Cards

How to apply for the Mercantil Bank Payroll Card

See now how to apply for the Banco Mercantil payroll card in a quick, easy and safe step by step.

Advertisement

Mercantil Bank Payroll Card

Payroll Bank Mercantil has therefore been an advantageous option for those with fixed income and wish to have a better credit option to use during the month.

With zero annuity, low minimum income requirement, digital invoice, international reach and no surprise values, it is therefore a great option, especially for negatives.

If you are interested and want to apply for this card, follow now an easy and safe step by step. Learn how to order yours, how to download the app and other necessary steps.

Step by step to apply for the Mercantil Bank Card

Anyway, see below the step by step to apply for your Banco Mercantil payroll card. So you can start right now and apply from your home. Therefore, follow the steps and enjoy the advantages offered by this bank that only grows in Brazil.

Remember, therefore, to check all the information and ensure access to the right website so as not to fall into fraud.

Order online

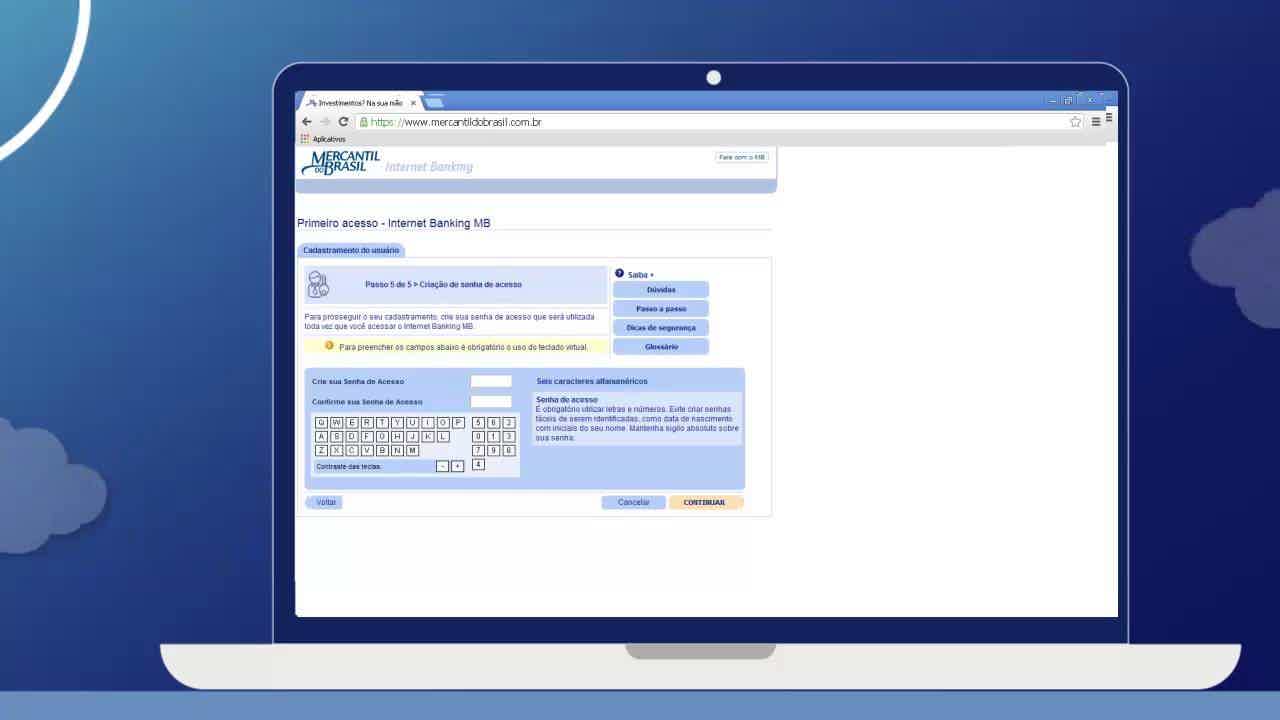

To apply for your card online and from home, you will first need to open a bank account.

Then, access the Bank's website, go to the card option and choose the payroll. There you will be able to check all the information and specifications given here, to guarantee the information. Then, create your bank account, send your documents and, once approved, apply for your card.

