Cards

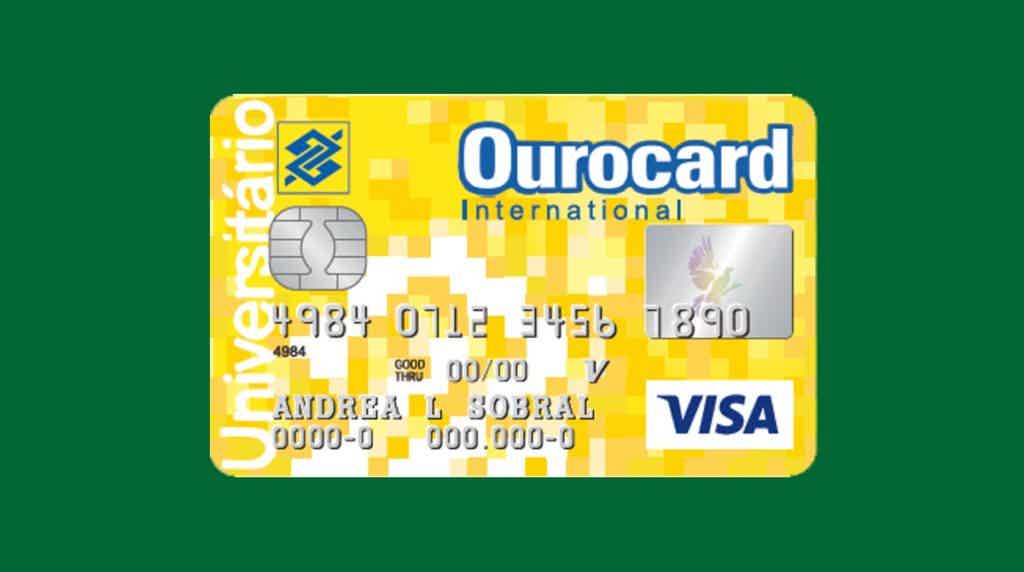

Ourocard Universitário Card or Access Card: which one to choose?

Either the Ourocard Universitário card or the Acesso card, both have international coverage and do not require proof of income. Compare here!

Advertisement

Ourocard Universitário x Access: find out which one to choose

If you are in doubt between the Ourocard Universitário card or the Access card, you don't have to worry anymore! Today, we are going to talk more about these two financial products so that you can choose which one best fits your needs.

So, although both cards have international coverage, each one has a different flag. In addition, the Ourocard Universitário card has a specific audience, while the Acesso card is a great option for those who want to control spending.

So read on to learn the pros and cons of each financial product and decide which one is best for you. Let's go?

How to apply for a Ourocard Universitário card

The Ourocard Universitário card is an alternative for undergraduate students. It waives proof of income and offers free annuity. See how to order!

How to Apply for a Credit Card

Requesting your Access credit card is very easy and simple. See how it works!

| Ourocard Universitário | Access | |

| minimum income | not required | not required |

| Annuity | No annuity | R$ 5.95 per month |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Pre-approved limit of R$ 1,500.00, approximation payment | No consultation with the SPC or Serasa, exemption from the annuity when there is no balance |

Ourocard University Card

Undoubtedly, the card is a good option for those looking for more financial autonomy. Thus, with the student public in mind, Banco do Brasil launched the Ourocard Universitário card.

So, if you are studying at a higher level and are between 16 and 28 years old, the card can be an incredible opportunity for you to take care of your finances in a practical and simple way.

However, if you are under 18 years of age, you will need to ask your legal guardian for permission to apply.

Now, about the main features of the card, we can mention its international coverage and Visa flag. This way, you can shop in Brazil and around the world much more easily, in addition to being able to shop in person and online. In addition, the flag allows you to participate in the Vai de Visa program to gain special discounts at various partner establishments.

Furthermore, Banco do Brasil knows that many students still cannot work because of their studies. Therefore, you do not need to prove income and the card also has no annual fee. So this is quite an opportunity to have more financial freedom, isn't it?

Access Card

Well then, the Access card is an interesting option for those who want to keep control of their finances and not overindulge in spending. This is because it works in prepaid mode and you only spend the amount available in your account balance. Thus, to use the card, you must recharge it first.

Furthermore, to top up your card is very easy and you can do it in several ways, such as a bank slip, transfer, deposit into an account and even at accredited establishments.

Another feature of the card is that it has international coverage for you to make purchases in physical stores and online, both in Brazil and abroad.

In addition, you have two card versions: physical and virtual. Thus, your purchases are much more practical, in addition to being able to subscribe and pay for services such as Netflix and Uber.

