Cards

How to apply for AME card

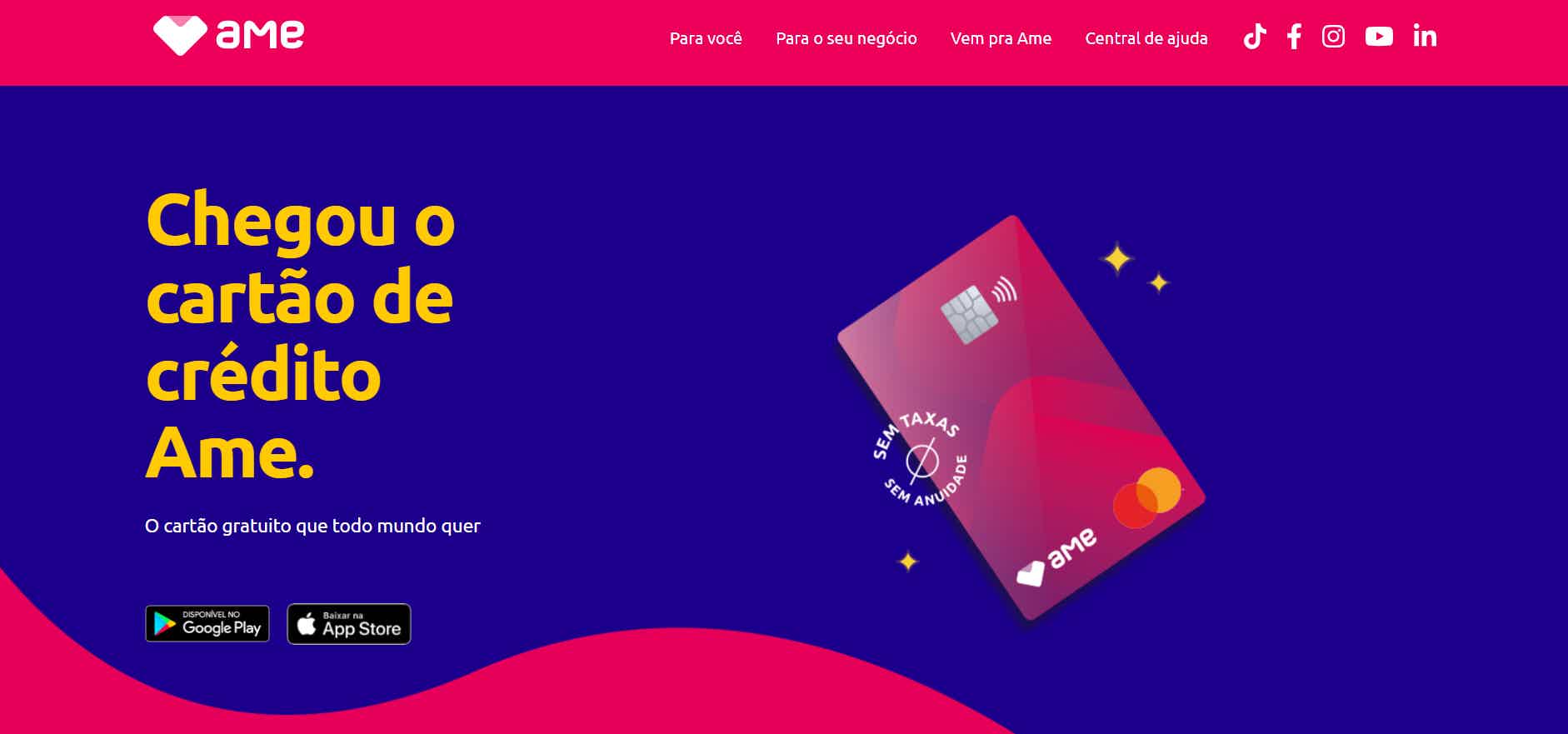

The AME credit card offers payment in up to 24 installments at Lojas Americanas, as well as access to exclusive offers and discounts! Don't waste time, get to know the application process.

Advertisement

AME card: Mastercard brand with international coverage

First, the AME card is international with the Mastercard brand, so you can use it to make purchases in cash and in installments at thousands of establishments accredited by the brand.

Well, now that you know the characteristics of the card, how about requesting yours? The process is simple and can be done either in the comfort of your home or in person at Lojas Americanas.

Also, want to know more? So, read on and check it out!

Order online

First, it is not possible to apply for your AME credit card through the AME website, nor through the Americanas or Banco do Brasil websites.

But you can access the official website of the card page if you want to know more about the product or if you want to solve your doubts.

Request via phone

So, it is also not possible to order your card over the phone, but you can contact AME Digital via telephone (11) 4003 2120, if you have questions about the product or if you want more information about it. The service is from Monday to Saturday, from 09:00 to 20:00.

Request by app

So, to make the request through the app, you first need to download the AME Digital app on your smartphone through the App Store or Google Play.

Then select the option “AME cards” and then “credit card”. So, to proceed with the process, it is important that you have some personal documents at hand, such as your RG, CPF, proof of residence and proof of income.

After filling in all the requested fields, your request is sent for analysis and you receive the response to your request through the application itself. Simple, isn't it?

Méliuz card or AME card: which one to choose?

We know that nowadays there are thousands of credit card options with numerous benefits, and that it is not always easy to choose which one suits your financial situation.

So if you're not sure if the AME credit card is the best option for you, no problem! We brought another similar option on the market, which is the Méliuz card. It also has an international flag and offers cashback. Want to know more? Check the table below!

| Méliuz card | AME card | |

| Minimum Income | Minimum wage | not informed |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Zero annuity, cashback, international coverage, Mastercard Surprise | Zero annuity, cashback, Ourocard and Mastercard Surprise benefit programs |

How to apply for the Méliuz card

The Méliuz card does not charge an annual fee and has international coverage! See here how to order yours!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Learn how to make money with beauty products

Check out how it works to be a Mary Kay reseller and how much you will need to invest to start earning money by reselling products.

Keep Reading

How to apply for Omni card

Find out how to apply for the Omni card with a differentiated annual fee and win R$500.00 every week on the Premium Invoice. Check out!

Keep Reading

Is a Santander payroll loan safe?

Check the text and find out if the santander payroll loan is safe. It has low interest rates and great repayment terms.

Keep ReadingYou may also like

How to apply for the Revolut Premium card

See how to apply for the Revolut Premium card and get a card with travel insurance that facilitates foreign exchange.

Keep Reading

What can I do to increase my Nubank credit card limit this month?

A good credit card limit can be an excellent financial ally when used correctly. However, achieving this benefit is not always the easiest task! So, check out some suggestions on what to do to increase your Nubank card limit later this month.

Keep Reading