Cards

Discover the Activo Bank credit card

The Activo Bank credit card offers a series of advantages. Know what they are and see if it's worth asking for.

Advertisement

Activo Bank credit card

The Activo Bank credit card belongs to a fintech of the same name which, in turn, belongs to the Portuguese bank Millennium. Learn more about him today.

You can get this card without leaving your home, over the internet. It has a Visa flag, is international and also offers a series of benefits. And all this without charging operating fees. Therefore, free of charge!

Want to get to know this card better? So keep reading to see all the details of it. So you can see if it's a good fit for you.

How to apply for the Activo Bank card

Activo Bank is the name of a Portuguese institution that offers numerous financial services. For example, checking account and credit cards.

How does the Activo Bank credit card work?

The credit card is available to anyone who has a fintech digital account. With this, it is possible to conquer both a checking account and a debit and credit card.

In this way, the card works normally. Since it has the Visa International flag, it allows purchases worldwide. Incidentally, they can be in person or online, in cash or in installments. See, then, how many facilities this card has.

However, like every card it has its advantages and disadvantages. So, to find out if it was made for you, be sure to keep reading. Check the positive and negative points in the following items and draw your conclusion.

What is the Activo Bank credit card limit?

Like most other types of credit card, it has a variable limit. That is, the amount that the bank releases will depend on each customer. Therefore, some can be approved with high values, while others not so much.

Thus, it is not possible to say right away what value the customer will have available. This is only available after the application, as well as the analysis of the application and its eventual approval.

Is the Activo Bank credit card worth it?

As stated above, the Activo Bank card has negative and positive points. In this way, the answer to this question will vary according to what you are looking for, with your characteristics and needs.

See, then, what are the highs and lows of this Portuguese fintech card. With that, you can conclude whether or not it is a good alternative for your case.

free annuity

The credit card does not charge operating fees. With this, the annuity is waived. This allows you to access the digital account, as well as debit and credit, for free.

Benefits at partner establishments

Like many banks and fintechs, Activo Bank also has many partnerships. They, in turn, translate into advantages for consumers. For example, you get 01 ticket for a companion whenever you go to NOS cinemas.

Points and Cashback program

The Portuguese credit card has an Activo+ points program. It offers 01 point for every 10 euros spent on the card. With this you accumulate a score and, with it, get discounts and advantages in partner stores. Among the main ones are Zara and FNAC.

In addition, Activo's credit card has a cashback program. That is, "cash back". That way, you receive part of the expenses on the invoice as a bonus.

Visa International Flag

The Activo Bank credit card has the Visa International flag. This is one of the most comprehensive flags in the world. Thus, those who have this card can make purchases on the internet and in person all over the world.

Exclusive for those who have a Portuguese Tax Identification Number (NIF)

On the other hand, it is impossible not to mention that the card is exclusive to those who have a Portuguese Tax Identification Number (NIF). Therefore, it is only available to those who live in Portugal or have Portuguese citizenship.

That is, Brazilians who live in Portugal or who have dual citizenship, one of which being Portuguese, can apply for it. Otherwise, it is not presented to Brazilians, being exclusive to these two cases.

How to make an Activo Bank credit card?

To make the Activo Bank card, you just need to access the internet banking or the institution's application. So, you need to open an account or, if you already have one, go directly to apply for your card.

How to apply for the Activo Bank card

Activo Bank is the name of a Portuguese institution that offers numerous financial services. For example, checking account and credit cards.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out if being an Avon reseller is for you

Understand how simple it is to be an Avon reseller and earn extra income at the end of the month. Check here how to register and enjoy the benefits.

Keep Reading

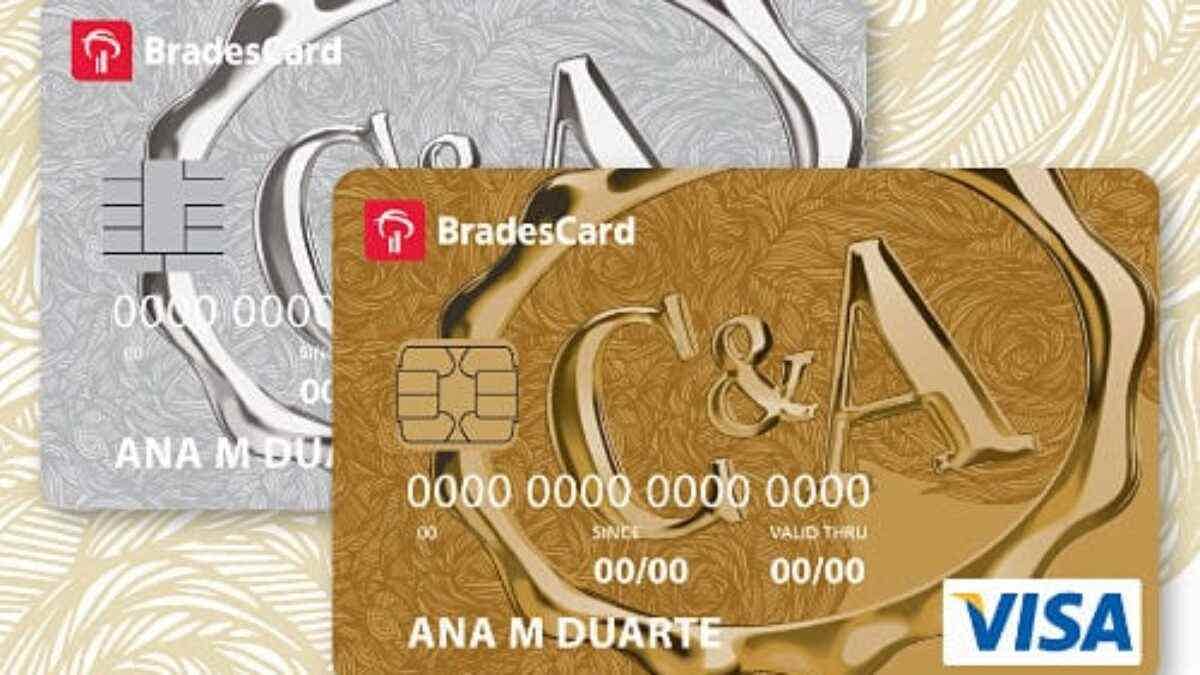

CEA 2021 Card Review

Check out our CEA card review and discover its facilities, exclusive discounts, as well as how to apply for one. Check out!

Keep Reading

5 loans without SPC/SERASA consultation

Yes, there are banks that make loans without consultation with the SPC/SERASA, for you who are negative. From Caixa to Banco Pan, find out more!

Keep ReadingYou may also like

Accelerate your journey as a driver: discover the essential apps to become a skilled driver

Learn-to-drive apps offer a convenient and affordable way to acquire driving skills. With interactive features and progress tracking, these apps are an effective tool for becoming a confident and safe driver.

Keep Reading

Right Agreement: negotiate Santander debts

Do you have outstanding debts with Banco Santander? Don't despair, this can be resolved! Find out here how the Agreement Right platform can help you stay up to date with your finances.

Keep Reading

Porto Seguro card or Caixa Mulher card: which one is better?

The Porto Seguro card is offered by the insurance company of the same name. Caixa Mulher, on the other hand, is created especially for women to gain financial autonomy. Confused between the two models? Read today's article and check it out!

Keep Reading