Cards

BluBank credit card review 2022

In this complete and updated BluBank card review, you will learn about the main positive and negative points of this option and you will be able to know with more certainty if it is the ideal option for you. Check out!

Advertisement

Card that accepts negatives and also releases a high limit

For those who are negative, getting a good credit card, with no annual fee or maintenance fees can be a big challenge. But, in this BluBank credit card review, you will realize that it came to change this reality for many Brazilians.

From it, people who have a dirty name or who still don't have a good credit history can have access to this financial product without paying absurd fees!

| Annuity | Exempt |

| minimum income | not required |

| Flag | Mastercard, Visa and Link |

| Roof | International |

| Benefits | accept negatives Can release a high limit Does not have annuity |

However, BluBank's credit card is relatively new to the market and doesn't have many users yet. Therefore, it is normal for some people to doubt whether using this product is the best option.

To help you with this, we have prepared a complete review of the card in this article. Here you will find a lot of information about him to decide whether or not he is a good financial option for you. Check it out below!

BluBank credit card review: everything you need to know

To make a good financial choice, you need to know everything about the product and what it can offer you. That way, you can make a more rational decision.

And, especially, when it comes to finances, making rational decisions is what will help you to keep them stable, in a way that guarantees your future.

Therefore, we separate below a review of the complete BluBank credit card. Thus, you will be able to make the best decision for your personal finances!

annuity and coverage

This review already starts with a feature that many Brazilians will love. The BluBank credit card is an option that does not charge its users an annuity.

In this way, this card follows the operations in a similar way to digital banks that also do not charge annuity and other fees that the public is already tired of paying.

Thus, by not having this expense with the card, the user can be sure that he will only be paying for what he actually bought using his credit card.

In addition, with the BluBank credit card, the user can still make international purchases.

Therefore, if you are a person who travels a lot or who simply likes to shop in international e-commerces, you will have this possibility when you have the BluBank card.

fees and tariffs

As much as the BluBank credit card does not charge annuity or monthly fee for the card, it still charges other fees and charges.

When requesting the card, for example, the user must pay a fee of R$49.99. This payment refers to the opening of the digital account that must be made in order to apply for the BluBank credit card.

In addition to this fee, if the user needs to issue a duplicate card, it will be necessary to pay another fee. This time, it's a fee worth R$24.90. Thus, BluBank will be able to cancel the lost card and send you a new one.

flag and benefits

The BluBank credit card is available under Visa, Mastercard and Elo flags. That way, you can have more chances of accessing the benefits that each flag brings!

For example, the Mastercard brand can give access to the Mastercard Surprise Program. With Visa, it is possible to participate in the Vai de Visa Program, which offers several benefits and prizes for purchases made with the card.

And with the Elo flag, you can compete in raffles that can give you incredible prizes. In addition, it is also possible to join the Elo Club and get a discount on purchases.

However, the choice of brand will need to undergo a credit analysis, in addition to checking its availability in stock.

Advantages of the BluBank card

One of the biggest advantages of the BluBank credit card, and one that will win the hearts of many Brazilians, is the fact that it releases credit for negatives.

That way, even with a dirty name, you can access this credit card and have a limit of up to R$10,000.00! And the best part is that credit release happens quickly and completely online.

In addition, when applying for your card, you also open a BluBank account and can easily access other financial services. One of them is the loan where users are entitled to borrow up to R$25,000.00.

Disadvantages of the BluBank card

As much as it approves credit faster and does not require proof of income, the BluBank credit card still has some disadvantages in its product.

The first is the fee to be able to issue the credit card, which in addition to being charged is a very high amount. Nowadays, we can easily find digital credit card options without this built-in fee.

Another disadvantage is that the card is prepaid. This means that your limit is made up of the balance you leave in the account. However, it is always possible to request a card limit after a period of use.

card application

As it is a digital card, BluBank offers a free application that can be found in Android system application stores.

From it, you can check your balance, view your invoice, issue slips and pay for your purchases made with your BluBank credit card.

The application is simple, practical and safe to use, in addition to guaranteeing you access to your virtual card. That way, after creating your account and requesting the card, you can start shopping even before the physical card arrives!

application process

In this review of the BluBank card, you saw that it manages to offer several interesting advantages to its users. Thus, it becomes a good digital credit card option for negative credit cards.

