Cards

How to apply for VestCasa card

The VestCasa card is mainly recommended for customers of this chain of stores. But if you are interested in obtaining an international card, that is, accepted in national and international establishments, analyzing this option is a great idea!

Advertisement

VestCasa Card

Incidentally, the VestCasa card was created especially for customers of this chain of stores.

In this way, it is possible to buy in physical or digital stores, with many benefits and exclusive offers.

This card is international, that is, it allows you to make purchases in national and international establishments.

In addition, the model has contactless technology, which allows transactions by bringing the card closer to the machine.

The card limit is up to R $3,500.00, which is assigned to the consumer after a credit analysis. It is worth noting that purchases can be paid in up to 12 interest-free installments!

Also, before applying for a credit card, consider these factors, especially if you are a loyal customer of the store. However, it is also important to compare the options being offered in the market.

Step by step to apply for the VestCasa card

Order online

The process to apply for the credit card can be done completely online!

To do this, simply access the official website of the network and select the option “Order now here”. However, after entering the code, as well as your CPF data, select “Send”.

Furthermore, as soon as you fill in all the necessary data, your request will be sent and you just have to wait until the analysis is completed.

However, if the answer is positive, the physical card will be sent to your residence.

Request in person

One of the alternatives to request the card is to go to one of the VestCasa units in person.

To do this, just have the following documents in hand: RG, CPF, proof of residence and proof of income.

However, with the documentation in hand, just request registration from an attendant and wait until the credit analysis is completed.

Leroy card or VestCasa card: which one to choose?

Finally, if you are having doubts about choosing the Leroy or VestCasa card, we have created a comparison table so that you understand the advantages of each one.

So, see below!

| VestCasa | leroy | |

| Minimum Income | not required | not required |

| Annuity | 12x of R $19.90 | 12x of R $8.25 |

| Roof | International | International |

| Benefits | Discount club / Points in the loyalty program. | Mastercard Surprise Program. |

How to apply for the Leroy card

The Leroy card is ideal for customers of the Leroy Merlin network and Mastercard partners. So check out how you can apply for this card!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Can someone with a dirty name get a Pan card?

Can someone with a dirty name get a Pan card? Find out how this bank releases credit and see if you have a chance of being approved!

Keep Reading

Booking app: find out how to buy cheap tickets and accommodation

See how to download the Booking app, in addition to information about how it works and its pros and cons.

Keep Reading

Superdigital Card or Neon Card: which one to choose?

The Superdigital card or Neon Card are very different cards, but they seek to offer quality services! Check out!

Keep ReadingYou may also like

How to apply for the Credluz loan

Are you negative and need to pay your debts? With the Credluz loan, you can catch up on your bills and still have 24 months to pay. Want to know how to order yours? Read this post and check it out!

Keep Reading

Oney loan: how it works

Do you want to know a little about how the Oney loan works? Read the post below and check out some of the most important information.

Keep Reading

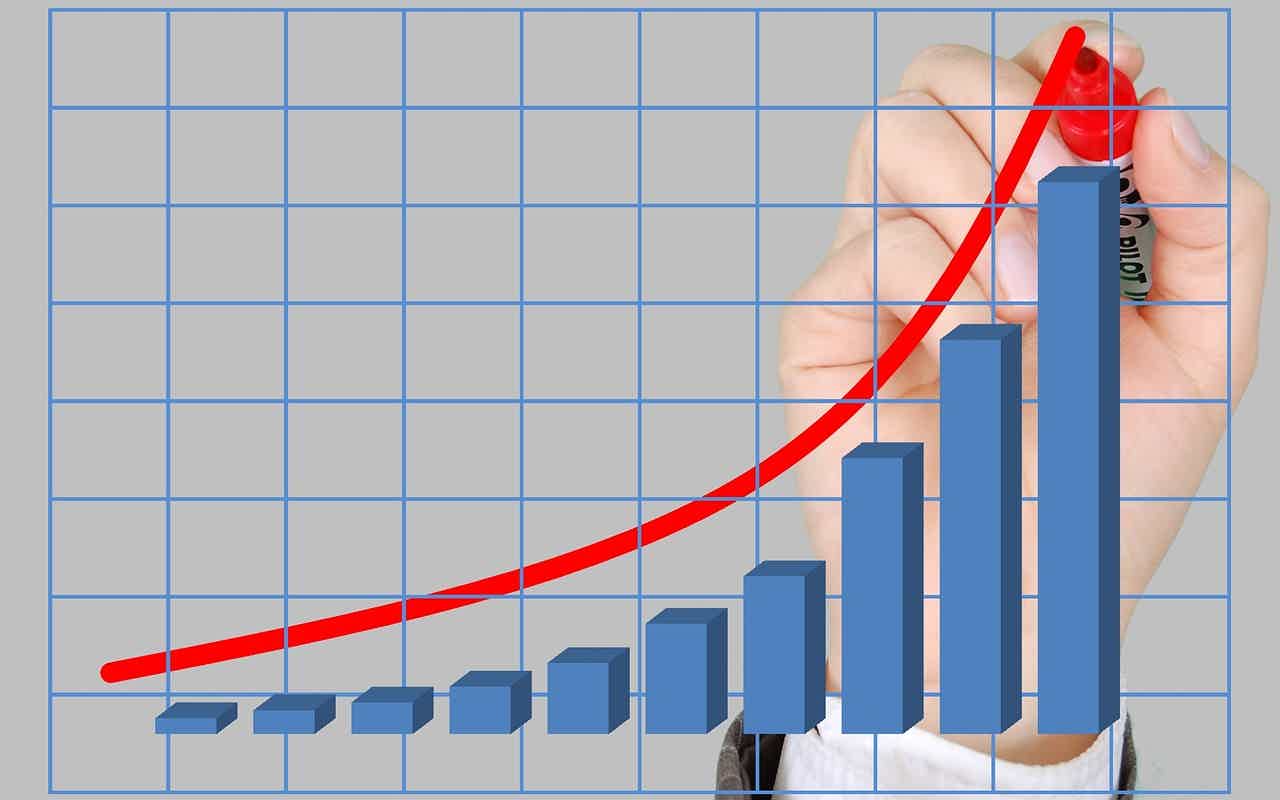

What is the most profitable and secure financial application?

Do you want to know which are the safest financial applications with the highest yields to start making a profit today? So check it out!

Keep Reading