loans

How to apply for the Postalis loan

With the Postalis loan, Postal Service employees have an alternative to solve their financial problems. Learn here how to apply for credit with direct payment on the payroll. Check out!

Advertisement

Postalis loan: fully online application

First, learn how to apply for the Postalis loan and see how this credit can help you in your financial life, as it is without any bureaucracy. In addition, it is also a loan that is completely online and easy to apply for.

So, learn how to apply for the loan here. So check it out!

Order online

Initially, you can apply for the Postalis loan through the institution's website. So, to do so, go to the Postalis website, follow the recommendations and wait for the institution to respond.

Request via phone

First, you cannot apply for the loan over the phone, but you can contact the Call Center on 0800 878 98 80.

Request by app

So, it is also not possible to request through the application, as this process can only be done through the institution's website. So, enter the official website for information.

Superdigital loan or Postalis loan: which one to choose?

First, Postalis is a great option for anyone looking for a loan to solve short-term financial problems. On the other hand, Superdigital is also a good option.

In this option, hiring is also completely online and very simple. So, see the details below and understand which works best for your reality.

So you can already make a comparison. At the end, you will be directed to the Superdigital request page. So, check out the table and content below.

| Loan Superdigital | Loan postcards | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1,60% per month | not informed |

| Deadline to pay | Up to 24 months | Uninformed |

| Where to use the credit | Pay the bills Renegotiate debts | Renegotiate debts settle debts |

| Benefits | 100% digital request Long term for payment | Partial payroll deduction Online application |

How to apply for the Superdigital loan

Learn all about how to apply for this loan with amounts of up to R$25 thousand, low interest rates and up to 24 months to pay off the credit.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the app for pregnant My Pre-Natal

Follow the stages of pregnancy and calculate the gestation period with the Meu Pré-Natal application. Discover more functions of the app here!

Keep Reading

Credits personal loan: what is it and how does it work

The Creditas loan offers three types of credit and the application is 100% online, without bureaucracy. Discover more benefits here!

Keep Reading

Carrefour without annuity and exclusive installment plan

The Carrefour card with no annual fee offers exclusive installments for those who buy at Carrefour establishments. Learn more in this article!

Keep ReadingYou may also like

Is it worth investing in Magazine Luiza shares?

Do you want to invest in stocks still in 2021? We tell you here in this post if Magazine Luiza actions are a good deal. Continue reading and find out!

Keep Reading

Find out about the Disability Pension

If you are looking for a simple and practical way to maintain your income while taking care of your health, the Disability Pension is a great option. To learn more about this alternative, just continue reading the article!

Keep Reading

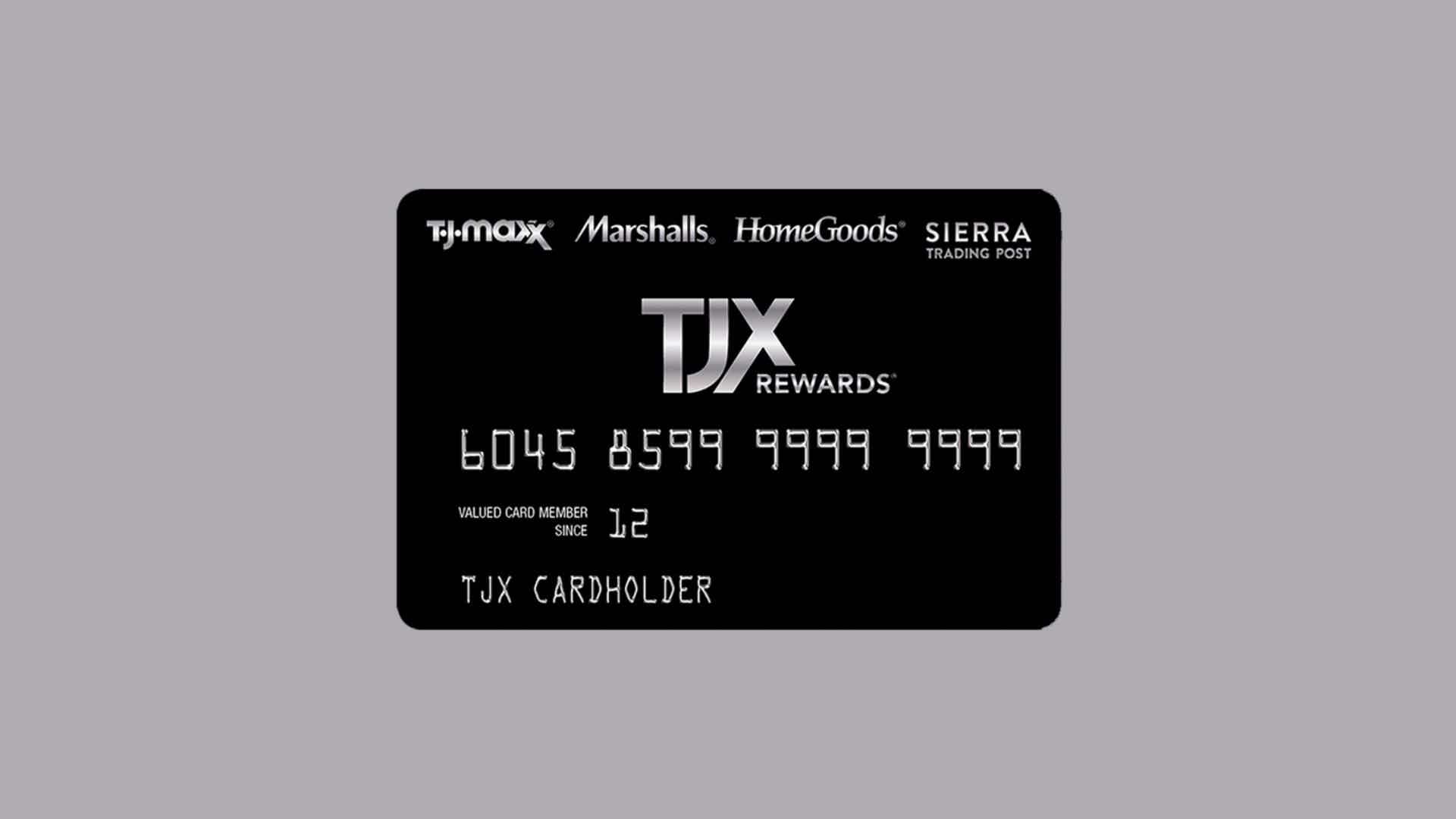

TJX Rewards credit card: how it works

The TJX Rewards card is a credit card for those who want to renew their wardrobe. Therefore, the TJ Maxx store offers its customers this opportunity to buy with advantages. Learn more about him here.

Keep Reading