Therefore, if you liked everything you learned about it in this review and would like to request yours, check out the complete step-by-step content below for you to order your BluBank credit card!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

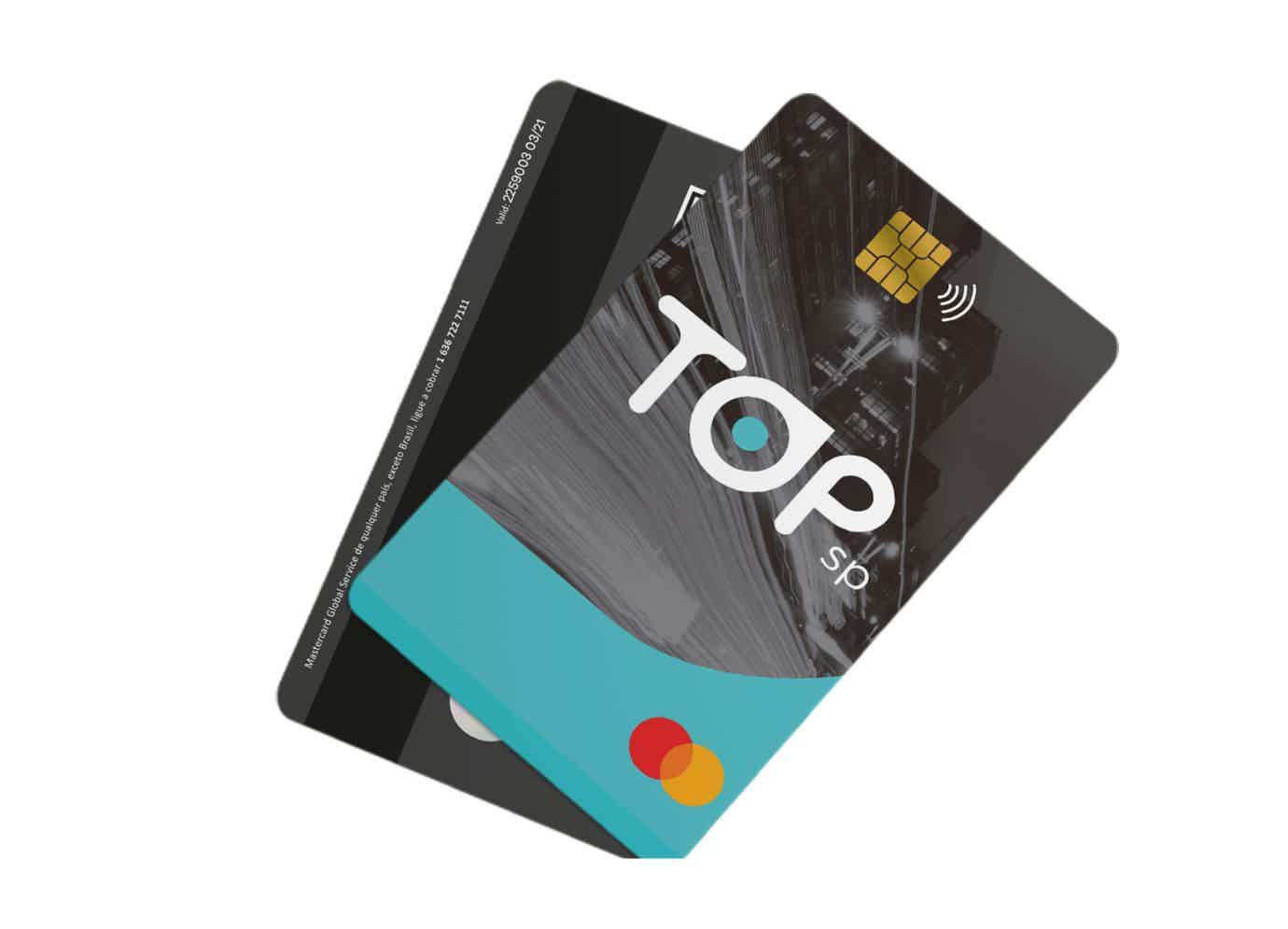

Discover the Top Credit Card

Get to know the features of the Top credit card and see how it helps make your life easier by offering 3 essential features!

Keep Reading

Application to view the city via satellite: check out the best

Explore cities and landscapes around the world in incredible detail with the satellite city view app. Download now!

Keep Reading

How to become an MRV dream agent?

Want to become an MRV dream agent? In this article we will show you the step by step for you to be a promoter or broker. Check out!

Keep ReadingYou may also like

How to apply for Real Estate Credit Creditas

Often, all we need to make a dream come true is that little push, an incentive, isn't it? Therefore, having Creditas real estate credit is the best way to sell your property and manage to anticipate up to 60% of its value, or also, to move forward on that dream job in your home. Learn more here.

Keep Reading

The trilogy of films about the relationship between Prince Harry and actress Meghan Markle is shown on cable TV

With a relationship that shook the structures of the British monarchy and left the world's press in a state of shock, Prince Harry and actress Meghan Markle had their lives transformed into a series of films, and you can check out all the details on Pay TV through from the Lifetime channel. Understand.

Keep Reading

Is it worth investing in Azul shares?

Are you thinking of investing in Azul? We tell you here in this post if this is a worthwhile investment or not. Continue reading to find out.

Keep Reading