Cards

How to apply for the Ewally card

See how to apply for the Ewally Card in a simple and informative way. Check out!

Advertisement

ewally card

Ewally creates creative and customized financial solutions to meet the needs of its clients. So, one of the services offered by Ewally is the ewally card.

In this case, the card is linked to a digital account, which provides various services such as TED, transfers and 24-hour bank withdrawals, as well as several other advantages such as allowing people with a dirty name to make a digital account.

Therefore, today we are going to show you how you can apply for this card, in addition to giving tips so that you are no longer dependent on carrying physical money, all you need is to have your cell phone with the app downloaded in your hands. So keep reading with us!

Order online

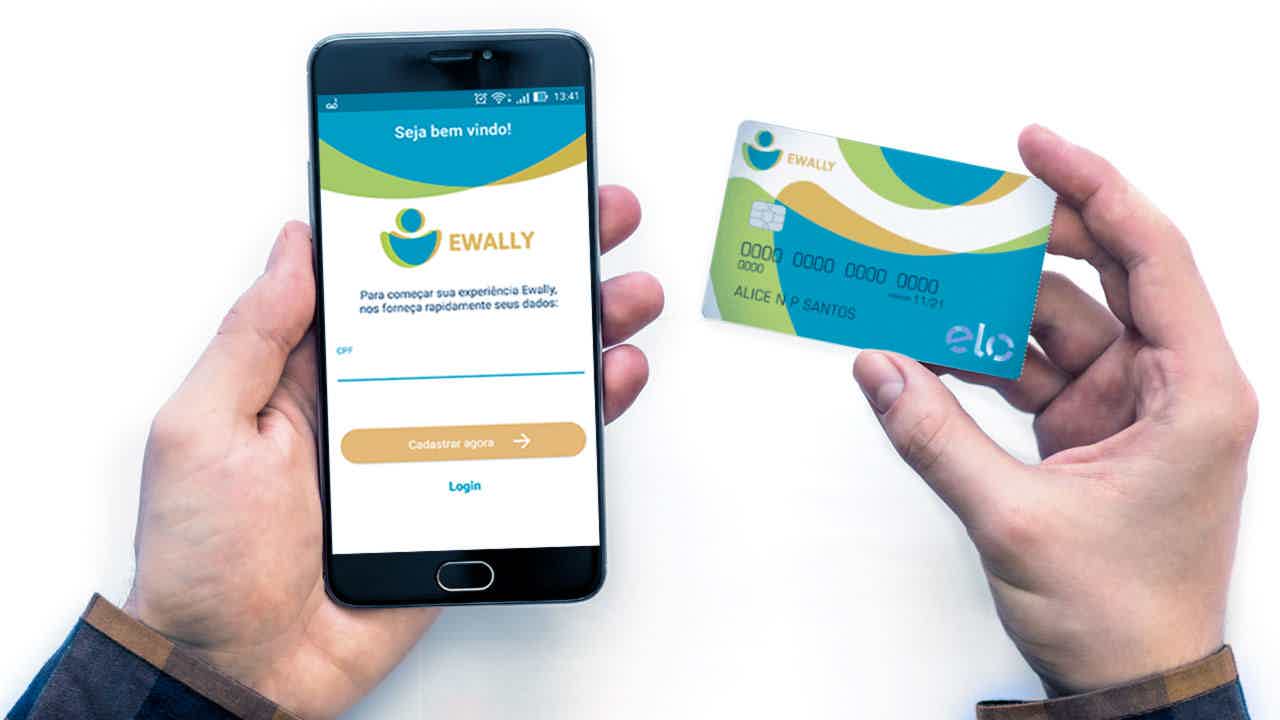

Initially, to apply for the ewally card, simply register and log in to the platform. And, to register on the platform, just download the application.

You will then be asked to take a photo and upload your personal documents as well as proof of address. That is, you must send a photo of your RG and CPF, and other documents that may be requested for you to send.

So, after completing the registration, you will receive confirmation of registration within two business days. However, remember that if there is any pending, you will be notified by fintech.

