Cards

Comparison of the Casas Bahia card to other options in detail

The Casas Bahia card offers a program of benefits, discounts and a pre-approved limit. But, if you are in doubt, see a detailed comparison with similar good ones: Americanas and Magalu.

Advertisement

Casas Bahia, Americanas or Magalu card?

If none of the options in our Comparison suit you, go to your email box and look for Confirm your registration. You will find instructions to increase your chances of approval on your next application.

But if you are not yet subscribed to our newsletter, click here to register and start our Quiz. So you will find out which card recommendation is best for you.

Casas Bahia Card

| minimum income | R$788.00 reais |

| Annuity | R$167.88 reais for the holder and R$68.88 reais for additional cards. |

| Flag | Visa or Mastercard |

| Roof | National |

| Benefits | 10% discount on first purchase, 50% at Cinemark, among other exclusives. |

The Casas Bahia card is an option created by the retail chain, which offers good benefits such as discounts and different payment methods. In addition, you can buy with an initial limit of 2,000 reais to spend at Casas Bahia chains. By the way, you also get 10% off your first purchase with the card.

Thus, you can buy at a discount and enjoy promotions in more than 720 stores across Brazil. And all this with a card created in partnership with Banco Bradesco, which brings more security to customers.

So, if you are interested and want to order yours, just click below:

How to apply for the Casas Bahia card

The Casas Bahia card gives you a 10% discount on your first purchase, 3 insurances, and several other offers! Want to know how to order it? Read on!

Americans

| minimum income | Under credit analysis |

| Annuity | 12x of R$ 13.08 |

| Flag | Visa/Mastercard |

| Roof | National/International |

| Benefits | Exclusive discounts and offers in American stores Additional credit for installment purchases at Americanas stores |

Because the Americanas card has a series of good benefits and advantages for customers. For example, you can count on exclusive discounts and offers on American and partner networks. In addition, there is still a cashback program, where you buy and earn money back for your next purchases.

In fact, you can choose between Visa or Mastercard flags, and National or International card models. So you can have a personalized card for your needs. So, if you are interested and want to order yours, just click below:

How to apply for the Americanas card

In this quick article, you will find out exactly how to order your Americanas card in a practical way.

Magalu card

| minimum income | R$800 |

| Annuity | Luiza Presencial Card 12x R$11.99 or R$143.88 at sight. |

| Flag | Mastercard/Visa |

| Roof | International |

| Benefits | Exclusive offers and installments up to 24x |

The Magalu card is a financial product created to facilitate purchases by its customers both in physical stores and online stores. In addition, you can enjoy exclusive discounts and offers both in the Magazine Luiza network and in partners such as Época Cosméticos, Netshoes and Zattini.

Incidentally, it also has discounts at the Magazine Luiza Offers Club. Thus, it has all the advantages of a card with the Visa or Mastercard brand, which offers annuity exemption in the virtual version and International coverage.

So, if you feel like ordering one for yourself, just click below:

How to apply for the Magalu card?

Find out right now how you can apply for the Magazine Luiza card in a simple and hassle-free way, the process can be 100% online.

