loans

How to apply for a loan

The Deu Crédito loan does not consult the SPC and Serasa, which is why it is ideal for negative people. If you fit this profile, read our post and learn how to apply for this payroll loan.

Advertisement

Gave Credit: apply now for your payroll loan

Need to make a big purchase, and don't want to suffer with high credit card interest? Deu Crédito's payroll loan may be a good option for you. At Deu Crédito, the loan is 100% online. With this, you avoid a lot of bureaucracy, as well as queues and exposure.

The company has partnerships with the largest banks in Brazil, such as Itaú, Bradesco, BMG and several others. Thus, you can receive the best credit offers on the market. Today, we will tell you step by step how to apply for this credit. Check out!

Order online

Applying for your loan online is the best way. All quickly, easily and without any bureaucracy. See the step by step:

- Access the website;

- Click on “Simulate Loan”;

- Fill in your details;

- Wait for Deu Crédito to find the best options for you;

- Choose the value that fits in your pocket;

- Submit the documentation and wait for the contract.

And after signing the contract, the money arrives in your account within 48 hours.

Request via phone

It is not possible to apply for a loan over the phone. Just as the institution does not provide a number to solve doubts.

Request by app

Deu Crédito still doesn't have an app, so you can't apply for the loan through the app.

BMG loan or Deu Credit loan: which one to choose?

Banco BMG also has the payroll loan modality. With rates of 1.8% per month and 96 months to pay, this loan can be very attractive. In addition, BMG does not carry out consultations with the SPC or Serasa. That is, negatives can contract the service quietly, only subject to credit analysis.

Comparing BMG with Deu Crédito we can say that both have many advantages, so it is common to be in doubt. Therefore, check out our comparison table and decide which is the best option for your pocket.

| BMG | gave credit | |

| Minimum Income | not informed | not informed |

| Interest rate | 1.80% per month | not informed |

| Deadline to pay | Up to 96 months | Up to 96 months |

| Where to use the credit | Pay debts; Make investments. | Make reforms; Invest in a course. |

| Benefits | Low rates and long payment terms | 100% process online and without bureaucracy |

How to apply for the BMG loan

Applying for your BMG loan is much easier than you might think! Read our text and understand more about this process.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the PagSeguro card machine

Get to know all the features offered by the PagSeguro card machine and see how it can be a great ally for your business!

Keep Reading

Coop Fácil credit card: what is Coop Fácil?

Coop is a consumer cooperative, and the Coop Fácil card is a product created to offer advantages and benefits to customers. Look!

Keep Reading

Sadia vacancies: how to check the options?

Find out in this post how to find Sadia vacancies currently available and find out how much you can earn by working at this great company!

Keep ReadingYou may also like

Discover the Sicoob Cabal Classic credit card

The Sicoob Cabal Clássico credit card is a complete solution to manage your finances and offer the resources you need to stay calm in case of unexpected expenses. To find out more, just continue with us throughout the article!

Keep Reading

Discover the BV Gold credit card

Do you like to travel, get discounts and be able to choose your credit card flag? If so, take the opportunity to learn about the BV Gold card in the post below and enjoy these and other benefits.

Keep Reading

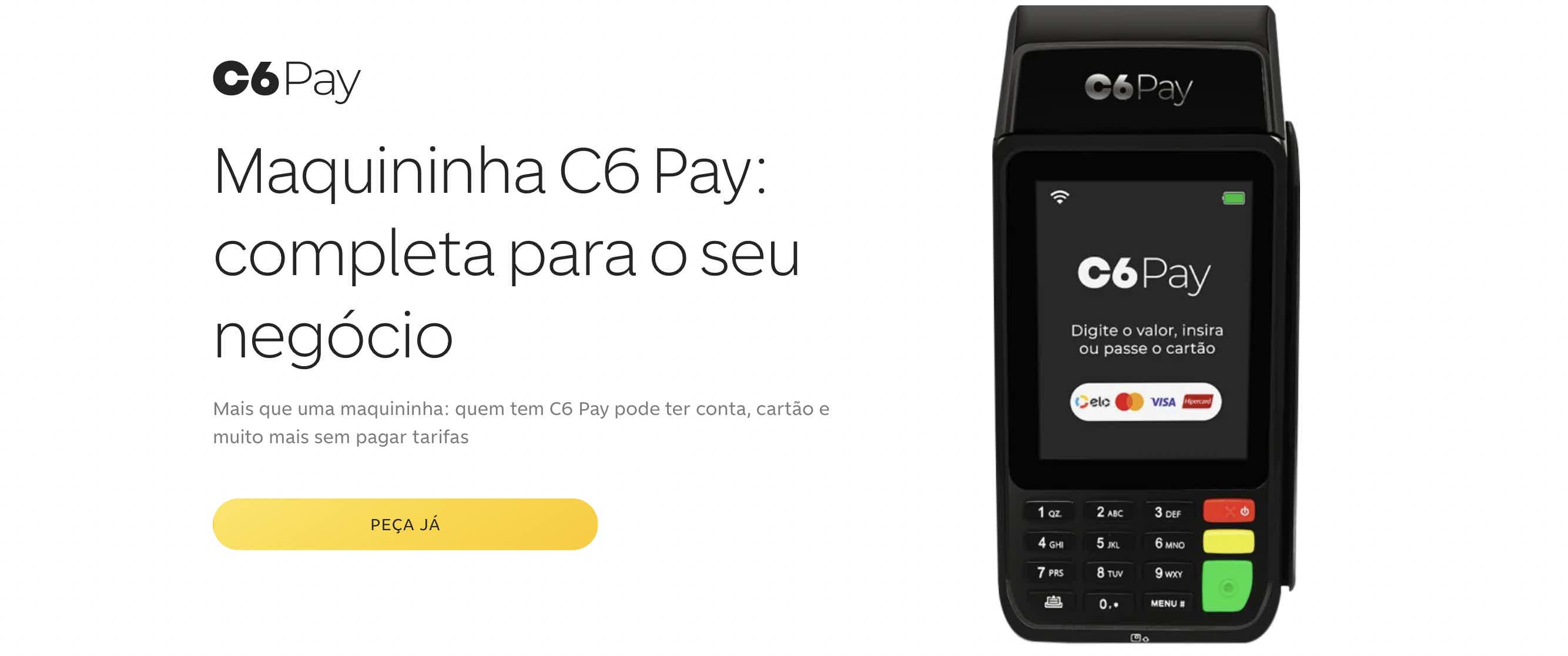

Discover the C6 Bank card machine

C6 Bank innovated and brought its card machine to the market, with the quality and security that are already the company's trademark. Learn all about her here!

Keep Reading