loans

How to apply for the KeyCash loan

KeyCash loan can help you improve your business. For this, it facilitates the contracting of credit, in addition to offering a great payment term. Your request is completely online and secure. Check more here!

Advertisement

KeyCash MEI: simplified hiring and 240 months to pay

Well, if you are thinking of entering the world of micro, small and medium-sized entrepreneurs, then the KeyCash loan can help you! Whether to renovate your establishment, pay your employees or even to modernize your production line. This line of credit can help you keep your business stable.

So, do you want to know how to take out the KeyCash loan? Well check it out here!

Order online

Firstly, the KeyCash loan aims at practicality and speed when it comes to getting extra money. That is, its proposal is to facilitate the process, which can be done quickly and safely, without you having to leave your home.

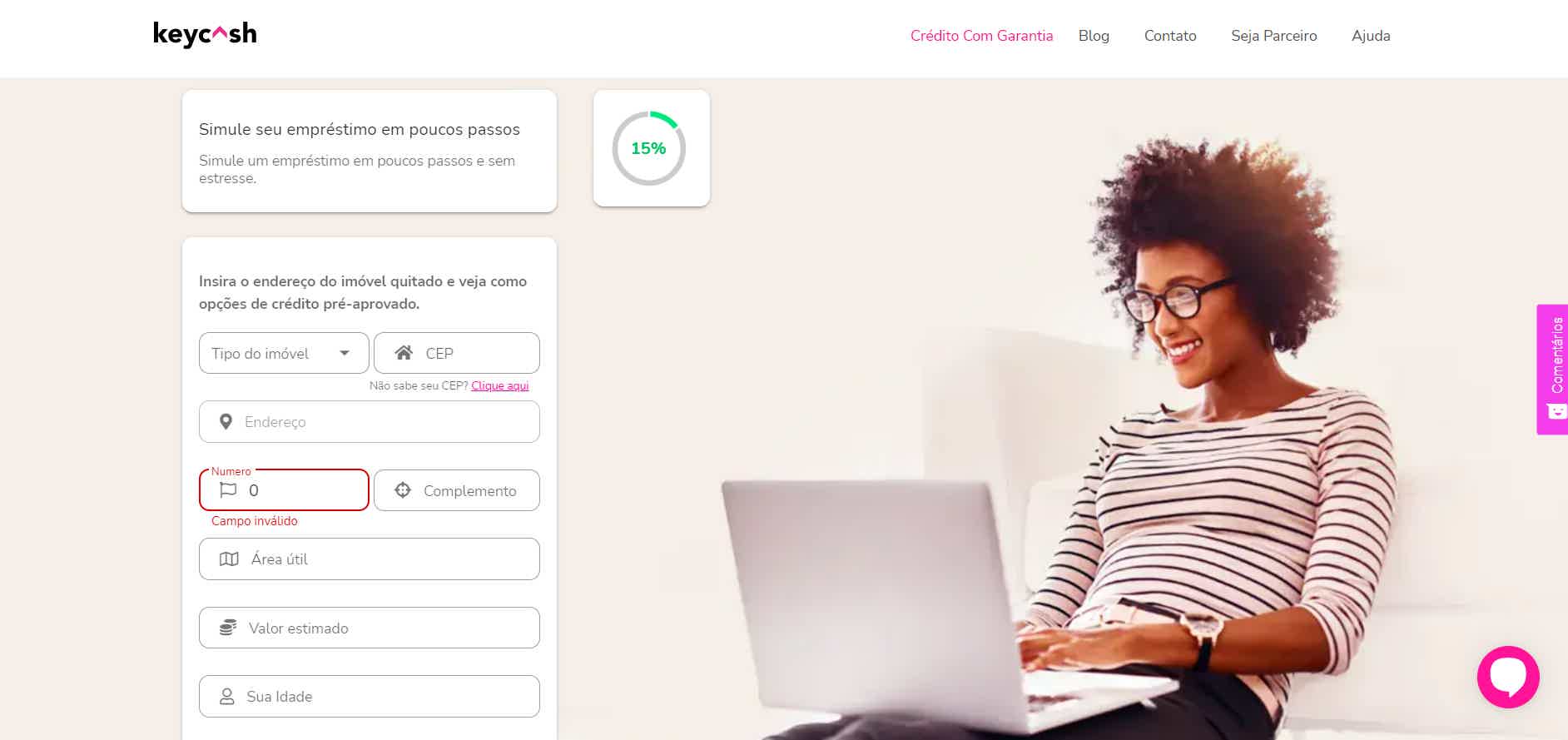

First of all, you must access the official website of the finance company and carry out your credit simulation. Because there you say how much you need and how long you want to pay off your debt.

Then you must analyze the result and choose the best payment terms. After that, you must apply for the credit and wait for the financial proposal. By the way, it is at this stage that you must inform the address and other information of the paid property that you will offer as loan guarantee.

So, if you approve the proposal sent by KeyCash, you must wait for the contract to be sent. You will sign the contract digitally. Therefore, there is no need to leave the house, everything is done quietly and safely in the comfort of your home.

Then, you must wait for the amount to be released, which will be available in the informed account. See how simple it is?

Request via phone

So, unfortunately, it is not possible to make the loan over the phone. To join, you must access the official KeyCash website and follow the steps. But if you need to clear up doubts about the process or the credit, just send a message to the company's WhatsApp whose number is 55 11 97205 2083.

Request by app

Well, the finance company does not have an application. But you can apply for KeyCash loan through your cell phone. That is, you just need to access the financial website through your smartphone and make your credit request.

Cash loan or KeyCash loan: which one to choose?

However, you are still in doubt about which loan best suits your financial needs. So check out our content below with more loan options for you.

So, both Caixa loan and KeyCash loan offer lower interest rates. In addition, both payment terms are longer and you can use the amount as you wish. Check out more features below.

| Box | keycash | |

| Minimum Income | not informed | not informed |

| Interest rate | From 0.83% per month | From 0.82% per month |

| Deadline to pay | Up to 60 months | Up to 240 months |

| Where to use the credit | As you wish | As you wish |

| Benefits | payment flexibility Possibility of pre- or post-fixed interest Freedom to use credit | Credit can be used as you wish low interest rates Online process |

How to apply for a Business Loan

With the Caixa Empresarial loan, you can expand your business and strengthen your cash flow. All this with up to 60 months to pay. Find out how to apply here

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Santander SX Card or Pan Card: which one to choose?

The Santander SX card or Pan Card are credit card options for those looking for practicality and good offers and discounts when using the card!

Keep Reading

How to apply for the Caixa Elo Nanquim card

In this article you will find out how to apply for your Caixa Elo Nanquim card with international coverage and exclusive benefits from Caixa. Check out!

Keep ReadingYou may also like

How to apply for the Mateuscard

Do you live in the north or northeast and are looking for a card for routine purchases? With the Mateuscard card you can pay your purchases in up to 24 installments. Learn more below!

Keep Reading

How to apply for the Activo Bank Card

Activo Bank card offers a series of advantages and exemption from annuity! Click and check out how to apply for your credit card!

Keep Reading

How to apply for the Santander car consortium

After all, do you know how to enjoy the benefits of the Santander car consortium? We explain the step by step here, see!

Keep Reading