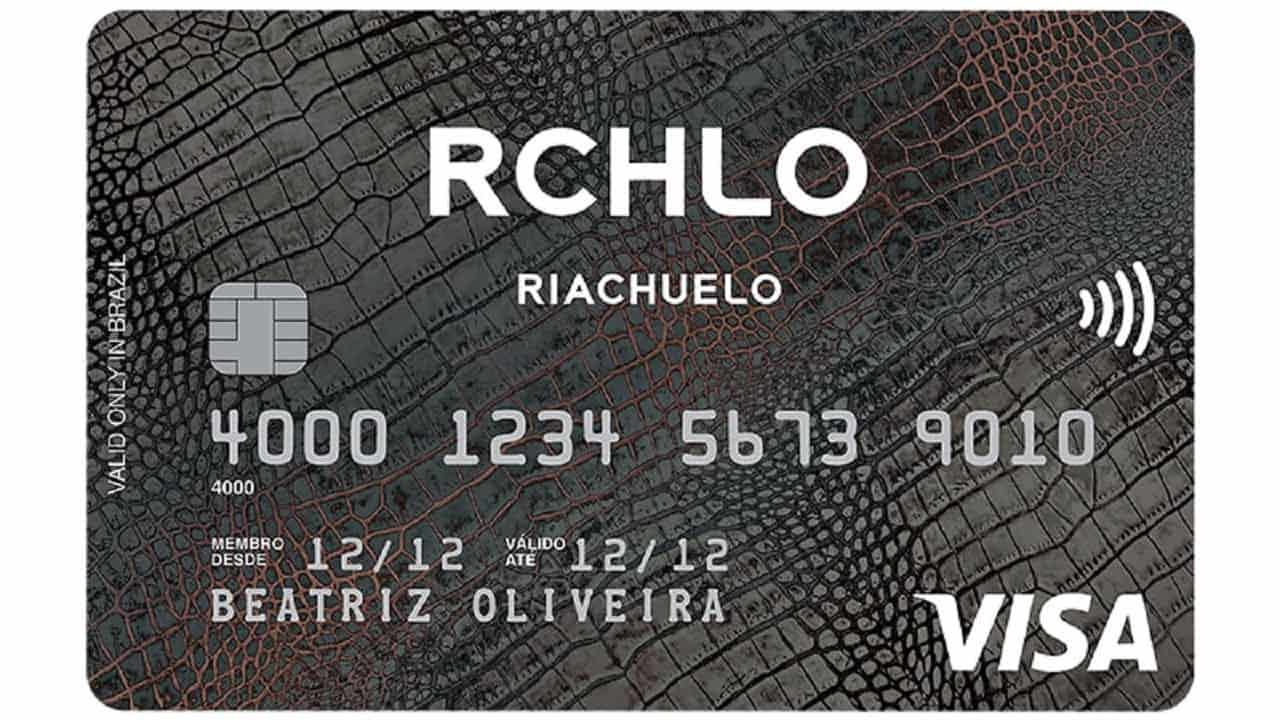

But, if you are still in doubt and want to know more about a fourth option, how about the Riachuelo card? Because it also offers exclusive discounts on the retail network, in addition to payment facilities. So click below and learn more about it and how to order yours.

How to apply for your Riachuelo credit card

Discover in this article some features of the Riachuelo card and how to request it step by step in a simple way and 100% online.

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Unicred Gold credit card: what is Unicred Gold?

The Unicred Gold card has a points program, international coverage, Visa brand and several other advantages. Check it out here!

Keep Reading

How to apply for the Caixa Elo Diners Club card

Do you want a credit card with exclusive privileges? So, learn here how to apply for the Caixa Elo Diners Club card.

Keep Reading

Real Estate Credit Bank of Brasilia: what is it?

Up to 420 months to pay and the lowest rates on the market. These are just some of the advantages of BRB real estate credit. Check out!

Keep ReadingYou may also like

Atacadão Card or Will Bank Card: which is better?

With the variety of cards available in the market today, choosing one of them has become increasingly difficult. In this sense, checking the comparisons can be the best way to see which one matches your profile the most. So, check now which card is better, Atacadão or Will Bank.

Keep Reading

Anniversary withdrawal: what is it and how to join?

The birthday withdrawal is a benefit that every worker is entitled to, annually, in the month of their birthday. In addition, it is possible to anticipate the withdrawal of some installments of the birthday withdrawal by means of a loan. To find out more, just continue reading.

Keep Reading

How to apply for Itaú university credit

Itaú university credit offers more comfort and ease for everyone who wants to start or complete their higher education studies, such as the payment of financing in up to 12 months. To find out how to apply, read on!

Keep Reading