Cards

How to apply for a PagSeguro credit card

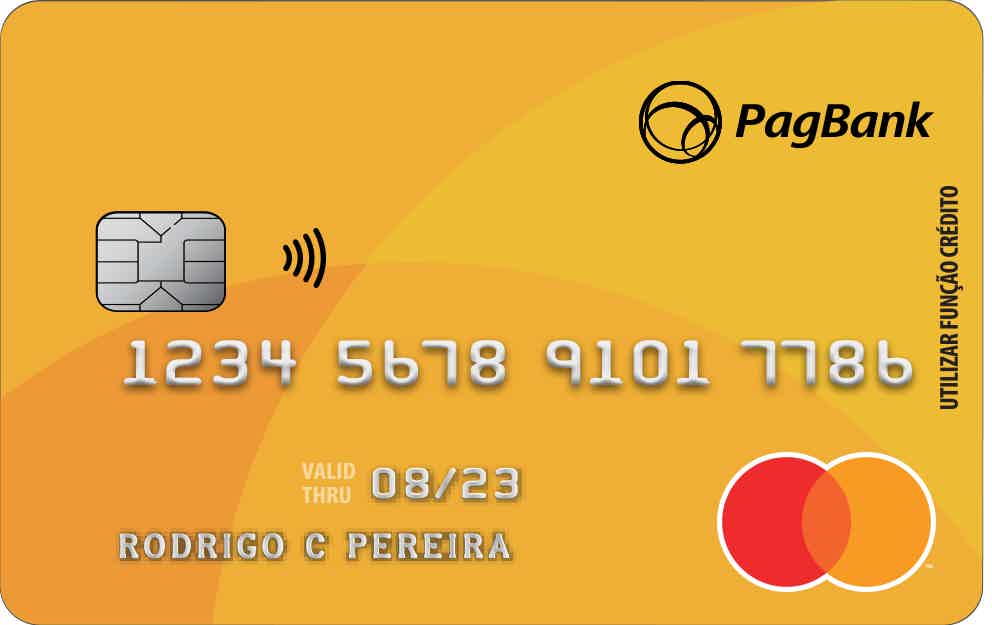

The PagSeguro card is one of the types of credit provided by the financial institution. First of all, the PagSeguro card is recommended for consumers looking for an easy and quick solution for their financial life.

Advertisement

PagSeguro Card

For those looking for an easier and faster card solution, PagSeguro is an excellent choice! Thus, the PagSeguro Card, in addition to being very safe, is very practical, and can be requested in several ways.

In addition, the card has no annual fee or monthly fee, and is issued under the Mastercard brand, accepted in several establishments.

Step by step to apply

Above all, to apply for the card, there is no need to present proof of income or undergo a credit analysis. Therefore, the entire procedure is uncomplicated, facilitating access to credit.

Order online

In principle, to request the PagSeguro card via the website, the following procedure must be followed:

- So, access your PagBank account in a browser;

- Then, click on the “credit card” option;

- So, after that, click on “order yours now”.

Request via phone

First, it is not possible to apply for the card over the phone or in person. But it is possible to clear any doubt through the communication centers:

- 4003 1775: For capitals and metropolitan regions;

- 0800 728 2174: Other locations, but excluding cell phones.

Request by app

First, to apply for the card, you must be a selected customer. However, just follow the procedure:

- So, download the PagBank application on your Android or iOS smartphone;

- Then, go to the “cards” tab;

- Also, look for the option “ask for my card”;

- Then after that, a tab will appear to confirm your address.

Magalu Card or PagSeguro: which one to choose?

Anyway, if you are having trouble choosing between the two cards presented, check out the characteristics of both modalities in the comparison table below:

| Magalu card | PagSeguro Card | |

| Minimum Income | R $800.00 | not required |

| Annuity | 12X of R $9.99 | Free |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Exclusive discounts in stores and supermarkets In addition, invoices can be extended up to 24 times international card Access to two additional cards | Guarantee income on savings Furthermore, there is zero annual fee Access to the Vai de Visa program access to cashback |

How to apply for the Magalu Card

Learn how to apply for the Magalu card, the Magazine Luiza network card, ideal for shopping on Magalu websites and in the app with various discounts! Check out!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What are the youth loan lines?

Do you know what are the lines of loan for young people? Find out and see which option is best for you. Check out!

Keep Reading

How to find the best machine operator jobs

Understand where to find machine operator jobs and how to create a presentation resume that draws the attention of the company.

Keep Reading

BluBank credit card review 2022

Are you in doubt whether to apply for this card? Check out in this BluBank credit card review how this option can help you!

Keep ReadingYou may also like

Discover the brokers with the lowest brokerage fees

For those thinking about investing, knowing the brokerages with the lowest brokerage fee is essential. So be sure to continue reading to check it out.

Keep Reading

Visa card: know the main options

If you are looking for a card with more benefits for your financial life, the Visa card and its variants may be the best solution for you. To learn more about the card, types and features, continue reading and check out more information.

Keep Reading

I need money: what to do?

If the bills squeezed, don't despair! Here are some tips for you to increase your monthly budget. So, read on to find out more!

Keep Reading