Cards

How to apply for an Activo Bank card

Do you know the Activo Bank card? It waives the annual fee, has a points and cashback program and other advantages. See how to get it!

Advertisement

Active Bank Card

The Activo Bank card is an option that belongs to a Portuguese fintech. However, it offers, in addition to credit and debit options, a digital account. Also, today, learn how to apply for it.

Step by step on how to apply for the Activo Bank card

First, there are several ways to apply for the card! So, see below how to apply and enjoy all the benefits.

Order online

First, you can apply for the card on the website of the Portuguese financial institution. For this, enter the fintech page. Then, in the menu at the top of the screen, click on “Cards” and then on “Credit Card”.

Then click on “Order yours”. There will be a page redirect, please wait. However, if you already have an Activo Bank account, login with your code and password.

However, otherwise, click on “Open Account”, a process that takes only 15 minutes. With the account open, within internet banking, ask for your credit card.

Request via phone

Likewise, you can request your Activo Bank card over the phone. However, just call the telephone switchboard.

However, it is available from Monday to Friday between 8am and 10pm, considering the Portuguese time zone, of course. So look at the number:

- 210 030 700.

Therefore, within the same hours you can request assistance via Skype, whose contact is Activo Bank Simplifica.

Request by app

Finally, you can also apply for your card through the institution's application. To do this, download and install the app. Then log in or click “Open Account”.

Then, with the account open and the login done, look for the Cards option in the menu. Then request yours and wait for the answer!

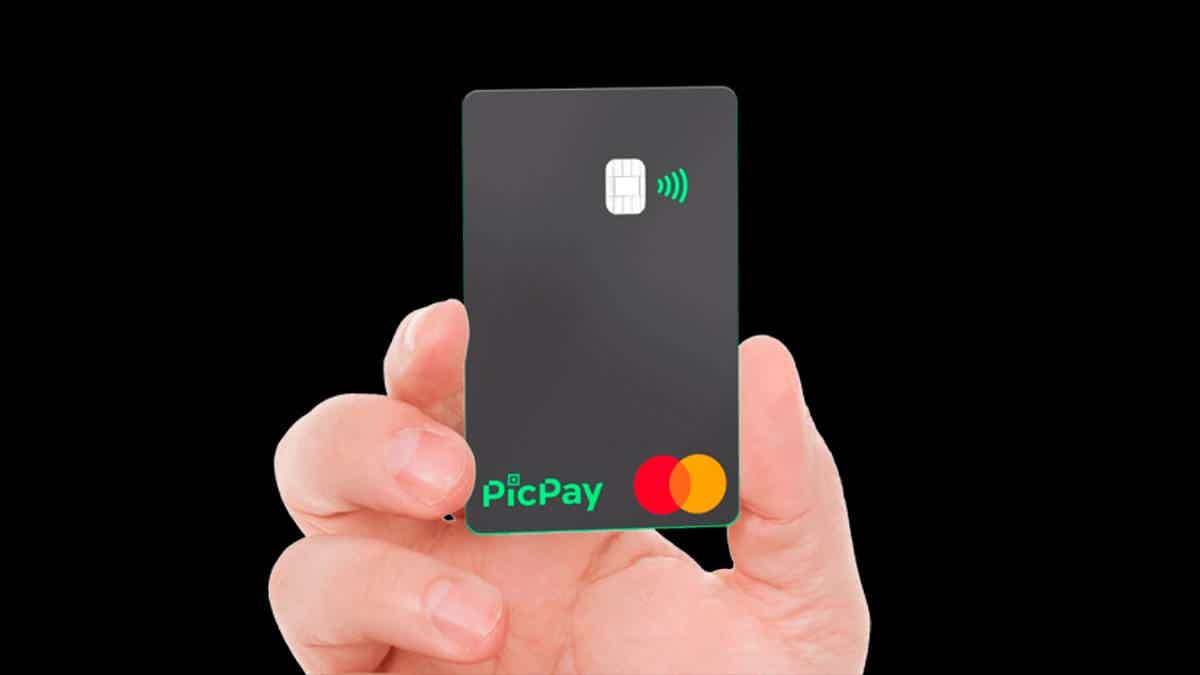

PicPay card or Activo Bank: which one to choose?

Still in doubt about which card to order? So, be sure to check the table below. In this way, you compare the Activo Bank card with another very popular option, the PicPay Card:

| PicPay Card | Asset Bank | |

| Minimum Income | R$ 800 | not informed |

| Annuity | free | free |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Exclusive promotions and discounts, Cashback at establishments, Mastercard Surprise program | Promotions at partner establishments, cashback, Activo+ program, |

How to apply for the picpay card

The PicPay credit card is a product PicPay is a fintech created in 2012 in Vitória, Espírito Santo. See more here!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out now all about the Petrobras card

Petrobras, in partnership with Banco do Brasil, launched its credit card, which is free of fees and annuities. Know the card now.

Keep Reading

Secure borrowed money: how to get it?

The online loan came to simplify your life and optimize your time. Want tips on how to get personal credit online? Check out!

Keep Reading

Geru loan online: personal credit without bureaucracy

Check out how the Geru loan online works and how you can access credit with the best conditions without leaving home!

Keep ReadingYou may also like

Discover the Santander Business Credit Card

The Santander Business Credit Card offers competitive rates, generous limits and benefits to boost the success of your business. Request now and transform your business finances.

Keep Reading

Find out what cryptogames are and how to earn money playing!

Now it is possible to earn a lot of money having fun with online games! Cryptogames offer digital coins through play-to-earn mode. But, be careful when investing in this world so you don't fall for scams! Learn more here.

Keep Reading

How to increase Bahamas card limit?

Discover everything about how to increase your Bahamas card limit and enjoy it with comfort and practicality. It's a simple, easy process and can be 100% online, hassle free.

Keep Reading