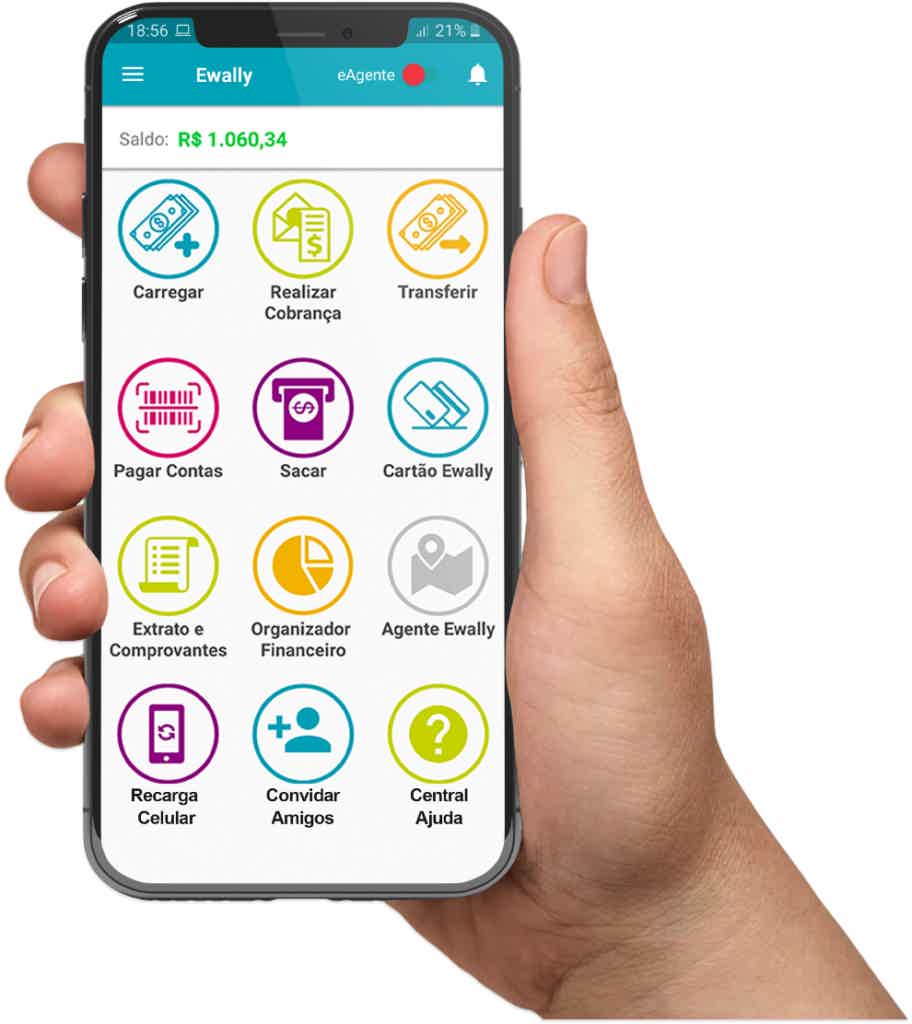

Well, after registration, you must go to the application menu and click on “Cartão Ewally” to request the card.

It is important to mention that the amount of R$9.90 is charged for the issuance fee for the Ewally card, under the ELO brand, in order to access all the benefits. So after that, just wait for the card to arrive at your house!

Request via phone

Well, unfortunately, the request to have the prepaid card can only be done online via the fintech platform.

However, if you have questions about the Ewally card, you can contact us via whatsapp 11 98806-6619. Also, by e-mail contato@ewally.com.br. And in addition, it also has direct support through the fintech application to solve all your doubts.

download app

At first, downloading the application is very simple. This is because the app is available in versions for iOS and Android and the services are offered in prepaid mode.

That is, the customer cannot pay for purchases in installments or make purchases beyond the limit provided by the digital account. That's because the card works with the values that the customer has made available in Ewally's own digital account.

Therefore, it also becomes a safe option to have the ewally card, since the customer will only spend the amounts he can spend, without being able to incur debts. Furthermore, another advantage of this card is the possibility of making purchases by approximation.

That is, payments can be made via contactless or by inserting the card into the card machine itself. So, as an approximation, just place the card near the payment reader, in the machines that have contactless and then wait for the confirmation beep.

Also, to make purchases on international websites, register for delivery apps or cloud service stores, such as Google, as well as AWS. And, to withdraw money abroad, you can use Pulse.

To close the advantages of the Ewally card, a super benefit is the fact that most card services are free, bringing more comfort.

Therefore, as we mentioned earlier, all you have to do is download the application to register on the platform and apply for the ewally card to access all these services.

Hererton Iti Itaú oru Ewally?

| Iti Itaú Card | ewally card | |

| Minimum Income | EXEMPT (1 minimum wage is recommended) | FREE |

| Annuity | FREE | FREE |

| Flag | VISA | LINK |

| Roof | INTERNATIONAL | INTERNATIONAL |

| Benefits | free account Bill payment Data management through the app Payment in physical stores that have a machine that generates QR Code Accepted in several establishments | free account Bill payment 24 hour recharge Money transfer payment collection Withdrawals on the 24 Hours Network, Bradesco Expresso and Alelo |

That is, the two options have several advantages, as well as disadvantages, for example, one card offers a greater number of locations for withdrawals in physical establishments than the other.

Therefore, to choose which is the best prepaid card option, just compare the existing cards, as well as see which ones suit your needs.

How to apply for the Iti Itaú card

How about requesting the Iti Itaú card right now? Ask and enjoy all the advantages it has to offer you.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get the first credit card?

To get your first credit card, it's important to have a clean name and a good credit score. Check here for more tips!

Keep Reading

How to subscribe to The Wall? See the process

Find out in this post how to sign up for The Wall and thus have the chance to take home the prize of more than one million reais!

Keep Reading

Data leak: be careful with your CPF

Your data is something very important and you need to take care of it. Learn how to protect your CPF and avoid data leakage over the internet

Keep ReadingYou may also like

Meet the new Bitz credit card

Bitz is a fintech created by Bradesco in 2020 with the aim of providing simpler financial solutions to its customers. Last week, it launched its first credit product, and promises a range of exclusive benefits to its users. Check out the details below!

Keep Reading

How to make money selling airline miles?

Are you looking for some extra money? We teach you here how you can make money selling airline miles, as well as taking advantage of credit card rewards programs. So, if it's a subject that interests you, just keep reading to find out more!

Keep Reading

Unibanco cards: what are they and how to choose the best one?

Thinking of applying for a credit card? So, come and learn about the main options for Unibanco cards, their features, benefits and more, and see which one best meets your expectations and needs.

Keep Reading