| Minimum Income | not required |

| Annuity | No annuity |

| Flag | MasterCard |

| Roof | National and international |

| Benefits | No credit analysis or consultation with SPC or Serasa Service Recharges Earn Points according to your purchases. Cashback and discount at partner stores Withdrawals on the Banco24Horas network |

| issuer | protest |

How to apply for the protest card

Learn all the steps to apply for the Proteste card, one of the best for negatives.

Find out who Protest is

Before you learn more about the Proteste card, you need to know the institution behind it. For those who don't know it, Proteste is a non-profit, non-partisan and independent association, which has been working for over 20 years in the defense of consumer rights.

Founded in 2001, Proteste supports Brazilians in their daily choices of purchasing and contracting services, providing the best consumer solutions for the population, supporting the market in correcting failures and participating in the improvement of Brazilian legislation. Currently, the association has partnerships with more than 100 companies, including insurance companies, e-commerce sites, cell phone operators and other organizations.

It should be noted that all Proteste partner companies undergo a careful selection process and continuous evaluation. If, at any time, one of them fails to meet the consumer's needs, the partnership is immediately terminated. The association's priority will always be you.

With the mission of promoting balance between consumers, suppliers and regulatory bodies, Proteste contributes to the improvement of consumer relations in society. To this end, the association has specialists in consumer protection who advise them on their rights and intervene with companies in the search for the best solution to their consumption problems, with more than 90% of cases being resolved. Absolute success, isn't it?!

Discover the protest card

As you can see, Proteste is, without a doubt, a very serious and respected association in the market. But that's not for nothing! After all, all its products and services have unquestionable qualities and benefits, starting with the Proteste card.

Exclusive only to the institution's associates, the Proteste card is, in fact, a prepaid card and it is not a conventional credit card, which means that you need to deposit an amount on it to use it in the credit function. In practice, it works as follows: if you want to make a purchase of R$500.00, you will first have to deposit that amount in your card account, either by bank slip or by TED/DOC. Once this is done, then you can pay for your purchase using the cash credit option.

Due to this characteristic, the Proteste card cannot be used for purchases in installments, as it is only possible to purchase while there is an available balance. However, attention! Unfortunately, there are card recharge limits, which respect the categories of each service, as described below.

- Light category card: balance cannot be greater than R$ 5,000.00.

- Standard category card: balance cannot be greater than R$ 10,000.00.

The limit is informed when the customer is carrying out the recharge and, if they want to increase it, it is possible to contact the company to make the request. That is, there is a fully possible solution to your problem – you just need to want to solve it!

Advantages and benefits of the Proteste card

As we have already mentioned, the Proteste card is a prepaid card. Just because it has this feature, it has several advantages, including the fact that it does not have bills and interest to pay, which is excellent for those who lose track and end up spending more than their budget. But there are even more benefits! Check it out.

1. Greater financial control

Continuing the conversation, one of the great advantages of the Proteste card is that, as it is prepaid, it offers greater financial control to its users. As you only spend the amount you deposit in it, there is no possibility of spending more than your balance. Consequently, it is impossible to blow your budget and, with that, get into debt.

2. No SPC or Serasa consultation

If the Proteste card is a prepaid card, where it is possible to spend only the balance you deposit, with the bank not being able to grant you credit and, therefore, running the risk of default, then why check your name at the SPC or Serasa, right? Yeah, there's no reason! Precisely for this reason, the Proteste card has become a great ally for those with CPF restrictions.

3. No annual fee

Another huge advantage of the Proteste card is that there is no annual fee to have it. That is, there is no annoying charge that exists in virtually every conventional credit card. However, you need to pay attention to one detail: the Proteste card is only available to members of the non-profit institution. So, despite the card's free annual fee, the customer must be associated with Proteste, paying a subscription from R$19.90 per month, charged quarterly.

4. Discounts at partner stores

One of the requirements to have the Proteste card is to be associated with the institution, correct? Well, this, in turn, brings several advantages, including discounts at partner stores. Proteste has a benefits club with more than 400 partner establishments, which offer discounts on partner health services: pharmacies, exams and medical appointments.

5. Cashback program

Have you ever thought about having a card that, in addition to not charging you an annuity, still gives you cash back when you use it? This is the case with the Protest! To receive the cashback, you must use the card at the stores associated with Circuito VoltaQUI!. The cashback amount is automatically accumulated and varies according to the company where the purchase was made.

Cashback is credited to the card each time the accumulated amount reaches R$ 30.00 and can be used for new purchases, withdrawals or whatever the customer prefers. According to Proteste, there are more than 15 establishments participating in the program and, to find out which ones they are and the cashback value of each one, you need to go to the card's website or application.

How to apply for your protest card?