Request via phone

Banco Mercantil does not, therefore, offer the form of request via telephone, for the safety of its customers, as it needs a photo of documents.

download app

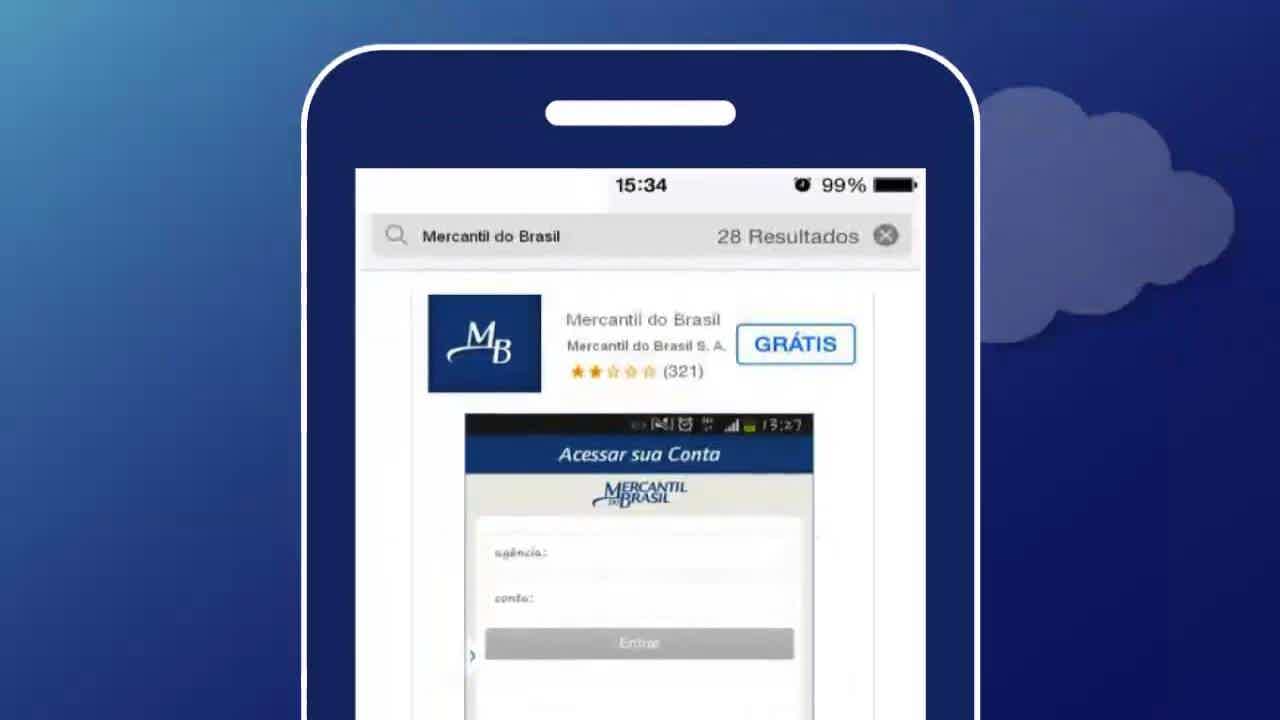

You can also download the Mercantil bank application to track your available payroll balance, purchases made, invoice amounts, that is, to have all your movements at hand.

So then, you avoid fraud and manage to have greater control of what you are doing every month with your finances.

To do this, just access your mobile app store (Play Store or App Store), search for Banco Mercantil and download.

After that, you will need to access your account, with the previously received data. Then your information will be available to track from month to month.

Cetelem Card or Banco Mercantil Payroll Card?

So, to help you decide once and for all the best payroll card to use on a daily basis with your purchases, we'll make a comparison.

Cetelem offers a card that is a direct competitor to Mercantil. So, see the characteristics and what differs from each other to be able to decide the best.

| Mercantile Bank | Cetelem | |

| Minimum Income | subject to review | 1 minimum wage |

| Annuity | Zero | Zero |

| Flag | unspecified | mastercar |

| Roof | International | National |

| Benefits | Digital invoice, lower interest | Duty free |

Finally, here you can understand how to apply for your Banco Mercantil payroll card and also see a comparison between another competitor. Now it's up to you to decide which one is best for you!

How to apply for the Cetelem Payroll Card

Zero annuity and benefits for you. Request Cetelem now and use this step by step below to order yours from home.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Shoptime credit card: what is Shoptime?

The Shoptime card is a product made for you to use in national and international purchases, under the Mastercard banner! See more here!

Keep Reading

How to query dirty name

Do you think you are restricted but don't know for sure how your CPF is? See how to do the dirty name consultation and know where to negotiate

Keep Reading

How to apply for the Epa card

Check out in this post the complete step-by-step to apply for your Epa card and enjoy the unmissable advantages it offers!

Keep ReadingYou may also like

How to apply for the Bradesco Marvel card

Have you ever thought about living a unique experience in London inspired by the Marvel Eternals movie? With the Bradesco Marvel card you can. See here how to order yours!

Keep Reading

Invest with a bank or brokerage?

To decide to invest with a bank or broker, know that banks can offer higher rates, but brokers require a new account. Understand the characteristics of each one so that you can choose the best option!

Keep Reading

Discover the MOVA Loan

MOVA loan is a novelty that appeared in the Brazilian financial market, with better conditions and without intermediary banks. Check it out!

Keep Reading