Finally, you can request the financial product even if it is negative, as credit protection bodies are not consulted. So the card is a great way to take care of finances, don't you think?

What are the advantages of the Ourocard Universitário card?

So, let's talk now about the main advantages of each card so that you can decide which one best fits your financial life.

Well then, the Ourocard Universitário card is a very interesting tool for young higher education students to control their finances.

Thus, the card already comes with a pre-approved limit in the amount of R$ 1,500.00. That way, you can use it according to your needs. But remember to keep expenses under control and always have good financial planning so you don't run the risk of generating debt.

Furthermore, Banco do Brasil is a great sponsor of cultural, sports and entertainment events, isn't it? So your customers wouldn't be left out! Therefore, you take advantage of exclusive discounts and promotions in several of these events.

Another advantage of the card is the approximation payment technology. So, to finish shopping, just bring your Ourocard card or wristband to the machine and that's it! Thus, the operation is much safer, as it is not necessary to use the password.

What are the advantages of the Access card?

Now, about the positive points of the Acesso card, we can mention that you don't need to be a bank account holder to order yours. Thus, you enjoy all its benefits without having to worry about opening an account.

Also, it's very easy to order yours! So, you have two purchase options: through the official website or in accredited stores and markets. It's very practical, isn't it?

In addition, the monthly charge for the maintenance fee for your card is only carried out if you have a balance. So, you don't have to worry about having a negative account.

Finally, the card has the Mastercard brand that offers several benefits to its customers. Thus, you can use your card in thousands of accredited establishments around the world, in addition to participating in the Mastercard Surpreenda rewards program.

What are the disadvantages of the Ourocard Universitário card?

Well, as we have already mentioned, the card has some restrictions established for its customers. Therefore, you can only apply for your financial product if you are between 16 and 28 years old and enrolled in a higher level course.

Furthermore, if you no longer meet these requirements, Banco do Brasil may change your card.

In addition, although paying by approximation with the Ourocard bracelet is a very practical way to make your purchases, there is a fee of R$ 40.00 for you to purchase yours. However, it is optional and you can continue using the technology normally with just the card.

What are the disadvantages of the Access card?

Well, one of the negative points of the card is that there are some fees for carrying out certain operations. For example, for top-ups below R$ 500.00, the service fee is R$ 2.50. If the amount is greater, the recharge is free.

In addition, the card charges a monthly fee of R$ 5.95. But, as we already mentioned, you need to have a balance for the amount to be deducted. That way, you never end up with a negative account.

In addition, you cannot pay for your purchases in installments. This is because the card is prepaid and does not allow this type of operation.

Ourocard Universitário card or Access card: which one to choose?

Now that you know better about the two cards, it's easier to make a decision, isn't it? Ourocard Universitário card or Access card?

So, to apply for the Ourocard Universitário card, you must be studying higher education, in addition to being between 16 and 28 years old. And if you fit into this category, the card is full of advantages, such as approximation payment and pre-approved limit.

The Access card, on the other hand, is perfect for those who want to control expenses, as it is necessary to have an account balance in order to use it. However, it is not the best option for those who want to make purchases in installments.

Therefore, calmly evaluate each card to choose the most suitable for your current financial needs.

But if you've come this far and you're still in doubt, we can help you! So, check out our recommended content below with a comparison of two more amazing cards available on the market.

Renner card or Polishop card?

Renner card or Polishop card: learn all about these two cards with exclusive discounts on purchases in physical stores and online.

Trending Topics

Leader Card Review 2021

Leader offers great discounts and special payment conditions. But, is your card worth it? Find out in the Leader card review!

Keep Reading

Is it worth opening an account at Banco Neon?

Want to find out if it's worth opening an account at Banco Neon? In this article we will show you all the details of this account. Check out!

Keep Reading

How to negotiate Caixa debts?

Are you hanging and don't know what else to do? See now the best tips on how to negotiate Caixa debts and get out of the red now.

Keep ReadingYou may also like

What is the limit of the Santander SX Universitário card?

Learn all about the Santander SX Universitário card limit. Here you will find out what the minimum amount is, how to increase and consult your card limit. Check out!

Keep Reading

How to get organized with little money

Are you low on money? Earn only a minimum wage, but have big dreams? Don't worry! Even so, it is possible to organize your personal finances and conquer your financial freedom. Check out our tips!

Keep Reading

How much does it cost to have a child?

Are you intending to have a child? This is a very special decision, however, it is important to keep in mind some financial precautions that you should take when planning. See below.

Keep Reading