As we have seen, there are advantages and disadvantages to owning a Proteste card and, therefore, there is no shortage of reasons to request one. To find out more about how the process of joining Proteste and requesting your card works, just click on the button below and you will have all your doubts cleared up. Good reading!

How to apply for the protest card

Learn all the steps to apply for the Proteste card, one of the best for negatives.

About the author / Priscilla de Cassia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Online Neon Card: no annual fee and elastic limit

Find out everything about the Neon card online and see the main features that made it the number 1 option for one and a half million Brazilians!

Keep Reading

KFC Careers: find the ideal job for you!

KFC is the kind of restaurant franchise you'll want to work for! Come and find out more about how to get it.

Keep Reading

Discover the C&C credit card

The C&C credit card is one of the products of the Casa e Construção C&C store, which allows its customers to benefit from purchases on the network.

Keep ReadingYou may also like

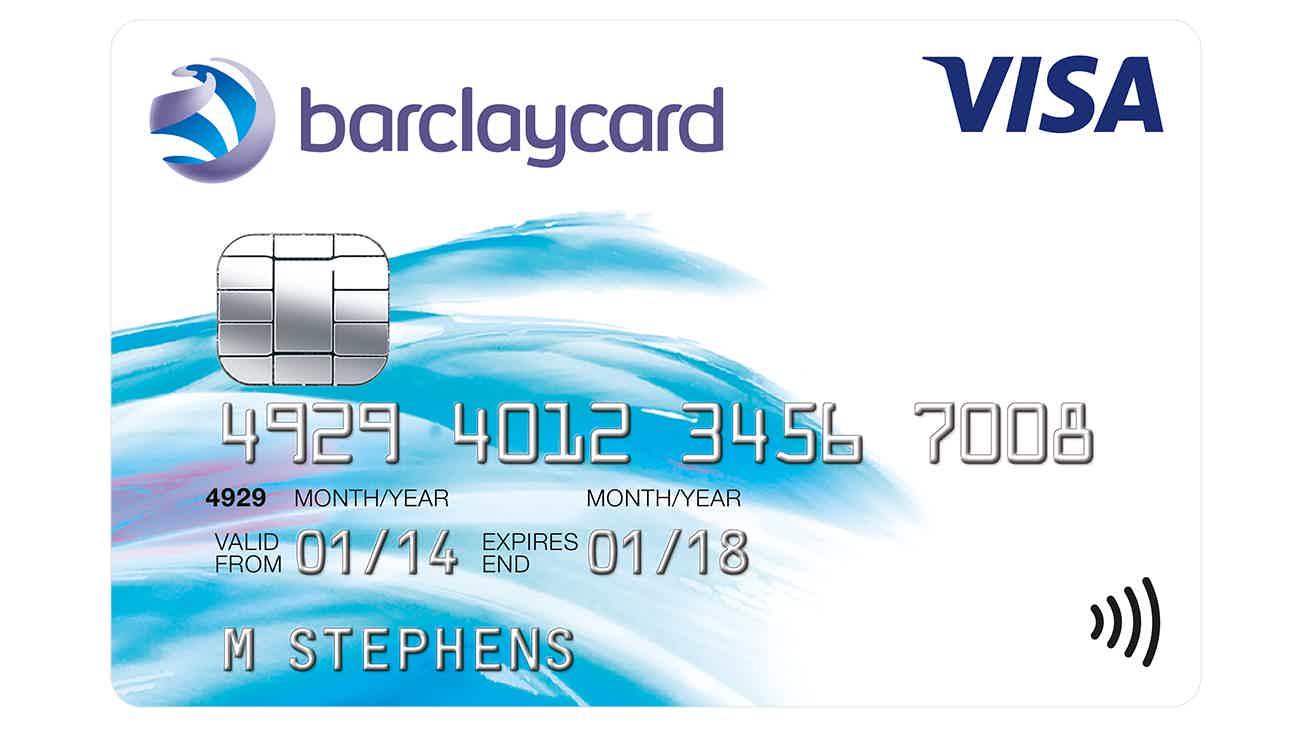

How to apply for a Barclaycard

Barclays bank has many years of tradition in the United Kingdom. Renowned, it has been modernized to improve the lives of its customers. Want to be a part? Find out and see how to apply for the Barclaycard here. A card with no annual fee, safe and practical.

Keep Reading

Discover the current account Abanca Minimum Services

Looking for an account for you that doesn't have high commissions and still gives you access to a debit card? So, take the opportunity to get to know the Abanca Minimum Services account, which offers everything you need. Find out everything in the post below!

Keep Reading

How to apply for the Alfa Financeira loan

The Alfa Financeira payroll loan can be a great option for you. Want to know how to order it? So, read on and check it out!

Keep Reading